Multiple Choice

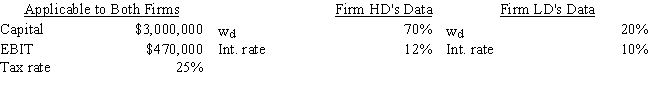

Firms HD and LD are identical except for their use of debt and the interest rates they pay--HD has more debt and thus must pay a higher interest rate.Both companies are small,so they are not subject to the interest deduction limitation.Based on the data given below,how much higher or lower will HD's ROE be versus that of LD,i.e. ,what is ROEHD - ROELD? Do not round your intermediate calculations.

A) 5.62%

B) 4.02%

C) 6.69%

D) 5.35%

E) 5.09%

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Southeast U's campus book store sells course

Q10: Modigliani and Miller's first article led to

Q11: Gator Fabrics Inc.currently has zero debt .It

Q16: Companies HD and LD have identical amounts

Q27: Modigliani and Miller's first article led to

Q32: Firms U and L each have the

Q44: Which of the following statements is CORRECT?<br>A)

Q51: A firm's business risk is largely determined

Q61: Which of the following statements is CORRECT?<br>A)

Q81: Modigliani and Miller (MM)won Nobel Prizes for