Exam 26: Property Transactions: Section 1231 and Recapture

Exam 1: Tax Research111 Questions

Exam 2: an Introduction to Taxation106 Questions

Exam 3: Corporate Formations and Capital Structure122 Questions

Exam 4: Determination of Tax144 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions139 Questions

Exam 7: Corporate Nonliquidating Distributions112 Questions

Exam 8: Gross Income: Exclusions112 Questions

Exam 9: Other Corporate Tax Levies103 Questions

Exam 10: Property Transactions: Capital Gains and Losses141 Questions

Exam 11: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses138 Questions

Exam 13: Corporate Acquisitions and Reorganizations100 Questions

Exam 14: Itemized Deductions122 Questions

Exam 15 Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts117 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation147 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation,cost Recovery,amortization,and Depletion99 Questions

Exam 21: Corporations103 Questions

Exam 22: Accounting Periods and Methods114 Questions

Exam 23: The Gift Tax103 Questions

Exam 24: Property Transactions: Nontaxable Exchanges118 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture109 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods,tax Credits,and Payment of Tax130 Questions

Exam 29: Administrative Procedures102 Questions

Select questions type

Sec.1245 applies to gains on the sale of depreciable personal property,but it generally does not apply to depreciable real property.

(True/False)

4.8/5  (38)

(38)

Trena LLC,a tax partnership owned equally by Trent and Nina,sells a building it had placed in service five years ago.Sec.291 will require that part of the gain (up to 20% of accumulated depreciation)be treated as ordinary gain,with the balance treated as Sec.1231 gain.

(True/False)

4.8/5  (35)

(35)

If the accumulated depreciation on business equipment held longer than one year exceeds realized gain on the sale of the equipment,all of the realized gain will be treated as Sec.1231 gain.

(True/False)

4.8/5  (36)

(36)

Sec.1245 ordinary income recapture can apply to buildings placed in service prior to 1987.

(True/False)

4.9/5  (42)

(42)

A taxpayer purchased a factory building in 1985 for $800,000.After claiming ACRS-accelerated depreciation of $800,000,she sells the asset for $1,000,000 during the current year.No payment is received during the current year,and the $1,000,000 balance to be paid with interest at the interest rate in four annual payments beginning one year from date of sale.The installment sales method is adopted.How much ordinary income is recognized in the current year?

(Multiple Choice)

4.9/5  (36)

(36)

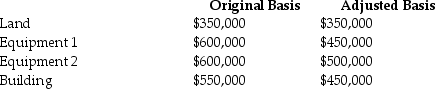

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000.Each asset was purchased in 2011 and is used in a trade or business.There are no other gains and losses and no nonrecaptured Section 1231 losses.

(Essay)

4.9/5  (33)

(33)

A corporation owns many acres of timber,which it acquired three years ago,and which has a $150,000 basis for depletion.The timber is cut during the current year for use in the corporation's business.The FMV of the timber on the first day of the current year is $280,000.If the corporation makes the appropriate election,the tax result is

(Multiple Choice)

4.9/5  (41)

(41)

In addition to the normal recapture rules of Sec.1250,corporations which sell depreciable real estate are subject to additional recapture rules of Sec.291.

(True/False)

4.8/5  (34)

(34)

Showing 101 - 109 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)