Multiple Choice

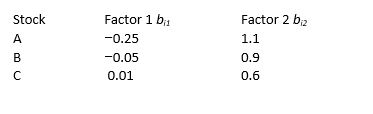

Refer to the following information. Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return (λ0) = 0.025 and the risk premiums for the two factors are (λ1) = 0.12 and (λ0) = 0.10.

Stock Factor 1 bi1 Factor 2 bi2 Calculate the expected returns for stocks A, B, C.

Calculate the expected returns for stocks A, B, C.

A B C

A) 0.082 0.091 0.033

B) 0.105 0.109 0.032

C) 0.132 0.128 0.033

D) 0.165 0.121 0.032

E) 0.850 0.850 0.610

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Consider the following list of risk factors:

Q6: In a microeconomic (or characteristic) based risk

Q7: In a multifactor model, confidence risk represents<br>A)

Q9: Refer to the following information. Consider the

Q10: Refer to the information in the previous

Q11: The table below provides factor risk sensitivities

Q12: To date, the results of empirical tests

Q15: Assume that you are embarking on a

Q34: Consider a two-factor APT model where the

Q42: One approach for using multifactor models is