Exam 20: Depreciation,cost Recovery,amortization,and Depletion

Exam 1: Tax Research111 Questions

Exam 2: an Introduction to Taxation106 Questions

Exam 3: Corporate Formations and Capital Structure122 Questions

Exam 4: Determination of Tax144 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions139 Questions

Exam 7: Corporate Nonliquidating Distributions112 Questions

Exam 8: Gross Income: Exclusions112 Questions

Exam 9: Other Corporate Tax Levies103 Questions

Exam 10: Property Transactions: Capital Gains and Losses141 Questions

Exam 11: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses138 Questions

Exam 13: Corporate Acquisitions and Reorganizations100 Questions

Exam 14: Itemized Deductions122 Questions

Exam 15 Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts117 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation147 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation,cost Recovery,amortization,and Depletion99 Questions

Exam 21: Corporations103 Questions

Exam 22: Accounting Periods and Methods114 Questions

Exam 23: The Gift Tax103 Questions

Exam 24: Property Transactions: Nontaxable Exchanges118 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture109 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods,tax Credits,and Payment of Tax130 Questions

Exam 29: Administrative Procedures102 Questions

Select questions type

On October 2,2015,Dave acquired and placed into service 5-year business equipment costing $70,000.No other acquisitions were made during the year.Dave does not use Sec.179 expensing.The depreciation for this year is using the most accelerated method possible is

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

B

If the business use of listed property is 50% or less of the total usage,the alternative depreciation system must be used.

Free

(True/False)

4.8/5  (34)

(34)

Correct Answer:

True

If a company acquires goodwill in connection with the acquisition of a business,the goodwill is amortizable over a 60-month period.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

False

When a taxpayer leases an automobile for 100% business purposes,the entire lease payment is deductible.

(True/False)

4.9/5  (40)

(40)

The election to use ADS is made on a year-by-year,property-class by property-class basis for real and personal property.

(True/False)

4.8/5  (26)

(26)

Harrison acquires $65,000 of 5-year property in June 2013 that is required to be depreciated using the mid-quarter convention (because of other purchases that year).He did not elect Sec.179 immediate expensing.Bonus depreciation was not available.If Harrison sells the property on August 23,2015,what is the amount of depreciation claimed in 2015?

(Multiple Choice)

4.9/5  (40)

(40)

Land,buildings,equipment,and common stock are examples of tangible property.

(True/False)

4.9/5  (38)

(38)

The straight-line method may be elected for depreciating tangible personal property placed in service after 1986.

(True/False)

4.8/5  (34)

(34)

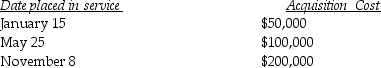

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2015 and does not use Sec.179.Mehmet places the property in service on the following schedule:  What is the total depreciation for 2015?

What is the total depreciation for 2015?

(Essay)

4.8/5  (33)

(33)

In April of 2014,Brandon acquired five-year listed property (not an automobile)for $30,000 and used it 70% for business.No election was made regarding Sec.179 and bonus depreciation was not available.In 2015,his business use of the property dropped to 40%.Which of the following statements is true?

(Multiple Choice)

4.8/5  (35)

(35)

Once the business use of listed property falls to 50% or below,the alternative depreciation system must be used for the current year and all subsequent years,even if the business use percentage increases to more than 50% in a subsequent year.

(True/False)

4.8/5  (45)

(45)

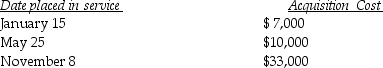

Greta,a calendar-year taxpayer,acquires 5-year tangible personal property in 2015 and places the property in service on the following schedule:  Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2015?

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2015?

(Essay)

4.8/5  (43)

(43)

The basis of an asset must be reduced by the depreciation allowable.

(True/False)

4.8/5  (42)

(42)

On January l Grace leases and places into service an automobile with a FMV of $39,000.The business use of the automobile is 60%.The "inclusion amount" for the initial year of the lease from the IRS tables is $20.The annual lease payments are $8,000.What are the tax consequences of this lease?

(Multiple Choice)

4.9/5  (34)

(34)

Fred purchases and places in service in 2015 personal property costing $221,000.What is the maximum Sec.179 deduction that Fred can deduct,ignoring any taxable income limitation?

(Multiple Choice)

4.8/5  (43)

(43)

The mid-quarter convention applies to personal and real property.

(True/False)

4.9/5  (34)

(34)

Under what circumstances might a taxpayer elect the alternative depreciation system for new equipment acquired this year?

(Multiple Choice)

4.8/5  (40)

(40)

Jimmy acquires an oil and gas property interest for $600,000.Jimmy expects to recover 200,000 barrels of oil.Intangible drilling and development costs are $160,000 and are charged to expense.Other expenses are $40,000.During the year,25,000 barrels of oil are sold for $800,000.Jimmy's depletion deduction is

(Multiple Choice)

4.9/5  (35)

(35)

Eric is a self-employed consultant.In May of the current year,Eric acquired a computer system (5-year property)for $6,000 and used the computer 80% for business and 20% for personal purposes.Eric does not take any Sec.179 deduction.The maximum depreciation deduction for is

(Multiple Choice)

4.9/5  (35)

(35)

Any Section 179 deduction that is not allowed currently due to the taxable income limitation may be carried over and deducted in future years.

(True/False)

4.7/5  (34)

(34)

Showing 1 - 20 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)