Multiple Choice

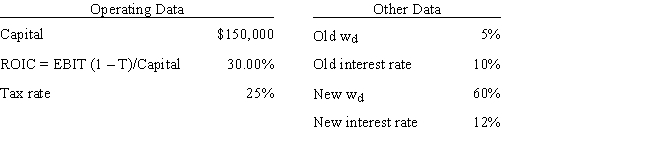

Your firm's debt ratio is only 5.00%,but the new CFO thinks that more debt should be employed.She wants to sell bonds and use the proceeds to buy back and retire common shares so the percentage of common equity in the capital structure (wc) = 1 - wd.Other things held constant,and based on the data below,if the firm increases the percentage of debt in its capital structure (wd) to 60.0%,by how much would the ROE change,i.e. ,what is ROENew - ROEOld? Do not round your intermediate calculations.

A) 31.23%

B) 26.98%

C) 30.32%

D) 34.56%

E) 26.07%

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The Miller model begins with the Modigliani

Q11: Gator Fabrics Inc.currently has zero debt .It

Q12: You work for the CEO of a

Q13: A major contribution of the Miller model

Q14: Senate Inc.is considering two alternative methods for

Q18: Assume that you and your brother plan

Q41: Financial risk refers to the extra risk

Q62: Other things held constant,firms with more stable

Q64: If two firms have the same expected

Q80: If a firm utilizes debt financing,a 10%