Multiple Choice

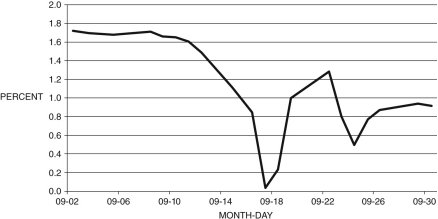

The following figure shows the daily three-month treasury yield in September 2008. Refer to the following figure when answering the following questions.

Figure 10.1: Daily Three-Month Treasury Yield: September 2008

-Consider the data in Figure 10.1. What does the data for mid-September in this figure suggest?

A) Increasing investor confidence in the effectiveness of TARP led to smaller purchases of U.S. treasuries.

B) There was a rapid movement of assets from treasuries to stocks.

C) In the aftermath of the collapse of Lehman Brothers, investors fled to the safety of short-term treasuries.

D) Prices of gold declined in line with short-term treasury yields.

E) General Motors and Chrysler declared bankruptcy.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Unemployment in the Great Recession peaked at

Q26: One of the key differences between the

Q27: The average decline in GDP growth for

Q28: IMF studies conducted after the financial crisis

Q29: Briefly compare the impact of the Great

Q31: In addition to oil price increases in

Q32: The following table shows real GDP and

Q33: The majority of mortgage-backed securities were held

Q34: Figure 10.2 shows the U.S. housing price

Q35: The Federal Deposit Insurance Corporation was established,