Exam 2: Determination of Tax

Exam 1: An Introduction to Taxation104 Questions

Exam 2: Determination of Tax138 Questions

Exam 3: Gross Income: Inclusions132 Questions

Exam 4: Gross Income: Exclusions107 Questions

Exam 5: Property Transactions: Capital Gains and Losses133 Questions

Exam 6: Deductions and Losses130 Questions

Exam 7: Itemized Deductions114 Questions

Exam 8: Losses and Bad Debts114 Questions

Exam 9: Employee Expenses and Deferred Compensation135 Questions

Exam 10: Depreciation, Cost Recovery, Amortization, and Depletion93 Questions

Exam 11: Accounting Periods and Methods107 Questions

Exam 12: Property Transactions: Nontaxable Exchanges115 Questions

Exam 13: Property Transactions: Section 1231 and Recapture100 Questions

Exam 14: Special Tax Computation Methods, Tax Credits, and Payment of Tax117 Questions

Exam 15: Tax Research127 Questions

Exam 16: Corporations137 Questions

Exam 17: Partnerships and S Corporations133 Questions

Exam 18: Taxes and Investment Planning81 Questions

Select questions type

Eliza Smith's father, Victor, lives with Eliza who is a single taxpayer. During the year, Eliza purchased clothing for her father costing $1,200 and provided him with a room that could have been rented for $6,000. In addition, Eliza spent $4,000 for groceries she shared with her father. Eliza purchased a new television for $900 which she placed in the living room for both her father and her use.

What is the amount of support provided by Eliza to her father?

(Essay)

4.8/5  (32)

(32)

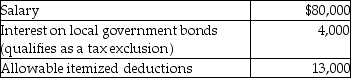

A single taxpayer provided the following information for 2014:  What is taxable income?

What is taxable income?

(Multiple Choice)

4.8/5  (35)

(35)

Kate is single and a homeowner. In 2014, she has property taxes on her home of $3,000, makes charitable contributions of $2,000, and pays home mortgage interest of $7,000. Kate's adjusted gross income for 2014 is $77,000.

Required: Compute her taxable income for 2014.

(Essay)

4.9/5  (39)

(39)

Charishma is a taxpayer with taxable income exceeding $500,000. She sells a stock for a $50,000 gain. She acquired the stock 13 months earlier. The gain will be taxed at the 20% rate.

(True/False)

4.9/5  (34)

(34)

A married couple in the top tax bracket has a new baby. Due to the birth of the baby their taxable income will be reduced in 2014 by $3,950.

(True/False)

4.8/5  (45)

(45)

Although exclusions are usually not reported on an individual's income tax return, interest income on state and local government bonds must be reported on the tax return.

(True/False)

4.9/5  (39)

(39)

In 2014 Carol and Robert have salaries of $35,000 and $27,000, respectively. Their itemized deductions total $8,000. They are married, under 65, and live in a common law state.

a. Compute their taxable income assuming that they file a joint return.

b. Compute their taxable income assuming that they file separate returns and that Robert claims all of the itemized deductions.

(Essay)

4.9/5  (44)

(44)

Avi and Rianna are considering marriage before year-end. They each earn a salary of about $150,000, have some investment income and some itemized deductions. What additional taxes will Avi and Rianna face as a married couple?

(Essay)

4.8/5  (32)

(32)

What options are available for reporting and paying tax on the unearned income of a child under age 24?

(Essay)

4.9/5  (36)

(36)

Generally, deductions for (not from)adjusted gross income are personal expenses specifically allowed by tax law.

(True/False)

4.9/5  (36)

(36)

A married taxpayer may file as head of household under the abandoned spouse provisions if all of the following are met except

(Multiple Choice)

4.8/5  (40)

(40)

All of the following items are generally excluded from income except

(Multiple Choice)

4.8/5  (31)

(31)

Elise, age 20, is a full-time college student with earned income from wages of $4,400 and interest income of $500. Elise's parents provide more than half of her support. Elise's taxable income is

(Multiple Choice)

4.7/5  (37)

(37)

All of the following items are deductions for (not from)adjusted gross income except

(Multiple Choice)

4.8/5  (37)

(37)

Tom and Alice were married on December 31 of last year. What is their filing status for last year?

(Multiple Choice)

4.8/5  (35)

(35)

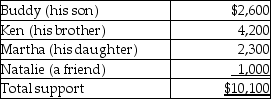

Blaine Greer lives alone. His support comes from the following sources:  Assuming a multiple support declaration exists, which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists, which of the individuals may claim Blaine as a dependent?

(Multiple Choice)

4.8/5  (29)

(29)

Kelsey is a cash-basis, calendar-year taxpayer. Her salary is $30,000, and she is single. She plans to purchase a residence in 2015. She anticipates her property taxes and interest will total $8,000 in 2015. Each year, Kelsey contributes approximately $1,500 to charity. Her other itemized deductions total $2,000. For purposes of this problem, assume 2015 tax rates, exemptions, and standard deductions are the same as 2014.

a. What will her gross tax be in 2014 and 2015 if she contributes $1,500 to charity in each year?

b. What will her gross tax be in 2014 and 2015 if she contributes $3,000 to charity in 2014 but makes no contribution in 2015?

c. What will her gross tax be in 2014 and 2015 if she makes no contribution in 2014 but contributes $3,000 to charity in 2015?

d. Why does alternative "c" yield the lowest tax?

(Essay)

4.9/5  (34)

(34)

Amber supports four individuals: Erin, her stepdaughter, who lives with her; Amy, her cousin, who lives in another state; Britney, her friend, who lives legally in Amber's home all year long; and Charlie, her father, who lives in another state. Assume that the dependency requirements other than residence are all met. How many personal and dependency exemptions may Amber claim?

(Multiple Choice)

4.9/5  (41)

(41)

Discuss reasons why a married couple may choose not to file a joint return.

(Essay)

4.8/5  (30)

(30)

Which of the following types of itemized deductions are included in the category of miscellaneous expenses that are deductible only if the aggregate amount of such expenses exceeds 2% of the taxpayer's adjusted gross income?

(Multiple Choice)

5.0/5  (38)

(38)

Showing 41 - 60 of 138

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)