Multiple Choice

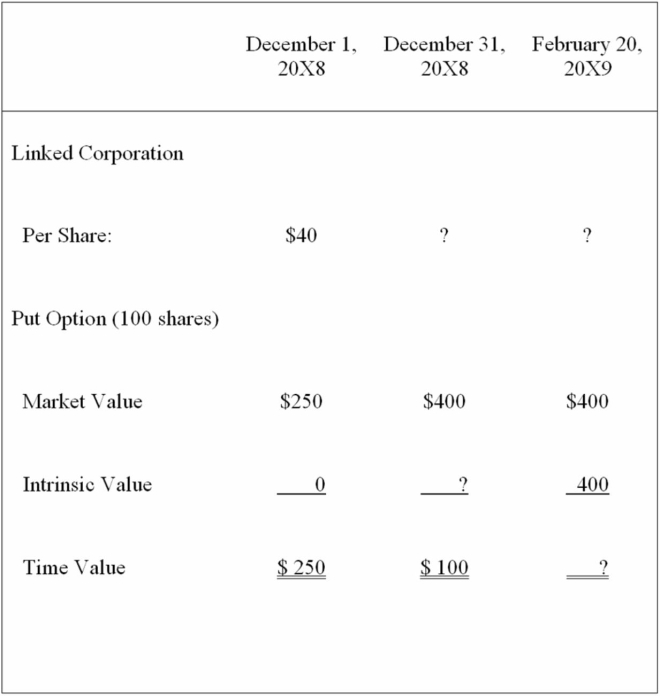

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:  Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

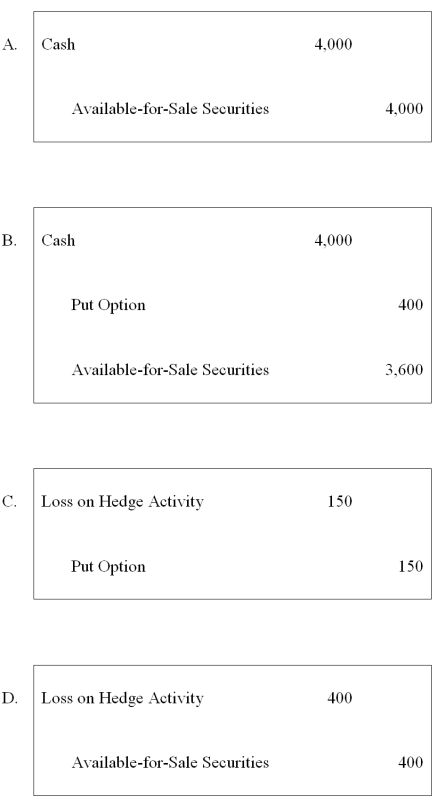

-Based on the preceding information, which of the following journal entries will be made on February 20, 20X9?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The fair market value of a near-month

Q34: On December 1,20X8,Hedge Company entered into a

Q44: Spiraling crude oil prices prompted AMAR Company

Q46: Levin Company entered into a forward contract

Q48: Heavy Company sold metal scrap to a

Q49: The fair market value of a near-month

Q51: On December 1, 2008, Denizen Corporation entered

Q52: Spiralling crude oil prices prompted AMAR Company

Q60: On December 1,20X8,Hedge Company entered into a

Q61: On December 1, 20X8, Winston Corporation acquired