Exam 8: Profit Maximization and Competitive Supply

Exam 1: Preliminaries64 Questions

Exam 2: The Basics of Supply and Demand106 Questions

Exam 3: Consumer Behavior132 Questions

Exam 4: Individual and Market Demand123 Questions

Exam 5: Uncertainty and Consumer Behavior144 Questions

Exam 6: Production92 Questions

Exam 7: The Cost of Production149 Questions

Exam 8: Profit Maximization and Competitive Supply130 Questions

Exam 9: The Analysis of Competitive Markets155 Questions

Exam 10: Market Power: Monopoly and Monopsony92 Questions

Exam 11: Pricing With Market Power108 Questions

Exam 12: Monopolistic Competition and Oligopoly91 Questions

Exam 13: Game Theory and Competitive Strategy130 Questions

Exam 14: Markets for Factor Inputs98 Questions

Exam 15: Investment,time and Capital Markets111 Questions

Exam 16: General Equilibrium and Economic Efficiency 1-8392 Questions

Exam 17: Markets With Asymmetric Information78 Questions

Exam 18: Externalities and Public Goods106 Questions

Select questions type

An association of businesses that are jointly owned and operated by members for mutual benefit is a:

(Multiple Choice)

4.8/5  (28)

(28)

Which of following is a key assumption of a perfectly competitive market?

(Multiple Choice)

5.0/5  (38)

(38)

In a supply-and-demand graph,producer surplus can be pictured as the

(Multiple Choice)

4.9/5  (36)

(36)

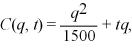

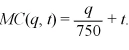

In the robotics industry there are 100 firms.Each firm shares the same long-run cost function.It is: C(q)= 100  .The relevant marginal cost function is MC(q)=

.The relevant marginal cost function is MC(q)=  .

Each of the 100 firms produce 64 units.The market demand for robotics is:

QD = 15,000 - 688P.Calculate the market price at this production level.Also,calculate the profits for a representative firm in the robotics industry.If one firm expanded production to 100 units while the remaining 99 firms kept output at 64 units,what would happen to the market price and profits? Would all firms benefit or lose if every firm expanded output to 100 units?

.

Each of the 100 firms produce 64 units.The market demand for robotics is:

QD = 15,000 - 688P.Calculate the market price at this production level.Also,calculate the profits for a representative firm in the robotics industry.If one firm expanded production to 100 units while the remaining 99 firms kept output at 64 units,what would happen to the market price and profits? Would all firms benefit or lose if every firm expanded output to 100 units?

(Essay)

4.8/5  (38)

(38)

An increasing-cost industry is so named because of the positive slope of which curve?

(Multiple Choice)

4.8/5  (38)

(38)

An industry analyst observes that in response to a small increase in price,a competitive firm's output sometimes rises a little and sometimes a lot.The best explanation for this finding is that

(Multiple Choice)

4.9/5  (42)

(42)

If current output is less than the profit-maximizing output,then the next unit produced

(Multiple Choice)

4.8/5  (40)

(40)

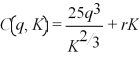

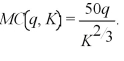

The manufacturing of paper products causes damage to a local river when the manufacturing plant produces more than 1,000 units in a period.To discourage the plant from producing more than 1,000 units,the local community is considering placing a tax on the plant.The long-run cost curve for the paper producing firm is:  where q is the number of units of paper produced and t is the per unit tax on paper production.The relevant marginal cost curve is:

where q is the number of units of paper produced and t is the per unit tax on paper production.The relevant marginal cost curve is:  If the manufacturing plant can sell all of its output for $2,what is the firm's optimal output if the tax is set at zero? What is the minimum tax rate necessary to ensure that the firm produces no more than 1,000 units? How much are the firm's profits reduced by the presence of a tax?

If the manufacturing plant can sell all of its output for $2,what is the firm's optimal output if the tax is set at zero? What is the minimum tax rate necessary to ensure that the firm produces no more than 1,000 units? How much are the firm's profits reduced by the presence of a tax?

(Essay)

4.7/5  (41)

(41)

An industry has 1000 competitive firms,each producing 50 tons of output.At the current market price of $10,half of the firms have a short-run supply curve with a slope of 1; the other half each have a short-run supply curve with slope 2.The short-run elasticity of market supply is

(Multiple Choice)

4.8/5  (33)

(33)

If a competitive firm's marginal costs always increase with output,then at the profit maximizing output level,producer surplus is

(Multiple Choice)

5.0/5  (30)

(30)

A firm maximizes profit by operating at the level of output where

(Multiple Choice)

4.9/5  (36)

(36)

Laura's internet services has the following short-run cost curve:  where q is Laura's output level,K is the number of servers she leases and r is the lease rate of servers.Laura's short-run marginal cost function is:

where q is Laura's output level,K is the number of servers she leases and r is the lease rate of servers.Laura's short-run marginal cost function is:  Currently,Laura leases 8 servers,the lease rate of servers is $15,and Laura can sell all the output she produces for $500.Find Laura's short-run profit maximizing level of output.Calculate Laura's profits.If the lease rate of internet servers rise to $20,how does Laura's optimal output and profits change?

Currently,Laura leases 8 servers,the lease rate of servers is $15,and Laura can sell all the output she produces for $500.Find Laura's short-run profit maximizing level of output.Calculate Laura's profits.If the lease rate of internet servers rise to $20,how does Laura's optimal output and profits change?

(Essay)

5.0/5  (43)

(43)

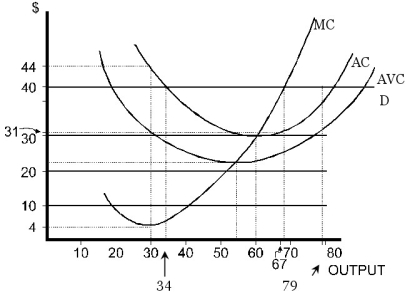

Consider the following diagram where a perfectly competitive firm faces a price of $40.  Figure 8.1

-Refer to Figure 8.1.At the profit-maximizing level of output,ATC is

Figure 8.1

-Refer to Figure 8.1.At the profit-maximizing level of output,ATC is

(Multiple Choice)

4.9/5  (40)

(40)

Consider the following statements when answering this question I.If the cost of producing each unit of output falls $5,then the short-run market price falls $5.

II.If the cost of producing each unit of output falls $5,then the long-run market price falls $5.

(Multiple Choice)

4.8/5  (38)

(38)

Use the following statements to answer this question: I.Markets that have only a few sellers cannot be highly competitive.

II.Markets with many sellers are always perfectly competitive.

(Multiple Choice)

4.9/5  (39)

(39)

In a constant-cost industry,an increase in demand will be followed by

(Multiple Choice)

4.9/5  (32)

(32)

Showing 101 - 120 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)