Exam 14: Taxes, Transfers, and Income Distribution

Exam 1: The Central Idea156 Questions

Exam 2: Observing and Explaining the Economy143 Questions

Exam 3: The Supply and Demand Model166 Questions

Exam 4: Subtleties of the Supply and Demand Model176 Questions

Exam 5: The Demand Curve and the Behavior of Consumers176 Questions

Exam 6: The Supply Curve and the Behavior of Firms179 Questions

Exam 7: The Efficiency of Markets163 Questions

Exam 8: Costs and the Changes at Firms Over Time191 Questions

Exam 9: The Rise and Fall of Industries139 Questions

Exam 10: Monopoly184 Questions

Exam 11: Product Differentiation, Monopolistic Competition, and Oligopoly169 Questions

Exam 12: Antitrust Policy and Regulation152 Questions

Exam 13: Labor Markets179 Questions

Exam 14: Taxes, Transfers, and Income Distribution179 Questions

Exam 15: Public Goods, Externalities, and Government Behavior197 Questions

Exam 16: Capital and Financial Markets188 Questions

Exam 17: Macroeconomics: the Big Picture159 Questions

Exam 18: Measuring the Production, Income, and Spending of Nations177 Questions

Exam 19: The Spending Allocation Model166 Questions

Exam 20: Unemployment and Employment212 Questions

Exam 21: Productivity and Economic Growth162 Questions

Exam 22: Money and Inflation153 Questions

Exam 23: The Nature and Causes of Economic Fluctuations185 Questions

Exam 24: The Economic Fluctuations Model205 Questions

Exam 25: Using the Economic Fluctuations Model176 Questions

Exam 26: Fiscal Policy138 Questions

Exam 27: Monetary Policy180 Questions

Exam 28: Economic Growth Around the World157 Questions

Exam 29: International Trade242 Questions

Exam 30: International Finance125 Questions

Select questions type

The amount of income tax that must be paid on an additional dollar of income is determined by the

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

D

If a welfare payment is reduced for every additional dollar a person earns, then the welfare program creates an incentive for that person to work.

Free

(True/False)

4.8/5  (34)

(34)

Correct Answer:

False

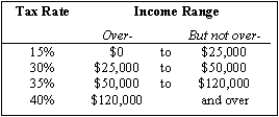

Exhibit 14-3  -Refer to Exhibit 14-3. Calculate the tax to be paid on $45,000 in gross income when the standard deduction and exemptions total $7,500.

-Refer to Exhibit 14-3. Calculate the tax to be paid on $45,000 in gross income when the standard deduction and exemptions total $7,500.

Free

(Essay)

4.8/5  (40)

(40)

Correct Answer:

$7,500

Taxable income = $45,000 - $7,500 = $37,500

Tax on first = $25,000 = $25,000 * 0.15 = $3,750

Tax on next = $12,500 = $12,500* 0.3 = $3,750

Total tax = $3,750 + $3,750 = $7,500

What is the difference between means-tested transfer programs and social insurance programs?

(Essay)

4.9/5  (29)

(29)

Suppose an economic historian discovers that a tax on a particular good resulted in a large price change while having little effect on the quantity demanded. Was this good most likely a necessity or a luxury good? Explain.

(Essay)

4.7/5  (35)

(35)

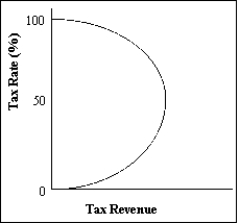

According to the Laffer curve, it is possible for the government to

(Multiple Choice)

4.9/5  (34)

(34)

Suppose a new law requires that employers pay for employees' total retirement benefits. Show how the law affects the supply of and demand for labor. What happens to wages and employment relative to the pre-law situation?

(Essay)

4.8/5  (25)

(25)

The greatest degree of income inequality is achieved when the Gini coefficient equals

(Multiple Choice)

4.7/5  (36)

(36)

In the case of a per-unit tax on a good, which of the following situations will lead to the greatest change in price?

(Multiple Choice)

4.7/5  (34)

(34)

If the average tax rate falls as income rises, the tax is called a

(Multiple Choice)

4.9/5  (40)

(40)

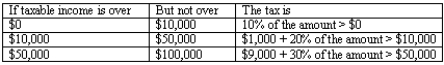

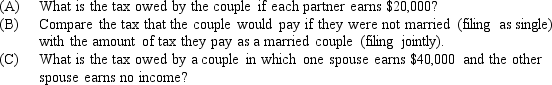

Consider the following income tax schedule for a married couple who are combining their incomes and filing jointly:

(Essay)

4.8/5  (27)

(27)

All other things being equal, which of the following results in the most tax burden for consumers in the case of a per-unit tax on a good?

(Multiple Choice)

4.8/5  (33)

(33)

Suppose the government decides to decrease the payroll tax paid by employers. What will happen to workers' wages? If the labor supply curve is perfectly inelastic, what will happen to employment? What will be the effect on workers' wages?

(Essay)

4.9/5  (36)

(36)

The average tax rate is the amount of tax an individual would have to pay on one more dollar of income.

(True/False)

4.7/5  (37)

(37)

It does not matter whether a worker or an employer physically pays a payroll tax; the net effect on wages is the same.

(True/False)

4.7/5  (37)

(37)

Head Start is a program that gives interest-free loans to poor people to help them start their own businesses.

(True/False)

4.8/5  (30)

(30)

Exhibit 14-2  -Refer to Exhibit 14-2. The curve is referred to as the ____ curve.

-Refer to Exhibit 14-2. The curve is referred to as the ____ curve.

(Multiple Choice)

4.7/5  (42)

(42)

Suppose that a four-person family can earn up to $15,120 and pay no income tax, and that income in the lowest tax bracket is taxed at 15 percent. Given the fact that the earned income tax credit falls by 21 cents for every additional dollar of gross income earned above $11,000, what is the marginal tax rate for a family of four if its gross income is $20,000?

(Multiple Choice)

4.8/5  (34)

(34)

The deadweight loss of a tax is larger if the price elasticity of demand is higher.

(True/False)

4.7/5  (30)

(30)

Showing 1 - 20 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)