Multiple Choice

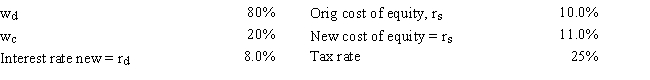

Gator Fabrics Inc.currently has zero debt .It is a zero growth company,and additional firm data are shown below.Now the company is considering using some debt,moving to the new capital structure indicated below.The money raised would be used to repurchase stock at the current price.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat,as indicated below.If this plan were carried out,by how much would the WACC change,i.e. ,what is WACCOld - WACCNew? Do not round your intermediate calculations.

A) 3.33%

B) 3.00%

C) 2.55%

D) 3.63%

E) 2.40%

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The Miller model begins with the Modigliani

Q8: Southeast U's campus book store sells course

Q10: Modigliani and Miller's first article led to

Q12: You work for the CEO of a

Q14: Senate Inc.is considering two alternative methods for

Q16: Your firm's debt ratio is only 5.00%,but

Q27: Modigliani and Miller's first article led to

Q32: Firms U and L each have the

Q51: A firm's business risk is largely determined

Q64: If two firms have the same expected