Essay

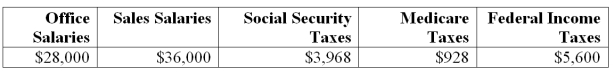

Frado Company provides you with following information related to payroll transactions for the month of May. Prepare journal entries to record the transactions for May.

a. Recorded the March payroll using the payroll register information given above.

b. Recorded the employer's payroll taxes resulting from the March payroll. The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee. Only $42,000 of the current months salaries are subject to unemployment taxes. The federal rate is .8%.

c. Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d. Issued a check to the state for the payment of the SUTA taxes for the month of May.

e. Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: A company's payroll information for the month

Q44: On December 1, Gates Company borrowed $45,000

Q45: Liabilities:<br>A) Must be certain.<br>B) Must sometimes be

Q46: The payroll records of a company provided

Q47: The wage bracket withholding table is used

Q49: Explain how to calculate times interest earned.

Q50: Arena Company's salaried employees earn two weeks

Q51: A high value for the times interest

Q52: An employee earned $47,000 during the year

Q53: Fixed expenses:<br>A) Create risk.<br>B) Can be an