Multiple Choice

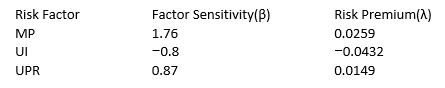

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in US industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

A) 12.32%

B) 9.32%

C) 4.56%

D) 6.32%

E) 8.02%

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Consider the following list of risk factors:

Q6: In a microeconomic (or characteristic) based risk

Q7: In a multifactor model, confidence risk represents<br>A)

Q9: Refer to the following information. Consider the

Q10: Refer to the information in the previous

Q12: To date, the results of empirical tests

Q14: Refer to the following information. Stocks A,

Q15: Assume that you are embarking on a

Q34: Consider a two-factor APT model where the

Q42: One approach for using multifactor models is