Essay

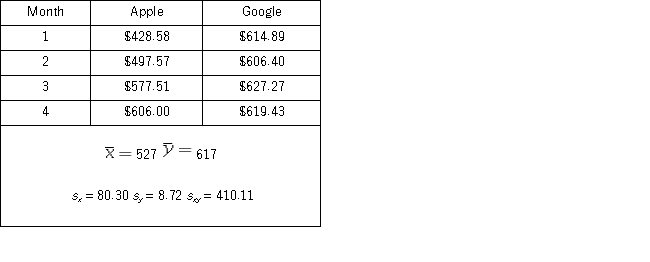

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little,if any,correlation.He wonders whether the stock prices for the firms Apple and Google are correlated.As a very preliminary step,he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a.Compute the sample correlation coefficient.

a.Compute the sample correlation coefficient.

b.Specify the competing hypotheses in order to determine whether the stock prices are correlated.

c.Calculate the value of the test statistic and approximate the corresponding p-value.

d.At the 5% significance level,what is the conclusion to the test? Explain.

Correct Answer:

Verified

The correlation coefficient is computed ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: An marketing analyst wants to examine the

Q11: A sociologist studies the relationship between a

Q12: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="Consider

Q13: Costco sells paperback books in their retail

Q15: Consider the sample regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg"

Q16: When estimating <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="When estimating

Q18: Assume you ran a multiple regression to

Q19: In the estimation of a multiple regression

Q62: _ correlation can make two variables appear

Q125: If two linear regression models have the