Exam 18: Employee Expenses and Deferred Compensation

Exam 1: Tax Research111 Questions

Exam 2: an Introduction to Taxation106 Questions

Exam 3: Corporate Formations and Capital Structure122 Questions

Exam 4: Determination of Tax144 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions139 Questions

Exam 7: Corporate Nonliquidating Distributions112 Questions

Exam 8: Gross Income: Exclusions112 Questions

Exam 9: Other Corporate Tax Levies103 Questions

Exam 10: Property Transactions: Capital Gains and Losses141 Questions

Exam 11: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses138 Questions

Exam 13: Corporate Acquisitions and Reorganizations100 Questions

Exam 14: Itemized Deductions122 Questions

Exam 15 Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts117 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation147 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation,cost Recovery,amortization,and Depletion99 Questions

Exam 21: Corporations103 Questions

Exam 22: Accounting Periods and Methods114 Questions

Exam 23: The Gift Tax103 Questions

Exam 24: Property Transactions: Nontaxable Exchanges118 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture109 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods,tax Credits,and Payment of Tax130 Questions

Exam 29: Administrative Procedures102 Questions

Select questions type

Educational expenses incurred by a CPA for courses necessary to meet continuing education requirements are fully deductible.

Free

(True/False)

4.7/5  (34)

(34)

Correct Answer:

True

When are home-office expenses deductible?

Free

(Essay)

5.0/5  (37)

(37)

Correct Answer:

Office-in-home expenses are deductible if any of the following conditions is met: 1.The office is used exclusively on a regular basis as the principal place of business for any trade or business of the taxpayer.2.The office is used as a place for meeting or dealing with patients,clients,or customers in the normal course of business.3.The office is used for administrative or management activities of the trade or business,and there is no other fixed location where those activities are conducted.In addition to satisfying one of the above conditions,if the taxpayer is an employee,the home office must be for the convenience of the employer.

According to the IRS,a person's tax home is the location of the family residence regardless of the location of the taxpayer's principal place of employment.

Free

(True/False)

4.9/5  (43)

(43)

Correct Answer:

False

A gift from an employee to his or her superior does not qualify as a business gift.

(True/False)

4.7/5  (33)

(33)

Tyne is a 48-year-old an unmarried taxpayer who is not an active participant in an employer-sponsored qualified retirement plan.Before IRA contributions,her AGI is $64,000 in 2015.What is the maximum amount she may contribute to a tax deductible IRA?

(Multiple Choice)

4.8/5  (41)

(41)

An accountant takes her client to a hockey game following a business meeting.Because it is a playoff game,and the tickets were purchased that day,a premium was paid.The deduction for the tickets is limited to 50% of the face value.

(True/False)

4.9/5  (39)

(39)

A partnership plans to set up a retirement plan to benefit the partners and the employees.All of the following retirement plans are appropriate except

(Multiple Choice)

4.7/5  (35)

(35)

Austin incurs $3,600 for business meals while traveling for his employer,Tex,Inc.Austin is reimbursed in full by Tex pursuant to an accountable plan.What amounts can Austin and Tex deduct?

(Multiple Choice)

4.8/5  (32)

(32)

Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2012.The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock.The option itself does not have a readily ascertainable FMV.Caroline exercised the option on August 1,2015 when the stock's FMV was $250.Caroline sells the stock on September 5,2016 for $300 per share.Martin Corporation will be allowed a deduction of

(Multiple Choice)

4.8/5  (31)

(31)

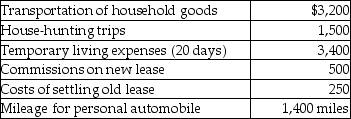

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

(Multiple Choice)

4.9/5  (36)

(36)

An employer receives an immediate tax deduction for pension and profit-sharing contributions made on behalf of employees.

(True/False)

4.9/5  (36)

(36)

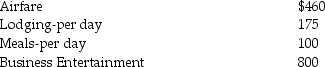

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:  What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

(Essay)

4.9/5  (31)

(31)

Which of the following is true about future qualified distributions from a Roth IRA by a person who will be 65 years old at the time the distributions begin? Assume the individual opened the account before age 60.

(Multiple Choice)

4.8/5  (30)

(30)

Josiah is a human resources manager of a large software company.He is considering asking for a leave of absence to pursue an MBA degree.Josiah will pay for his MBA tuition of $45,000 a year without any employer assistance.Josiah will incur a large debt if he pursues an MBA.Upon completing his MBA,he would want to consider various job opportunities.Discuss the tax issues affecting Josiah's decision.

(Essay)

4.7/5  (36)

(36)

Gambling losses are miscellaneous itemized deductions subject to the 2% of AGI floor.

(True/False)

4.8/5  (33)

(33)

Assuming AGI below the threshold,a contributor may make a deductible contribution to a Coverdell Education Savings Account for a qualified designated beneficiary of up to $2,000.

(True/False)

4.9/5  (35)

(35)

If an employee incurs travel expenditures and is fully reimbursed by the employer,neither the reimbursement nor the deduction is reported on the employee's tax return if reporting is pursuant to an accountable plan.

(True/False)

4.8/5  (40)

(40)

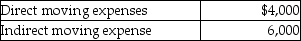

Edward incurs the following moving expenses:  The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

(Multiple Choice)

4.9/5  (41)

(41)

Showing 1 - 20 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)