Exam 13: Fundamentals of Project Evaluation

Exam 1: Introduction, Basic Principles, and Methodology43 Questions

Exam 2: Revenue of the Firm126 Questions

Exam 3: Topics in Demand Analysis and Estimation37 Questions

Exam 4: Economic Forecasting55 Questions

Exam 5: Production Analysis51 Questions

Exam 6: Cost of Production81 Questions

Exam 7: Profit Analysis of the Firm63 Questions

Exam 8: Perfect Competition and Monopoly67 Questions

Exam 9: Monopolistic Competition and Oligopoly75 Questions

Exam 10: Games, Information and Strategy58 Questions

Exam 11: Topics in Pricing and Profit Analysis70 Questions

Exam 12: Factor Markets59 Questions

Exam 13: Fundamentals of Project Evaluation72 Questions

Exam 14: Risk in Project Analysis57 Questions

Exam 15: Economics of Public Sector Decisions51 Questions

Exam 16: Legal and Regulatory Environment of the Firm36 Questions

Select questions type

The process by which we determine the present value of an amount to be received at some time in the future is called:

Free

(Multiple Choice)

4.8/5  (25)

(25)

Correct Answer:

C

Run Corporation has decided to undertake a capital project that has a useful life of five years and estimated annual net cash inflows of $38,500. At a discount rate of 12 percent, what is the present value of the five-year receipts stream?

Free

(Essay)

4.7/5  (46)

(46)

Correct Answer:

The present value is given by:

$38,500 x PVFa for 12% at 5 years = 38,500 x 3.6048

= 138,784.80, thus:

The present value of the cash flows is $138,784.80.

A project has an anticipated stream of annual net receipts of $25,000. Its life is 10 years. No salvage value is expected at the end of the 10 years. Compute the net present value of the project, if its price is $150,000 and the applicable discount rate is 12%.

Free

(Essay)

4.9/5  (30)

(30)

Correct Answer:

The present value of $25,000 per year for 10 years with a discount rate of 12% is given by $25,000 x PVFa for 10 years at 12 percent = 25,000 x 5.6502 = 141,255.

NPV = PV - Price = 141,255 - 150,000 = -8,745, thus:

The NPV of the project is <$8,745>

Compounding is the process of computing the value of a current sum of money at some future date.

(True/False)

4.7/5  (40)

(40)

The marginal cost of capital MCC) is calculated as a weighted average of the after-tax cost of funds from each source.

(True/False)

4.9/5  (39)

(39)

The future value of a sum of money held today is the amount received today that would be equivalent in value to the future payment or payments.

(True/False)

4.8/5  (40)

(40)

The present value of an investment's net cash inflows minus the present value of its cost outlays is called the:

(Multiple Choice)

4.9/5  (35)

(35)

A project has an anticipated stream of annual net receipts of $25,000. Its life is 10 years. No salvage value is expected at the end of the 10 years. Compute the net present value of the project, if its price is $150,000 and the applicable discount rate is 10%.

(Essay)

4.8/5  (33)

(33)

A project has an anticipated stream of annual net receipts of $25,000. Its life is 10 years. No salvage value is expected at the end of the 10 years. If the price of the project is $150,000 and the applicable discount rate is 8%, the net present value of the project is $167,752.50

(True/False)

4.9/5  (41)

(41)

The net cash flow of a project is equal to any increase in revenues brought about by the project less any increase in operating expenses and depreciation brought about by the project, plus the incremental depreciation associated with the project.

(True/False)

4.8/5  (47)

(47)

Pronto Delivery is contemplating an investment in a delivery truck. The estimate of the project's price is $22,000. The delivery truck will have a life of 5 years and have a salvage value of $2,000. Annual net cash flows from the five years of operations are expected to be $6,000. If Pronto's applicable discount rate is 10%, is the project acceptable? Why or why not?

(Essay)

4.9/5  (32)

(32)

The marginal cost of capital MCC) is the discount rate which represents the marginal cost of investment funds to the firm.

(True/False)

4.9/5  (35)

(35)

The amount that would be accumulated at some future date if we invested a sum of money held today at a particular rate of interest is called the:

(Multiple Choice)

4.9/5  (37)

(37)

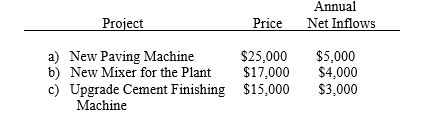

Pave-It, Inc. is trying to decide whether to purchase a new paving machine, purchase a new mixer for the plant or to upgrade the cement finishing machine. All of the alternatives are viewed as having the same ten year project life and none are expected to have any salvage value. However, different project prices are applicable to each and each has a different expected stream of annual net cash inflows. The firm's managers believe that a discount rate of 12 percent is appropriate for evaluating the alternatives. Data are as follows:

After examining the project prices, management finds it has sufficient capital budget to complete two of them. Assuming that the cash inflows from the project are independent of one another, which two projects should be undertaken?

After examining the project prices, management finds it has sufficient capital budget to complete two of them. Assuming that the cash inflows from the project are independent of one another, which two projects should be undertaken?

(Essay)

4.9/5  (36)

(36)

A project has an anticipated stream of annual net receipts of $1,000. Its life is 12 years. No salvage value is expected. What is the net present value of the project, if its price is $6,000 and the applicable discount rate is 12%?

(Essay)

4.8/5  (27)

(27)

A project has an anticipated stream of annual net receipts of $25,000. Its life is 10 years. No salvage value is expected at the end of the 10 years. Compute the net present value of the project, if its price is $150,000 and the applicable discount rate is 8%.

(Essay)

4.8/5  (45)

(45)

Afterthought Construction Co. is about to sell some used equipment to ABC Leasing. ABC has offered the following two payment schemes: a) $50,000 now and $200,000 at the end of seven years or b) $50,000 now, $50,000 at the end of two years, $50,000 at the end of five years, and $150,000 at the end of ten years. If the applicable discount rate for either transaction is 8%, the net present value of option a) is $166,700 and b) $196,375.

(True/False)

4.7/5  (29)

(29)

Discounting is the process of computing the present value of sums of money to be received in the future.

(True/False)

4.9/5  (34)

(34)

Afterthought Construction Co. is about to sell some used equipment to ABC Leasing. ABC has offered the following two payment schemes: a) $50,000 now and $200,000 at the end of seven years or b) $50,000 now, $50,000 at the end of two years, $50,000 at the end of five years, and $150,000 at the end of ten years. If the applicable discount rate for either transaction is 8%, what are the net present values for both payment schemes?

(Multiple Choice)

4.9/5  (32)

(32)

Showing 1 - 20 of 72

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)