Exam 20: Uncertainty and Information

Exam 1: What Is Economics479 Questions

Exam 2: The Economic Problem439 Questions

Exam 3: Demand and Supply515 Questions

Exam 4: Elasticity533 Questions

Exam 5: Efficiency and Equity449 Questions

Exam 6: Government Actions in Markets410 Questions

Exam 7: Global Markets in Action200 Questions

Exam 8: Utility and Demand364 Questions

Exam 9: Possibilities, Preferences, and Choices464 Questions

Exam 10: Organizing Production385 Questions

Exam 11: Output and Costs494 Questions

Exam 12: Perfect Competition487 Questions

Exam 13: Monopoly606 Questions

Exam 14: Monopolistic Competition320 Questions

Exam 15: Oligopoly280 Questions

Exam 16: Public Choices and Public Goods356 Questions

Exam 17: Externalities and the Environment284 Questions

Exam 18: Markets for Factors of Production382 Questions

Exam 19: Economic Inequality354 Questions

Exam 20: Uncertainty and Information233 Questions

Exam 21: Extension A: Review11 Questions

Exam 22: Extension B: Review25 Questions

Exam 23: Extension C: Review14 Questions

Exam 24: Extension D: Review38 Questions

Exam 25: Extension E: Review11 Questions

Exam 26: Extension F: Review18 Questions

Select questions type

How can a warranty at the seller's expense signal that a product is high quality?

(Essay)

4.7/5  (37)

(37)

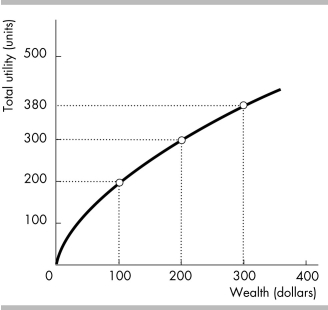

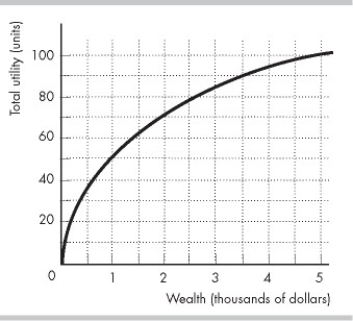

-Marylou, whose utility of wealth curve is shown in the figure above, faces two options. Option A yields $200 for sure. Option B has a 0.3 probability of yielding $100, and a 0.7 probability of yielding $300. Marylou, who is

-Marylou, whose utility of wealth curve is shown in the figure above, faces two options. Option A yields $200 for sure. Option B has a 0.3 probability of yielding $100, and a 0.7 probability of yielding $300. Marylou, who is

(Multiple Choice)

4.9/5  (37)

(37)

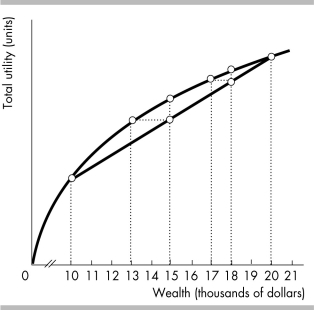

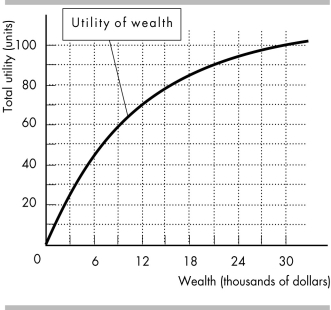

-John's utility of wealth curve is shown in the above figure. He currently has wealth of $20,000, and there is a 25 percent chance that he could lose it all. If an insurance company offers to insure against this loss for $6,000, John will

-John's utility of wealth curve is shown in the above figure. He currently has wealth of $20,000, and there is a 25 percent chance that he could lose it all. If an insurance company offers to insure against this loss for $6,000, John will

(Multiple Choice)

4.8/5  (31)

(31)

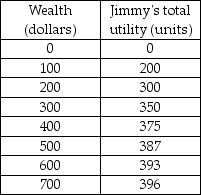

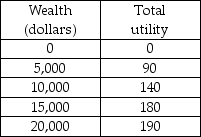

-Jimmy's utility of wealth schedule is given in the table above. Jimmy has a job with a one-third chance of earning $200 and a two-thirds chance of earnings $400. Jimmy's cost of risk is

-Jimmy's utility of wealth schedule is given in the table above. Jimmy has a job with a one-third chance of earning $200 and a two-thirds chance of earnings $400. Jimmy's cost of risk is

(Multiple Choice)

4.9/5  (33)

(33)

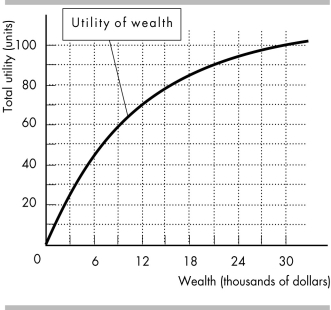

-Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000, and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless. Andrew would have the same expected utility as he currently has if his wealth was ________ and he faced no uncertainty.

-Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000, and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless. Andrew would have the same expected utility as he currently has if his wealth was ________ and he faced no uncertainty.

(Multiple Choice)

4.8/5  (35)

(35)

-Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000, and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless. The value of insurance to Andrew against an accident is

-Andrew has the utility of wealth curve shown in the above figure. He owns an SUV worth $30,000, and that is his only wealth. There is a 10 percent chance that he will have an accident within a year. If he does have an accident, his SUV is worthless. The value of insurance to Andrew against an accident is

(Multiple Choice)

4.8/5  (39)

(39)

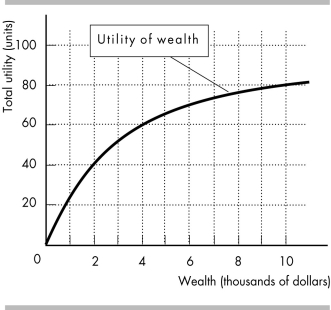

-Bobby is offered two fulltime jobs. In the first job, as a salesperson, he has a 50 percent chance to make $2,000 a month and a 50 percent chance to make $10,000 a month. The second job, as a construction worker, pays $4,500 a month with certainty. Bobby's utility of wealth curve is shown in the figure above. Bobby will take the ________ job because his expected ________ from this job is greater.

-Bobby is offered two fulltime jobs. In the first job, as a salesperson, he has a 50 percent chance to make $2,000 a month and a 50 percent chance to make $10,000 a month. The second job, as a construction worker, pays $4,500 a month with certainty. Bobby's utility of wealth curve is shown in the figure above. Bobby will take the ________ job because his expected ________ from this job is greater.

(Multiple Choice)

4.9/5  (37)

(37)

Expected wealth is a weighted average in which the weights are

(Multiple Choice)

4.7/5  (27)

(27)

-Steve owns a motorcycle valued at $5,000, and that is his only asset. There is a 5 percent chance that Steve will have an accident within a year. If he does have an accident, his motorcycle is worthless. Steve's utility of wealth curve is shown in the figure above. An insurance company agrees to pay Steve the full value of his motorcycle in case of an accident if he buys the company's insurance policy. The company's operating expenses are $500 per policy. With no insurance, Steve's expected wealth is

-Steve owns a motorcycle valued at $5,000, and that is his only asset. There is a 5 percent chance that Steve will have an accident within a year. If he does have an accident, his motorcycle is worthless. Steve's utility of wealth curve is shown in the figure above. An insurance company agrees to pay Steve the full value of his motorcycle in case of an accident if he buys the company's insurance policy. The company's operating expenses are $500 per policy. With no insurance, Steve's expected wealth is

(Multiple Choice)

4.8/5  (33)

(33)

Diminishing marginal utility of wealth leads to risk aversion because at a given level of wealth a dollar gained

(Multiple Choice)

4.7/5  (26)

(26)

-Based on the table and information in the previous question, which of the following is true?

-Based on the table and information in the previous question, which of the following is true?

(Multiple Choice)

4.8/5  (27)

(27)

An increase in Meta's wealth from $3,000 to $6,000 raises her utility from 80 units to 100 units. If she is risk averse, with a wealth of $9,000 her utility might be

(Multiple Choice)

5.0/5  (33)

(33)

Suppose that there are only two types of used cars, peaches and lemons. Peaches are worth $10,000 and lemons are worth $4,000. Without effective signals such as warranties, the owners of peaches cannot sell their cars for $10,000 because the

(Multiple Choice)

4.8/5  (44)

(44)

The cost of risk is the amount by which expected wealth must increase to give the same ________ as a no-risk situation.

(Multiple Choice)

4.8/5  (39)

(39)

If a lender checks credit reports on individuals before mailing out loan offers, it is most likely trying to avoid

(Multiple Choice)

4.8/5  (40)

(40)

If reckless drivers are more likely than safe drivers to buy automobile insurance, then a moral hazard problem has occurred.

(True/False)

4.9/5  (37)

(37)

Showing 161 - 180 of 233

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)