Exam 20: Depreciation,cost Recovery,amortization,and Depletion

Exam 1: Tax Research111 Questions

Exam 2: an Introduction to Taxation106 Questions

Exam 3: Corporate Formations and Capital Structure122 Questions

Exam 4: Determination of Tax144 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions139 Questions

Exam 7: Corporate Nonliquidating Distributions112 Questions

Exam 8: Gross Income: Exclusions112 Questions

Exam 9: Other Corporate Tax Levies103 Questions

Exam 10: Property Transactions: Capital Gains and Losses141 Questions

Exam 11: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses138 Questions

Exam 13: Corporate Acquisitions and Reorganizations100 Questions

Exam 14: Itemized Deductions122 Questions

Exam 15 Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts117 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation147 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation,cost Recovery,amortization,and Depletion99 Questions

Exam 21: Corporations103 Questions

Exam 22: Accounting Periods and Methods114 Questions

Exam 23: The Gift Tax103 Questions

Exam 24: Property Transactions: Nontaxable Exchanges118 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture109 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods,tax Credits,and Payment of Tax130 Questions

Exam 29: Administrative Procedures102 Questions

Select questions type

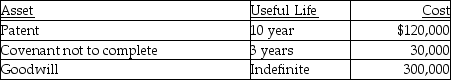

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million.Included in the assets acquired are the following intangible assets:  What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

(Essay)

4.8/5  (37)

(37)

Which of the following statements regarding Sec.179 is true?

(Multiple Choice)

4.9/5  (30)

(30)

Prithi acquired and placed in service $190,000 of equipment on August 1,2015 for use in her sole proprietorship.The equipment is 5-year recovery property.No other acquisitions are made during the year.Prithi elects to expense the maximum amount under Sec.179.Prithi's total deductions for the year (including Sec.179 and depreciation)are

(Multiple Choice)

4.8/5  (41)

(41)

Ilene owns an unincorporated manufacturing business.In 2015,she purchases and places in service $206,000 of qualifying five-year equipment for use in her business.Her taxable income from the business before any Sec.179 deduction is $17,000.Elaine takes the maximum allowable deduction under section 179.Which of the following statements is true regarding the Sec.179 election?

(Multiple Choice)

4.8/5  (32)

(32)

Intangible drilling and development costs (IDCs)may be deducted as an expense or may be capitalized.

(True/False)

5.0/5  (42)

(42)

If a new luxury automobile is used 100% for business and placed in service in 2015,the maximum MACRS depreciation on the vehicle for 2015 is $3,160.

(True/False)

5.0/5  (43)

(43)

MACRS recovery property includes tangible personal and real property that is used in a trade or business.

(True/False)

4.8/5  (28)

(28)

Paul bought a computer for $15,000 for business use on March 18,2013.This was his only purchase for that year.Paul used the most accelerated depreciation method available,but did not elect Sec.179.Bonus depreciation was not available.Paul sells the machine in 2015.The depreciation on the computer for 2015 is

(Multiple Choice)

4.8/5  (37)

(37)

In August 2015,Tianshu acquires and places into service 7-year business equipment (tangible personal property qualifying under Sec.179)for $70,000.This is the only asset that she purchased during the year; her taxable income from her trade or business is $23,000.She decides to limit her 179 election to the maximum amount currently deductible in her business for the current year.What is her maximum cost recovery (Sec.179 and depreciation)deduction for 2015?

(Essay)

4.8/5  (35)

(35)

A large SUV is place in service in 2015.MACRS depreciation on an SUV weighing over 6,000 pounds is limited to $3,160 for the first year placed in service.

(True/False)

4.8/5  (40)

(40)

In April 2015,Emma acquired a machine for $60,000 for use in her business.The machine is classified as 7-year property.Emma does not expense the asset under Sec.179.Emma's depreciation on the machine this year is

(Multiple Choice)

4.7/5  (41)

(41)

Amounts paid in connection with the acquisition of a business which represent a covenant not to compete are amortizable over the covenant's remaining life.

(True/False)

4.9/5  (35)

(35)

Discuss the options available regarding treatment of an amount paid in excess of the FMV of an acquired company's net assets in a business combination.

(Essay)

4.7/5  (28)

(28)

Arthur uses a Chevrolet Suburban (GVWR 7,500 pounds)100% for business.He acquired and placed the vehicle in service in his business in January of the current year.The vehicle cost $65,000.The maximum deduction allowed this year is

(Multiple Choice)

4.9/5  (38)

(38)

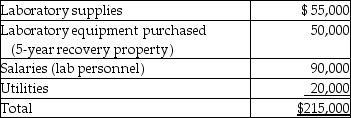

This year Bauer Corporation incurs the following costs in development of new products:  No benefits are realized from the research expenditures until next year.If Bauer Corporation elects to expense the research expenditures,the deduction is

No benefits are realized from the research expenditures until next year.If Bauer Corporation elects to expense the research expenditures,the deduction is

(Multiple Choice)

4.8/5  (44)

(44)

The MACRS system requires that residential real property and nonresidential rental property be depreciated using the straight-line method.

(True/False)

4.9/5  (39)

(39)

If the business use of listed property decreases to 50% or less of the total usage,the property is subject to depreciation recapture.

(True/False)

4.8/5  (43)

(43)

Bert,a self-employed attorney,is considering either purchasing or leasing a $50,000 automobile for use in his business.What are the issues he should consider in making his decision?

(Essay)

4.7/5  (41)

(41)

Kenrick is an employee of the Theta Corp.sales department.He uses his automobile 75% for making sales calls.He can deduct depreciation on his auto by reporting on Form 4562 (Depreciation and Amortization).

(True/False)

4.9/5  (45)

(45)

Showing 21 - 40 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)