Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing200 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing179 Questions

Exam 6: Process Costing211 Questions

Exam 7: Standard Costing and Variance Analysis221 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis120 Questions

Exam 10: Relevant Information for Decision Making143 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products133 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, Support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, Balanced Scorecards, and Performance Rewards191 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty103 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management167 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

In the formula y = a + bX, a represents

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

D

A basic concept of variable costing is that period costs should be currently expensed. What is the rationale behind this procedure?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

D

Consider the regression equation y = a + bX. The portion of the equation that represents the variable rate is __________.

Free

(Short Answer)

4.9/5  (28)

(28)

Correct Answer:

B

The performance measure that considers routine interruptions is known as ____________________ capacity.

(Short Answer)

4.9/5  (30)

(30)

In a(n) ____________________ cost system, factory overhead is assigned directly to products and services.

(Short Answer)

4.8/5  (25)

(25)

At its present level of operations, a small manufacturing firm has total variable costs equal to 75 percent of sales and total fixed costs equal to 15 percent of sales. Based on variable costing, if sales change by $1.00, income will change by

(Multiple Choice)

4.9/5  (38)

(38)

Weaknesses of the high-low method include all of the following except

(Multiple Choice)

4.7/5  (28)

(28)

Sales less variable cost of goods sold is referred to as ________________________________________.

(Short Answer)

4.7/5  (35)

(35)

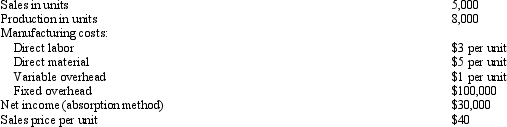

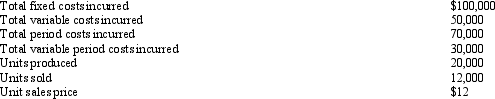

Austin Company The following information is available for Austin Company for its first year of operations:

Refer to Austin Company. What was the total amount of Selling,General and Administrative expense incurred by Austin Company?

Refer to Austin Company. What was the total amount of Selling,General and Administrative expense incurred by Austin Company?

(Multiple Choice)

4.7/5  (31)

(31)

Austin Company The following information is available for Austin Company for its first year of operations:

Refer to Austin Company. If Austin Company were using variable costing, what would it show as the value of ending inventory?

Refer to Austin Company. If Austin Company were using variable costing, what would it show as the value of ending inventory?

(Multiple Choice)

4.8/5  (37)

(37)

If production exceeds sales, absorption costing net income is less than variable costing net income.

(True/False)

4.8/5  (36)

(36)

In the application of "variable costing" as a cost-allocation process in manufacturing,

(Multiple Choice)

4.8/5  (40)

(40)

A ______________________________ is a planning document that presents expected variable and fixed overhead costs at different activity levels.

(Short Answer)

4.8/5  (36)

(36)

If underapplied overhead is considered to beimmaterial, it is closed to which of the following accounts?

(Multiple Choice)

4.8/5  (29)

(29)

How do differences in sales and production level affect net income computed under absorption costing and variable costing?

(Essay)

4.9/5  (34)

(34)

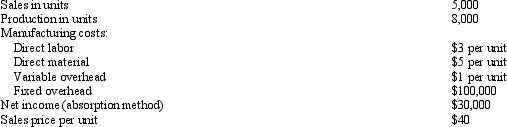

Bush Corporation The following information has been extracted from the financial records of Bush Corporation for its first year of operations:

Refer to Bush Corporation. Based on absorption costing, the Cost of Goods Manufactured for Bush Corporation's first year would be

Refer to Bush Corporation. Based on absorption costing, the Cost of Goods Manufactured for Bush Corporation's first year would be

(Multiple Choice)

4.8/5  (39)

(39)

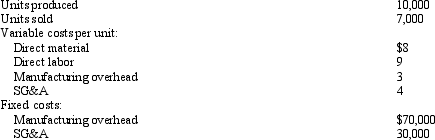

Oakwood Corporation Oakwood Corporation produces a single product. The following cost structure applied to its first year of operations:

Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation manufactured and sold 5,000 units in the current year. At this level of activity it had an income of $30,000 using variable costing. What was the sales price per unit?

Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation manufactured and sold 5,000 units in the current year. At this level of activity it had an income of $30,000 using variable costing. What was the sales price per unit?

(Multiple Choice)

4.8/5  (42)

(42)

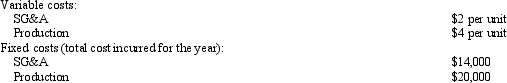

Sheets Corporation The following information was extracted from the first year absorption-based accounting records of Sheets Corporation

Refer to Sheets Corporation. Based on variable costing, if Sheets had sold 12,001 units instead of 12,000, its income before income taxes would have been

Refer to Sheets Corporation. Based on variable costing, if Sheets had sold 12,001 units instead of 12,000, its income before income taxes would have been

(Multiple Choice)

4.8/5  (38)

(38)

Phantom profits result when absorption costing is used and sales exceed production.

(True/False)

4.7/5  (31)

(31)

Showing 1 - 20 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)