Exam 20: Uncertainty and Information

Exam 1: What Is Economics479 Questions

Exam 2: The Economic Problem439 Questions

Exam 3: Demand and Supply515 Questions

Exam 4: Elasticity533 Questions

Exam 5: Efficiency and Equity449 Questions

Exam 6: Government Actions in Markets410 Questions

Exam 7: Global Markets in Action200 Questions

Exam 8: Utility and Demand364 Questions

Exam 9: Possibilities, Preferences, and Choices464 Questions

Exam 10: Organizing Production385 Questions

Exam 11: Output and Costs494 Questions

Exam 12: Perfect Competition487 Questions

Exam 13: Monopoly606 Questions

Exam 14: Monopolistic Competition320 Questions

Exam 15: Oligopoly280 Questions

Exam 16: Public Choices and Public Goods356 Questions

Exam 17: Externalities and the Environment284 Questions

Exam 18: Markets for Factors of Production382 Questions

Exam 19: Economic Inequality354 Questions

Exam 20: Uncertainty and Information233 Questions

Exam 21: Extension A: Review11 Questions

Exam 22: Extension B: Review25 Questions

Exam 23: Extension C: Review14 Questions

Exam 24: Extension D: Review38 Questions

Exam 25: Extension E: Review11 Questions

Exam 26: Extension F: Review18 Questions

Select questions type

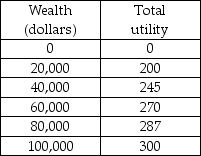

-Beachcomber Beatrice spent her entire wealth of $100,000 to build a beach house on the Gulf of Mexico. There is a 10 percent chance that the house will be destroyed by a hurricane. Beatrice's utility of wealth schedule is given in the table above. What is the maximum amount that Beatrice would be willing to pay for an insurance policy that pays $100,000 if her beach house is destroyed by a hurricane?

-Beachcomber Beatrice spent her entire wealth of $100,000 to build a beach house on the Gulf of Mexico. There is a 10 percent chance that the house will be destroyed by a hurricane. Beatrice's utility of wealth schedule is given in the table above. What is the maximum amount that Beatrice would be willing to pay for an insurance policy that pays $100,000 if her beach house is destroyed by a hurricane?

(Multiple Choice)

4.7/5  (35)

(35)

Because Don has health insurance, he is more likely to see the doctor when he has a cold. This is an example of

(Multiple Choice)

4.8/5  (35)

(35)

Used car buyers believe a car is good quality when the seller signals the car's quality by offering a warranty because

(Multiple Choice)

4.8/5  (42)

(42)

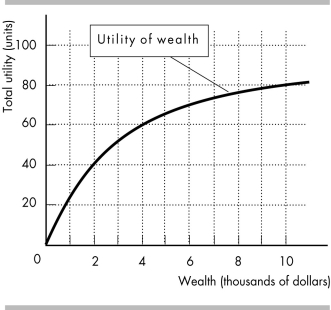

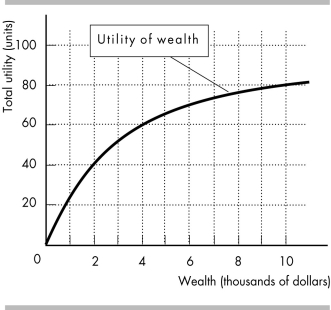

-Bobby is offered a job as a salesperson in which there is a 50 percent chance that he will make $2,000 and a 50 percent chance that he will make $10,000. Bobby's utility of wealth curve is shown in the figure above. What is Bobby's expected income from taking this job?

-Bobby is offered a job as a salesperson in which there is a 50 percent chance that he will make $2,000 and a 50 percent chance that he will make $10,000. Bobby's utility of wealth curve is shown in the figure above. What is Bobby's expected income from taking this job?

(Multiple Choice)

4.8/5  (40)

(40)

Hostess Brands is selling off its assets after liquidation. A potential buyer for the Twinkies brand has found that the total revenue will be $3 billion a year if the brand is managed well and $1 billion a year if the brand is managed poorly. There is .6 (or 60 percent) chance of managing the brand well and a .4 (or 40 percent) chance of managing the brand poorly. What is the expected total revenue?

(Multiple Choice)

4.9/5  (41)

(41)

In the market for automobile insurance, adverse selection implies that

(Multiple Choice)

4.8/5  (29)

(29)

Erika's utility with $3,000 of wealth is 6,000 and her utility with $3,001 of wealth is 6,005. Her marginal utility from gaining the additional $1 of wealth is ________.

(Multiple Choice)

4.9/5  (34)

(34)

The slope of the utility of wealth curve of a risk-averse person

(Multiple Choice)

4.9/5  (34)

(34)

Adriana wants to try working as an independent contractor this summer. She has a 50 percent chance that she will make $9,000 and 50 percent chance that she will make nothing. What's Adriana's expected income?

(Multiple Choice)

4.7/5  (32)

(32)

The International Maritime Bureau said the waters off Somalia are the world's most dangerous, accounting for nearly a third reported pirate attacks worldwide between January and September 2008. Suppose all boats are insured to $100,000 and pay a premium of $10,000 each. Suppose 10 out of 100 boats are attacked by pirates and these 10 file claims with their insurance. If the insurance company's only costs are the claims it must pay, has the insurance company earned an economic profit?

(Multiple Choice)

4.8/5  (35)

(35)

If Ben becomes less likely to buy smoke detectors after he has fire insurance, he is illustrating

(Multiple Choice)

4.9/5  (40)

(40)

Suppose that there are only two types of used cars, peaches and lemons. Peaches are worth $10,000, and lemons are worth $4,000. If the market is such that only lemons are sold, then used cars are

(Multiple Choice)

4.7/5  (25)

(25)

Mortgage insurance protects lenders when a borrower defaults by making up any shortfall needed to repay the loan if the sale of the property doesn't cover the debt. Federally regulated lenders must have mortgage insurance on loans where the buyer's down payment is less than 20 per cent of the price. In this example, what signal do potential homeowners give to indicate they are low-risk?

(Multiple Choice)

4.7/5  (43)

(43)

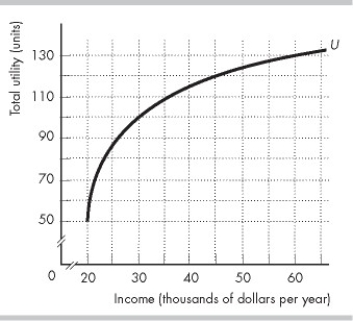

-Lucy works as a college instructor for a fixed annual salary of $30,000. She is considering quitting this job and becoming a real estate broker. Lucy believes that as a realtor she has a 40 percent chance to make $60,000 per year and a 60 percent chance to make $25,000 a year. The figure above shows Lucy's total utility of wealth curve (U). Lucy's expected annual income from real estate brokerage is

-Lucy works as a college instructor for a fixed annual salary of $30,000. She is considering quitting this job and becoming a real estate broker. Lucy believes that as a realtor she has a 40 percent chance to make $60,000 per year and a 60 percent chance to make $25,000 a year. The figure above shows Lucy's total utility of wealth curve (U). Lucy's expected annual income from real estate brokerage is

(Multiple Choice)

4.8/5  (39)

(39)

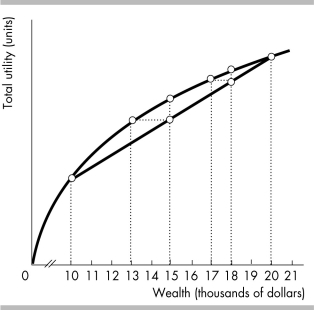

-John's utility of wealth curve is shown in the above figure. He currently has wealth of $20,000. If the state lottery offers a 1 in 10,000 chance of winning $10,000, John will

-John's utility of wealth curve is shown in the above figure. He currently has wealth of $20,000. If the state lottery offers a 1 in 10,000 chance of winning $10,000, John will

(Multiple Choice)

4.8/5  (32)

(32)

In the market for automobile insurance, moral hazard implies that

(Multiple Choice)

4.8/5  (43)

(43)

-Bobby is offered a job as a salesperson in which there is a 50 percent chance that he will make $2,000 and a 50 percent chance that he will make $10,000. Bobby's utility of wealth curve is shown in the figure above. What is Bobby's expected utility from taking this job?

-Bobby is offered a job as a salesperson in which there is a 50 percent chance that he will make $2,000 and a 50 percent chance that he will make $10,000. Bobby's utility of wealth curve is shown in the figure above. What is Bobby's expected utility from taking this job?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 101 - 120 of 233

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)