Essay

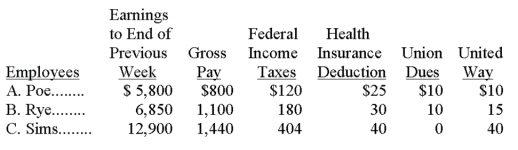

The payroll records of a company provided the following data for the current weekly pay period ended March 7.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: All of the following statements related to

Q42: If the times interest ratio:<br>A) Increases, then

Q43: A company's payroll information for the month

Q44: On December 1, Gates Company borrowed $45,000

Q45: Liabilities:<br>A) Must be certain.<br>B) Must sometimes be

Q47: The wage bracket withholding table is used

Q48: Frado Company provides you with following information

Q49: Explain how to calculate times interest earned.

Q50: Arena Company's salaried employees earn two weeks

Q51: A high value for the times interest