Multiple Choice

In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following questions is independent of the others.

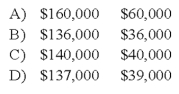

-Refer to the information provided above. David invests $40,000 for a one-fifth interest in the total capital of $220,000. What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q28: Two sole proprietors, L and M, agreed

Q32: Which of the following statements best describes

Q33: The ABC partnership had net income of

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q33: The JPB partnership reported net income of

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q49: The terms of a partnership agreement provide

Q58: In the AD partnership,Allen's capital is $140,000

Q61: In the ABC partnership (to which Daniel