Exam 14: Performance Measurement, Balanced Scorecards, and Performance Rewards

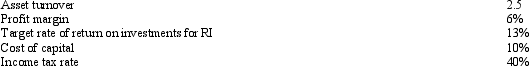

Electronic Telephone Systems (ETS), a division of Steelman Corporation buys and installs modular office components. For the most recent year, the division had the following performance targets:

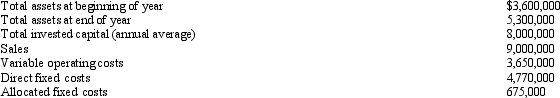

Actual information concerning the company's performance for last year follows:

Actual information concerning the company's performance for last year follows:

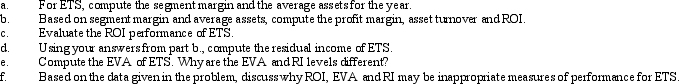

Required:

Required:

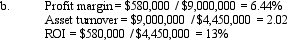

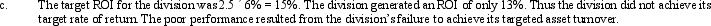

Average assets = ($3,600,000 + $5,300,000) / 2 = $4,450,000

Average assets = ($3,600,000 + $5,300,000) / 2 = $4,450,000

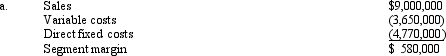

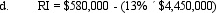

= $580,000 - $578,500 = $1,500

= $580,000 - $578,500 = $1,500

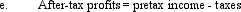

= $580,000 - ($580,000 ´ 40%) = $348,000

= $580,000 - ($580,000 ´ 40%) = $348,000

EVA = $348,000 - ($8,000,000 ´ 10%) = $(452,000)

EVA and RI differ for three reasons. First, RI is based on pre-tax rather than after-tax income. Second, RI is based on the book value of investment, whereas EVA is based on the market value of investment. Third, the target rates of return differ between the methods.

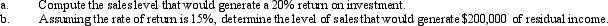

The manager of the St. Louis Division of Mississippi River Tours is preparing the budget for the upcoming year. At this point, he has determined that average total assets for the upcoming year will equal $4,000,000. The manager is evaluated on the amount of residual income generated by the division. Assume variable costs in the St. Louis Division are expected to equal 60% of total sales and fixed costs are expected to equal $400,000.

a. The required net income = 20% ´ $4,000,000 = $800,000.

sales = net income + fixed costs + variable costs

sales = $800,000 + $400,000 + (.60 ´ sales)

sales ´ 40% = $1,200,000

sales = $3,000,000

b. sales = fixed costs + variable costs + required return + residual income

sales = $400,000 + (.60 ´ sales) + (.15 ´ sales) + $200,000

sales = $2,400,000

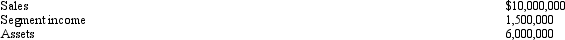

Eastern Division

The Eastern Division of Freeport Chemical Co. produced the following operating results for the previous year:

The Eastern Division is considering a $1,000,000 investment in a new project. The Eastern Division estimates that its return on investment (for all of its operations) would be at 22% with the new investment.

Refer to Eastern Division. How much net segment income is the new project expected to produce?

The Eastern Division is considering a $1,000,000 investment in a new project. The Eastern Division estimates that its return on investment (for all of its operations) would be at 22% with the new investment.

Refer to Eastern Division. How much net segment income is the new project expected to produce?

the total of the new segment income = .22($6,000,000+$1,000,000) =

.22($7,000,000) = $1,540,000

the portion of the total segment income that is produced by the new project =

$1,540,000 - $1,500,000 = $40,000

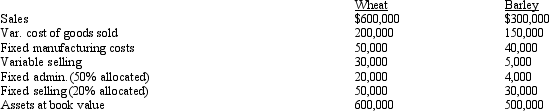

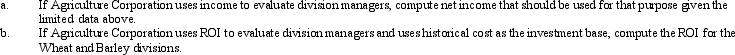

The following information is given for the Wheat and Barley Divisions of Agriculture Corporation.

A prospective project under consideration by the Internet Division of Communications Corporation. has an estimated residual income of $(20,000). If the project requires an investment of $400,000, the

On a balanced scorecard, which of the following would be most appropriate to measure production process integrity?

The objectives identified in an organization's values statement must be objective in nature.

The most common external performance measure used for all organizations is financial in nature.

Identify the steps to follow in establishing the performance reward system for a company.

Which of the following would be classified as a non-financial critical success factor?

The segment margin of a profit or investment center includes allocated common costs.

What items affect comparability of different divisions within the same company on the basis of EVA, ROI and RI?

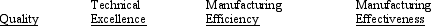

Lawton Company Lawton Company is a manufacturer of electronic components. The following manufacturing information is available for the month of May:

Refer to Lawton Company. What is the process quality yield?

Refer to Lawton Company. What is the process quality yield?

Which of the following is not a balanced scorecard category?

A pay plan that does not encourage the overall company good is

A company has set a target rate of return of 16% for its investment center. An investment center manager in this company would

A pay plan that gives an employee cash or stock equal to the difference between some specified stock price and the quoted market price at some future time period is

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)