Exam 22: Managing the Firms Assets

Exam 1: The Entrepreneurial Life101 Questions

Exam 2: Entrepreneurial Integrity and Ethics105 Questions

Exam 3: Getting Started103 Questions

Exam 4: Franchises and Buyouts98 Questions

Exam 5: The Family Business90 Questions

Exam 6: The Business Plan: Visualizing the Dream93 Questions

Exam 7: The Marketing Plan93 Questions

Exam 8: The Human Resources Plan: Managers, Owners, Allies, and Directors109 Questions

Exam 9: The Location Plan103 Questions

Exam 10: Understanding a Firms Financial Statements78 Questions

Exam 11: Forecasting Financial Requirements57 Questions

Exam 12: A Firms Sources of Financing86 Questions

Exam 13: Planning for the Harvest82 Questions

Exam 14: Building Customer Relationships88 Questions

Exam 15: Product and Supply Chain Management102 Questions

Exam 16: Pricing and Credit Decisions99 Questions

Exam 17: Promotional Planning109 Questions

Exam 18: Global Opportunities for Small Business102 Questions

Exam 19: Professional Management in the Entrepreneurial Firm99 Questions

Exam 20: Managing Human Resources103 Questions

Exam 21: Managing Operations93 Questions

Exam 22: Managing the Firms Assets103 Questions

Exam 23: Managing Risk in the Small Business85 Questions

Select questions type

A disadvantage of the accounting return on investment technique is that it ignores the time value of money.

(True/False)

4.8/5  (41)

(41)

Which of the following questions do all types of capital budgeting techniques try to answer?

(Multiple Choice)

4.9/5  (33)

(33)

When a business sells its accounts receivable to a finance company, this is called

(Multiple Choice)

4.8/5  (32)

(32)

If capital budgeting is so important, why do so few firms use the techniques the textbook discusses, especially the better methods? (Mention the textbook's premises in developing your answer.)

(Essay)

4.9/5  (40)

(40)

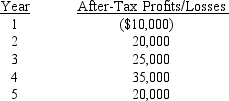

Assume that the cost of certain equipment your business is considering purchasing is $100,000. You plan to depreciate the equipment over five years, at which point the salvage value is expected to be $8,000. Anticipated after-tax profits (losses) are as follows:

Compute the accounting return on investment. (Show the formula and your computations.)

Compute the accounting return on investment. (Show the formula and your computations.)

(Essay)

4.7/5  (35)

(35)

You Make the Call-Situation 3

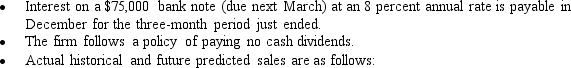

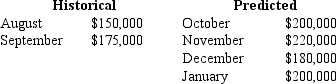

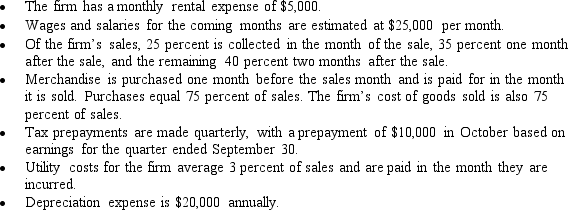

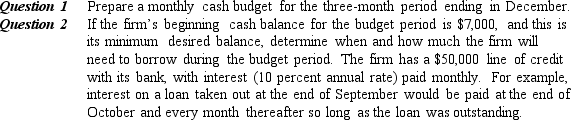

Adrian Fudge of the Fudge Corporation wants you to forecast its financing needs over the fourth quarter (October-December). He has made the following observations relative to planned cash receipts and disbursements:

(Essay)

5.0/5  (40)

(40)

The payback period technique deals with accounting profits in measuring how long it will take to recover the initial cash outlay of an investment.

(True/False)

4.8/5  (29)

(29)

Average annual after-tax profits per year divided by the average book value of the investment equals

(Multiple Choice)

4.9/5  (41)

(41)

The discounted cash flow technique measures the present value of future benefits from an investment as compared to the investment outlay.

(True/False)

4.9/5  (39)

(39)

Which of the following is not a part of managing working capital?

(Multiple Choice)

4.9/5  (39)

(39)

You Make the Call-Situation 2

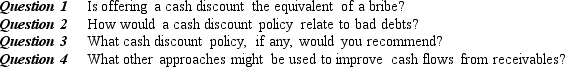

Ruston Manufacturing Company is a small firm selling entirely on a credit basis. It has experienced successful operation and earned modest profits. Sales are made on the basis of net payment in 30 days. Collections from customers run approximately 70 percent in 30 days, 20 percent in 60 days, 7 percent in 90 days, and 3 percent bad debts. The owner has considered the possibility of offering a cash discount for early payment. However, the practice seems costly and possibly unnecessary. As the owner puts it, "Why should I bribe customers to pay what they legally owe?"

(Essay)

4.9/5  (38)

(38)

The accounting return on investment technique reveals how many dollars in average profits are generated per dollar of investment.

(True/False)

4.8/5  (38)

(38)

The payback period technique does not consider the time value of money.

(True/False)

4.9/5  (32)

(32)

The date on which accounts receivable are collected affects the working-capital cycle.

(True/False)

4.8/5  (39)

(39)

Naomi needs to earn a twelve percent return from investing in her cousin's business. Under the NPV method of discounting cash flows, if the business can earn only a ten percent return, she will not satisfy her

(Multiple Choice)

4.9/5  (34)

(34)

A firm's working-capital cycle refers to the flow of cash to purchase and sell fixed assets.

(True/False)

4.7/5  (40)

(40)

Showing 81 - 100 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)