Exam 20: Uncertainty and Information

Exam 1: What Is Economics479 Questions

Exam 2: The Economic Problem439 Questions

Exam 3: Demand and Supply515 Questions

Exam 4: Elasticity533 Questions

Exam 5: Efficiency and Equity449 Questions

Exam 6: Government Actions in Markets410 Questions

Exam 7: Global Markets in Action200 Questions

Exam 8: Utility and Demand364 Questions

Exam 9: Possibilities, Preferences, and Choices464 Questions

Exam 10: Organizing Production385 Questions

Exam 11: Output and Costs494 Questions

Exam 12: Perfect Competition487 Questions

Exam 13: Monopoly606 Questions

Exam 14: Monopolistic Competition320 Questions

Exam 15: Oligopoly280 Questions

Exam 16: Public Choices and Public Goods356 Questions

Exam 17: Externalities and the Environment284 Questions

Exam 18: Markets for Factors of Production382 Questions

Exam 19: Economic Inequality354 Questions

Exam 20: Uncertainty and Information233 Questions

Exam 21: Extension A: Review11 Questions

Exam 22: Extension B: Review25 Questions

Exam 23: Extension C: Review14 Questions

Exam 24: Extension D: Review38 Questions

Exam 25: Extension E: Review11 Questions

Exam 26: Extension F: Review18 Questions

Select questions type

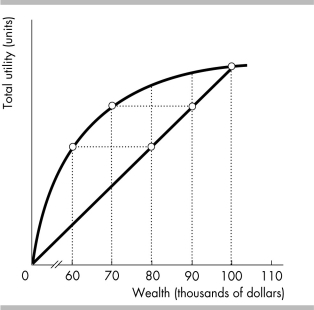

-Van, whose utility of wealth curve is shown in the above figure, owns a home that is valued at $100,000. There is a 10 percent chance that the house will be destroyed by hurricane. The minimum cost of insurance in this case is

-Van, whose utility of wealth curve is shown in the above figure, owns a home that is valued at $100,000. There is a 10 percent chance that the house will be destroyed by hurricane. The minimum cost of insurance in this case is

(Multiple Choice)

4.7/5  (30)

(30)

Used car buyers believe a car is good quality when the seller signals the car's quality by offering a warranty because

(Multiple Choice)

4.8/5  (29)

(29)

As more information is gather, the marginal cost of additional information ________ and the marginal benefit of additional information ________.

(Multiple Choice)

4.7/5  (30)

(30)

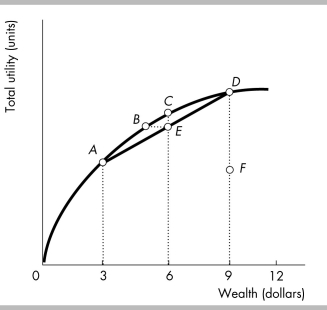

Goldie is indifferent between option A, which gives her $9,000 for sure, and option B, which gives her $3,000 with probability 1/3 or $18,000 with probability 2/3. Goldie's cost of risk for option B is

(Multiple Choice)

4.8/5  (31)

(31)

If Al is risk averse, as his wealth increases, his total utility of wealth ________ and his marginal utility of wealth ________.

(Multiple Choice)

4.7/5  (39)

(39)

In the market for automobile insurance, adverse selection implies that

(Multiple Choice)

4.8/5  (34)

(34)

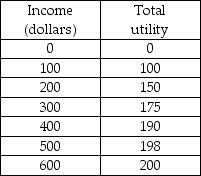

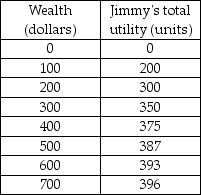

-James has a utility of wealth schedule in the above table. He is offered a job selling video games at Games Galore. James' compensation depends on how much he sells. In a poor sales period, a salesperson makes $100 per month. In a good sales period, a salesperson makes $600 per month. James is told by the manager that, in any given month, there is a 25 percent chance of a poor sales period and a 75 percent chance of a good sales period. Suppose that one of James' professors offers him the opportunity to be a research assistant for a fixed and guaranteed amount each month. Comparing the two opportunities, working at Games Galore versus being a research assistant, what is James' cost of risk?

-James has a utility of wealth schedule in the above table. He is offered a job selling video games at Games Galore. James' compensation depends on how much he sells. In a poor sales period, a salesperson makes $100 per month. In a good sales period, a salesperson makes $600 per month. James is told by the manager that, in any given month, there is a 25 percent chance of a poor sales period and a 75 percent chance of a good sales period. Suppose that one of James' professors offers him the opportunity to be a research assistant for a fixed and guaranteed amount each month. Comparing the two opportunities, working at Games Galore versus being a research assistant, what is James' cost of risk?

(Multiple Choice)

4.8/5  (24)

(24)

Dana wants to try working as an independent contractor this summer. She has a 50 percent chance that she will make $10,000 and 50 percent chance that she will make nothing. What's Dana's expected income from taking this job?

(Multiple Choice)

4.8/5  (29)

(29)

Of the following, the best example of private information is when

(Multiple Choice)

4.7/5  (28)

(28)

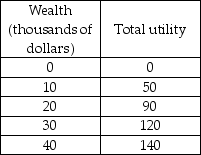

-Gunnar can work as a campus security officer at a guaranteed salary of $20,000 per year or as a real estate agent. If Gunnar works as a real estate agent, there is a 50 percent chance that he will earn $10,000 per year and a 50 percent chance that he will earn $30,000 per year. Based on the table above, Gunnar's expected utility if he works as a real estate agent is

-Gunnar can work as a campus security officer at a guaranteed salary of $20,000 per year or as a real estate agent. If Gunnar works as a real estate agent, there is a 50 percent chance that he will earn $10,000 per year and a 50 percent chance that he will earn $30,000 per year. Based on the table above, Gunnar's expected utility if he works as a real estate agent is

(Multiple Choice)

4.9/5  (35)

(35)

Suppose Nara could invest her $1000 in a savings account or she could invest in the stock market. After one year, the savings account has a guaranteed 5 percent interest rate and the stock market has a 10 percent chance of tripling her money, and 90 percent chance of losing it all. What is Nara's expected wealth if she places her money in the savings account?

(Multiple Choice)

4.8/5  (34)

(34)

-In the figure above, Lourdita faces a 0.5 probability of receiving $3,000 and a 0.5 probability of receiving $9,000. Her cost of bearing this risk is the distance from

-In the figure above, Lourdita faces a 0.5 probability of receiving $3,000 and a 0.5 probability of receiving $9,000. Her cost of bearing this risk is the distance from

(Multiple Choice)

4.7/5  (34)

(34)

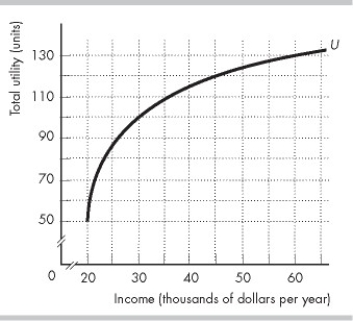

-Lucy works as a college instructor for a fixed annual salary of $30,000. She is considering quitting this job and becoming a real estate broker. Lucy believes that as a realtor she has a 40 percent chance to make $60,000 per year and a 60 percent chance to make $25,000 a year. The figure above shows Lucy's total utility of wealth curve (U). Of the following, what minimum salary raise (if any) should Lucy's current employer offer her to persuade her to stay?

-Lucy works as a college instructor for a fixed annual salary of $30,000. She is considering quitting this job and becoming a real estate broker. Lucy believes that as a realtor she has a 40 percent chance to make $60,000 per year and a 60 percent chance to make $25,000 a year. The figure above shows Lucy's total utility of wealth curve (U). Of the following, what minimum salary raise (if any) should Lucy's current employer offer her to persuade her to stay?

(Multiple Choice)

5.0/5  (38)

(38)

There is a growing market for buying and selling information about the online behavior of consumers. Most people use one of only a small number of search engines (such as Google, Bing, or Yahoo!) when surfing the net. It has been hard for new search engines to gain any market share. The market for search is best considered as

(Multiple Choice)

4.9/5  (37)

(37)

-Of the choices given below, Jimmy, whose utility of wealth schedule is given above, prefers

-Of the choices given below, Jimmy, whose utility of wealth schedule is given above, prefers

(Multiple Choice)

4.9/5  (31)

(31)

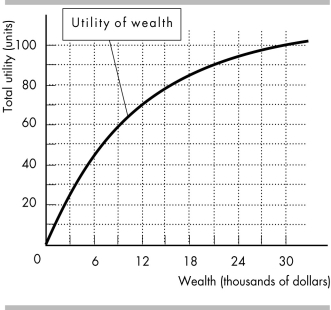

-Roy owns a sports car worth $40,000, and that is his only wealth. Roy is a reckless driver, and there is a 30 percent chance that he will have an accident within a year. If he does have an accident, his car is worthless. Roy's utility of wealth curve is shown in the figure below. An insurance company agrees to pay a car owner like Roy the full value of his car in case of an accident if the car owner buys the company's insurance policy. The company's operating expenses are $2,000 per policy.

a) What is Roy's expected wealth?

b) What is Roy's expected utility?

c) What is the maximum amount that Roy is willing to pay for car insurance?

d) What is the minimum premium that the insurance company is willing to accept?

e) Will Roy buy the insurance policy? Why or why not?

-Roy owns a sports car worth $40,000, and that is his only wealth. Roy is a reckless driver, and there is a 30 percent chance that he will have an accident within a year. If he does have an accident, his car is worthless. Roy's utility of wealth curve is shown in the figure below. An insurance company agrees to pay a car owner like Roy the full value of his car in case of an accident if the car owner buys the company's insurance policy. The company's operating expenses are $2,000 per policy.

a) What is Roy's expected wealth?

b) What is Roy's expected utility?

c) What is the maximum amount that Roy is willing to pay for car insurance?

d) What is the minimum premium that the insurance company is willing to accept?

e) Will Roy buy the insurance policy? Why or why not?

(Essay)

4.9/5  (31)

(31)

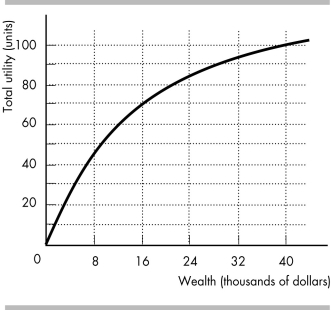

-Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000, and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless. What is Andrew's expected wealth?

-Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000, and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless. What is Andrew's expected wealth?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 21 - 40 of 233

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)