Exam 9: Break-Even Point and Cost-Volume-Profit Analysis

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing200 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing179 Questions

Exam 6: Process Costing211 Questions

Exam 7: Standard Costing and Variance Analysis221 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis120 Questions

Exam 10: Relevant Information for Decision Making143 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products133 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, Support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, Balanced Scorecards, and Performance Rewards191 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty103 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management167 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

After the break-even point is reached, each dollar of contribution margin is a dollar of after-tax profit.

(True/False)

4.8/5  (40)

(40)

With respect to fixed costs, CVP analysis assumes total fixed costs

(Multiple Choice)

4.8/5  (45)

(45)

A firm estimates that it will sell 100,000 units of its sole product in the coming period. It projects the sales price at $40 per unit, the CM ratio at 60 percent, and profit at $500,000. What is the firm budgeting for fixed costs in the coming period?

(Multiple Choice)

4.9/5  (33)

(33)

The margin of safety is an effective measure of risk for a company.

(True/False)

4.8/5  (37)

(37)

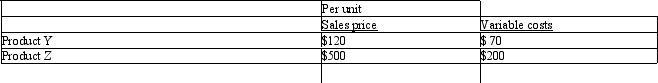

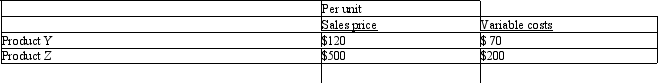

Castle Corporation

The following questions are based on the following data pertaining to two types of products manufactured by Castle Corporation:

Fixed costs total $300,000 annually. The expected mix in units is 60 percent for Product Y and 40 percent for Product Z.

Refer to Castle Corporation. How much is Castle's break-even point sales in units?

Fixed costs total $300,000 annually. The expected mix in units is 60 percent for Product Y and 40 percent for Product Z.

Refer to Castle Corporation. How much is Castle's break-even point sales in units?

(Essay)

4.7/5  (45)

(45)

CVP analysis relies on the assumptions that costs are either strictly fixed or strictly variable. Consistent with these assumptions, as volume decreases total

(Multiple Choice)

4.7/5  (44)

(44)

____ focuses only on factors that change from one course of action to another.

(Multiple Choice)

4.8/5  (48)

(48)

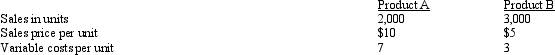

Moonbeam Corporation Moonbeam Corporation manufactures and sells two products: A and B. The operating results of the company are as follows:

In addition, the company incurred total fixed costs in the amount of $9,000.

Refer to Moonbeam Corporation. How many units would the company have needed to sell to produce a profit of $12,000?

In addition, the company incurred total fixed costs in the amount of $9,000.

Refer to Moonbeam Corporation. How many units would the company have needed to sell to produce a profit of $12,000?

(Multiple Choice)

4.8/5  (30)

(30)

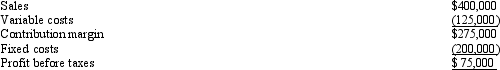

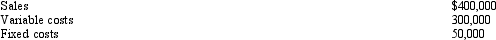

Palmer Company Below is an income statement for Palmer Company:

Refer to Palmer Company. Assuming that the fixed costs are expected to remain at $200,000 for the coming year and the sales price per unit and variable costs per unit are also expected to remain constant, how much profit before taxes will be produced if the company anticipates sales for the coming year rising to 130 percent of the current year's level?

Refer to Palmer Company. Assuming that the fixed costs are expected to remain at $200,000 for the coming year and the sales price per unit and variable costs per unit are also expected to remain constant, how much profit before taxes will be produced if the company anticipates sales for the coming year rising to 130 percent of the current year's level?

(Multiple Choice)

5.0/5  (37)

(37)

In a CVP graph, the area between the total cost line and the total fixed cost line yields the

(Multiple Choice)

4.8/5  (33)

(33)

The relationship between a company's variable costs and fixed costs is referred to as its ______________________________.

(Short Answer)

4.9/5  (37)

(37)

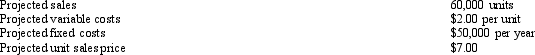

Teal Company The following information relates to financial projections of Teal Company:

Refer to Teal Company. If Teal Company achieves its projections, what will be its degree of operating leverage?

Refer to Teal Company. If Teal Company achieves its projections, what will be its degree of operating leverage?

(Multiple Choice)

4.8/5  (32)

(32)

Given the following notation, what is the break-even sales level in units? SP = selling price per unit, FC = total fixed cost, VC = variable cost per unit

(Multiple Choice)

4.8/5  (32)

(32)

The formula for margin of safety is _____________________________________________.

(Short Answer)

4.8/5  (34)

(34)

Information concerning Simmons Corporation's Product A follows:  Assuming that Simmons increased sales of Product A by 25 percent, what should the profit from Product A be?

Assuming that Simmons increased sales of Product A by 25 percent, what should the profit from Product A be?

(Multiple Choice)

4.7/5  (36)

(36)

Castle Corporation

The following questions are based on the following data pertaining to two types of products manufactured by Castle Corporation:

Fixed costs total $300,000 annually. The expected mix in units is 60 percent for Product Y and 40 percent for Product Z.

Refer to Castle Corporation. What is Castle's break-even point in sales dollars?

Fixed costs total $300,000 annually. The expected mix in units is 60 percent for Product Y and 40 percent for Product Z.

Refer to Castle Corporation. What is Castle's break-even point in sales dollars?

(Essay)

4.9/5  (41)

(41)

Showing 41 - 60 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)