Multiple Choice

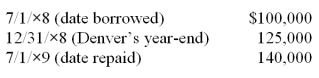

On November 1, 20X8, Denver Company borrowed 500,000 local currency units (LCU) from a foreign lender evidenced by an interest-bearing note due on November 1, 20X9, which is denominated in the currency of the lender. The U.S. dollar equivalent of the note principal was as follows:  In its income statement for 20X9, what amount should Denver include as a foreign exchange gain or loss on the note principal?

In its income statement for 20X9, what amount should Denver include as a foreign exchange gain or loss on the note principal?

A) 15,000 gain

B) 25,000 gain

C) 15,000 loss

D) 40,000 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Myway Company sold equipment to a Canadian

Q13: Spartan Company purchased interior decoration material

Q13: Mint Corporation has several transactions with foreign

Q15: Quantum Company imports goods from different

Q16: Chicago based Corporation X has a number

Q18: Chicago based Corporation X has a number

Q48: On December 1,20X8,Hedge Company entered into a

Q54: An investor purchases a put option with

Q62: Mint Corporation has several transactions with foreign

Q67: Taste Bits Inc. purchased chocolates from Switzerland