Multiple Choice

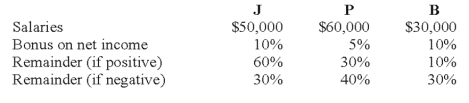

The JPB partnership reported net income of $160,000 for the year ended December 31, 2008. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 2008 be allocated to J, P, and B?

How should partnership net income for 2008 be allocated to J, P, and B?

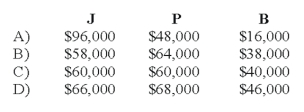

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q28: Two sole proprietors, L and M, agreed

Q32: In the AD partnership, Allen's capital is

Q32: Which of the following statements best describes

Q33: The ABC partnership had net income of

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q47: Transferable interest of a partner includes all

Q49: The terms of a partnership agreement provide

Q61: In the ABC partnership (to which Daniel