Exam 27: Monetary Policy

One of the changes that the Fed has established as a result of the financial crisis is that it now lends to other financial institutions that are not banks, such as the insurance giant AIG.

True

Explain the changes made by the Fed as a result of the 2007-08 financial crisis and the corresponding new types of assets it now holds.

Before the financial crisis the Fed did not hold private securities on its balance sheet, so this type of asset on the Fed's balance sheet is a completely new category, representing one of the ways in which the Fed has fundamentally changed as a result of the financial crisis. One example of the type of security in this category is commercial paper, which is a type of bond with very short-term maturity issued by a financial or non-financial firm. Another example is a mortgage-backed security (MBS), which is a collection of mortgages bundled together into one bond. These collections were put together by financial firms in order to make the mortgages more attractive to investors.

Other examples in the private securities category are securities backed by student loans or automobile loans or even credit card debt. Yet another example in the private securities category is the security portfolio formerly held by financial firms such as the large insurance company AIG or the former investment bank Bear Stearns.

The final category on the Fed's balance sheet consists of direct loans to other financial institutions that are not banks that take deposits from customers. This too is a new item, first appearing on the balance sheet in 2008 during the financial crisis. These other financial institutions include brokers and dealers and insurance companies such as AIG. One particular example is the primary dealer credit facility (PDCF), through which the Fed made loans to brokers and dealers.

Countries with fixed exchange rates will have their interest rates moving in the same direction.

The situation in which policymakers have the incentive to announce one economic policy but then change that policy after citizens have acted on the initial state policy is known as

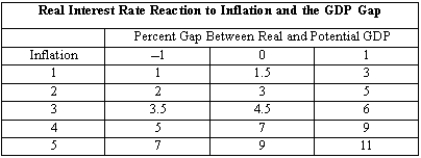

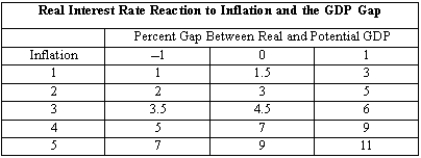

Exhibit 27-1  -According to the data in Exhibit 27-1, if the gap between real GDP and potential GDP is 1 percent and inflation is 5 percent, the Fed will set the real interest rate at

-According to the data in Exhibit 27-1, if the gap between real GDP and potential GDP is 1 percent and inflation is 5 percent, the Fed will set the real interest rate at

Explain the controversy surrounding the effectiveness of quantitative easing.

If we have a "Goldilocks economy," the Fed will not change monetary policy.

When central banks are independent of government, they are no longer accountable for their actions.

A central bank increases its inflation target when real and potential GDP are equal if it

The Phillips curve reflects a positive relationship between inflation and unemployment.

Exhibit 27-1  -Suppose the Fed decides to increase the real interest rate. According to the data in Exhibit 27-1,

-Suppose the Fed decides to increase the real interest rate. According to the data in Exhibit 27-1,

If Congress controlled central bank decisions, it would have

Which of the following statements best describes what it means for the Fed to manage aggregate demand?

Describe the new tools of monetary policy of the Fed and explain the reasoning of the Fed to create these new ways to deal with the recent financial crisis.

An increase in real GDP shortly before a presidential election could signal the start of

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)