Essay

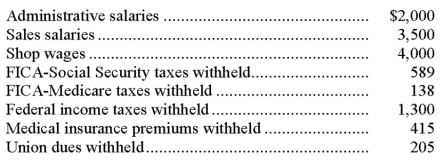

A company's payroll information for the month of May follows:

On May 31 the company issued Check No. 335 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check.

(1) Prepare the journal entry to record (accrue) the employer's payroll for May. (2) Prepare the journal entry to record payment of the May payroll. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. The wages and salaries subject to these taxes were $6,000. (3) Prepare the journal entry to record the employer's payroll taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Unearned revenues are liabilities.

Q39: A single liability can be divided between

Q40: Unearned revenues are amounts received _ for

Q41: All of the following statements related to

Q42: If the times interest ratio:<br>A) Increases, then

Q44: On December 1, Gates Company borrowed $45,000

Q45: Liabilities:<br>A) Must be certain.<br>B) Must sometimes be

Q46: The payroll records of a company provided

Q47: The wage bracket withholding table is used

Q48: Frado Company provides you with following information