Multiple Choice

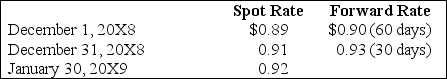

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

-Based on the preceding information,the entries on January 30,20X9,include a:

A) Debit to Dollars Payable to Exchange Broker, $184,000.

B) Credit to Foreign Currency Transaction Gain, $4,000.

C) Credit to Foreign Currency Receivable from Exchange Broker, $180,000.

D) Debit to Foreign Currency Units (SFr) , $184,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Company X denominated a December 1,20X9,purchase of

Q35: On December 5,20X8,Texas based Imperial Corporation purchased

Q42: Robert Company sold inventory to an Australian

Q52: Suppose the direct foreign exchange rates in

Q62: Spiralling crude oil prices prompted AMAR Company

Q64: On December 1, 20X8, Winston Corporation acquired

Q65: On December 5, 20X8, Texas based Imperial

Q66: Hunt Co.purchased merchandise for 300,000 British pounds

Q69: Levin company entered into a forward contract

Q70: On September 3,20X8,Jackson Corporation purchases goods for