Multiple Choice

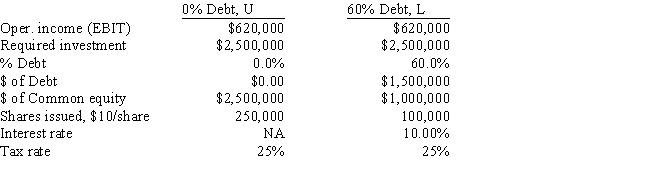

You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $620,000.Other data for the firm are shown below.How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity,i.e. ,what is EPSL - EPSU?

A) $1.50

B) $2.08

C) $1.91

D) $1.67

E) $1.58

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The Miller model begins with the Modigliani

Q8: Southeast U's campus book store sells course

Q10: Modigliani and Miller's first article led to

Q11: Gator Fabrics Inc.currently has zero debt .It

Q14: Senate Inc.is considering two alternative methods for

Q16: Your firm's debt ratio is only 5.00%,but

Q27: Modigliani and Miller's first article led to

Q32: Firms U and L each have the

Q64: If two firms have the same expected

Q80: If a firm utilizes debt financing,a 10%