Exam 10: Standard Costs and Variances

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

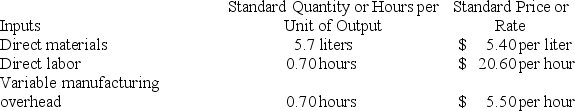

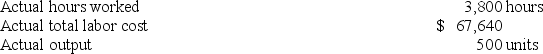

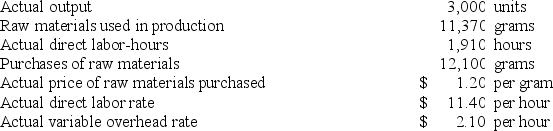

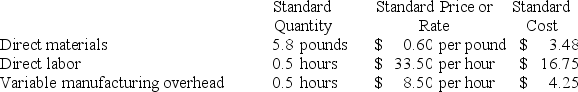

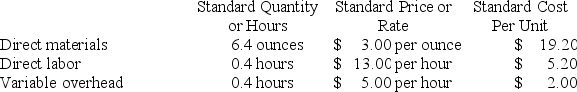

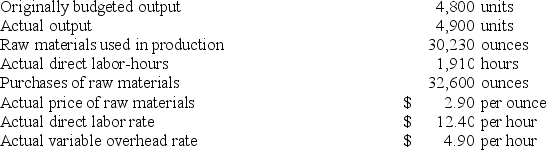

Fluegge Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The company has reported the following actual results for the product for December:

The company has reported the following actual results for the product for December:

The labor rate variance for the month is closest to:

The labor rate variance for the month is closest to:

(Multiple Choice)

5.0/5  (33)

(33)

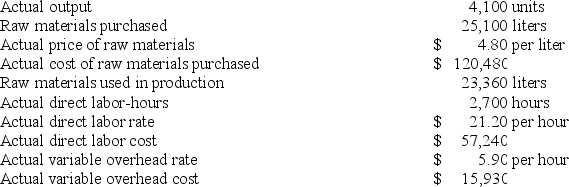

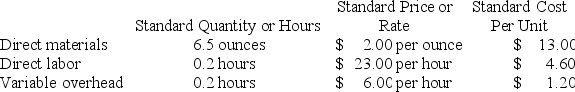

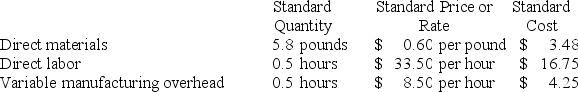

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for January is:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for January is:

(Multiple Choice)

4.8/5  (29)

(29)

Vermeillen Corporation uses a standard costing system in which variable manufacturing overhead is assigned to production on the basis of the number of machine setups. The following data pertain to one month's operations: Variable manufacturing overhead cost incurred: $70,000

Total variable manufacturing overhead variance: $4,550 Favorable

Standard machine setups allowed for actual production: 3,550

Actual machine setups incurred: 3,500

The standard variable overhead rate per machine setup is:

(Multiple Choice)

4.7/5  (35)

(35)

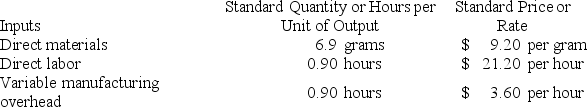

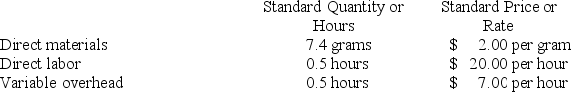

Thyne Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.  The actual output for the period was 3,900 units.

The total standard cost per unit is closest to:

The actual output for the period was 3,900 units.

The total standard cost per unit is closest to:

(Multiple Choice)

4.8/5  (31)

(31)

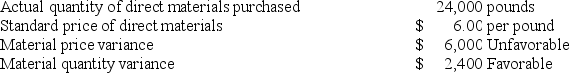

Suver Corporation has a standard costing system. The following data are available for June:  The actual price per pound of direct materials purchased in June was:

The actual price per pound of direct materials purchased in June was:

(Multiple Choice)

4.7/5  (39)

(39)

Gipple Corporation makes a product that uses a material with the quantity standard of 7.3 grams per unit of output and the price standard of $6.00 per gram. In January the company produced 3,400 units using 24,870 grams of the direct material. During the month the company purchased 27,400 grams of the direct material at $6.10 per gram. The direct materials purchases variance is computed when the materials are purchased. The materials price variance for January is:

(Multiple Choice)

4.9/5  (36)

(36)

The standard price per unit for direct materials should reflect the final, delivered cost of the materials.

(True/False)

4.8/5  (41)

(41)

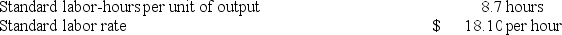

The following labor standards have been established for a particular product:  The following data pertain to operations concerning the product for the last month:

The following data pertain to operations concerning the product for the last month:

What is the labor efficiency variance for the month?

What is the labor efficiency variance for the month?

(Multiple Choice)

4.8/5  (42)

(42)

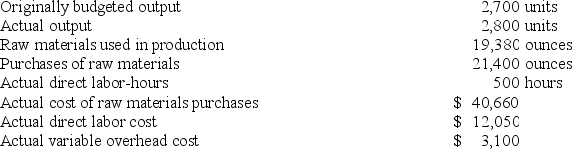

Tharaldson Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in June.

The company reported the following results concerning this product in June.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for June is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for June is:

(Multiple Choice)

4.8/5  (36)

(36)

Variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. If the labor efficiency variance is favorable, the variable overhead efficiency variance will be:

(Multiple Choice)

4.8/5  (41)

(41)

Bulluck Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in July.

The company reported the following results concerning this product in July.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The labor rate variance for July is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The labor rate variance for July is:

(Multiple Choice)

4.7/5  (35)

(35)

Ravena Labs., Inc. makes a single product which has the following standards: Direct materials: 2.5 ounces at $20 per ounce

Direct labor: 1.4 hours at $12.50 per hour

Variable manufacturing overhead: 1.4 hours at 3.50 per hour

Variable manufacturing overhead is applied on the basis of standard direct labor-hours. The following data are available for October:

3,750 units of compound were produced during the month.

There was no beginning direct materials inventory.

Direct materials purchased: 12,000 ounces for $225,000.

The ending direct materials inventory was 2,000 ounces.

Direct labor-hours worked: 5,600 hours at a cost of $67,200.

Variable manufacturing overhead costs incurred amounted to $18,200.

Variable manufacturing overhead applied to products: $18,375.

The variable overhead efficiency variance for October is:

(Multiple Choice)

4.8/5  (31)

(31)

Doogan Corporation makes a product with the following standard costs:  The company produced 5,200 units in January using 39,310 grams of direct material and 2,380 direct labor-hours. During the month, the company purchased 44,400 grams of the direct material at $1.70 per gram. The actual direct labor rate was $19.30 per hour and the actual variable overhead rate was $6.80 per hour.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for January is:

The company produced 5,200 units in January using 39,310 grams of direct material and 2,380 direct labor-hours. During the month, the company purchased 44,400 grams of the direct material at $1.70 per gram. The actual direct labor rate was $19.30 per hour and the actual variable overhead rate was $6.80 per hour.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for January is:

(Multiple Choice)

4.8/5  (35)

(35)

If variable manufacturing overhead is applied on the basis of direct labor-hours and the variable overhead rate variance is favorable, then:

(Multiple Choice)

4.8/5  (39)

(39)

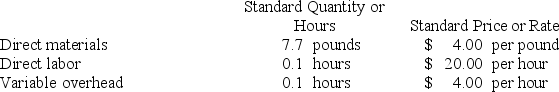

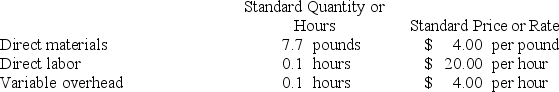

Puvo, Inc., manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company:

The company produced 2,400 units during the month.

A total of 19,400 pounds of material were purchased at a cost of $13,580.

There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.

During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.

Variable manufacturing overhead costs during March totaled $14,061.

The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for March is:

During March, the following activity was recorded by the company:

The company produced 2,400 units during the month.

A total of 19,400 pounds of material were purchased at a cost of $13,580.

There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.

During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.

Variable manufacturing overhead costs during March totaled $14,061.

The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for March is:

(Multiple Choice)

4.8/5  (43)

(43)

Puvo, Inc., manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company:

The company produced 2,400 units during the month.

A total of 19,400 pounds of material were purchased at a cost of $13,580.

There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.

During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.

Variable manufacturing overhead costs during March totaled $14,061.

The direct materials purchases variance is computed when the materials are purchased.

The materials price variance for March is:

During March, the following activity was recorded by the company:

The company produced 2,400 units during the month.

A total of 19,400 pounds of material were purchased at a cost of $13,580.

There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.

During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.

Variable manufacturing overhead costs during March totaled $14,061.

The direct materials purchases variance is computed when the materials are purchased.

The materials price variance for March is:

(Multiple Choice)

4.9/5  (50)

(50)

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for January is:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for January is:

(Multiple Choice)

4.8/5  (32)

(32)

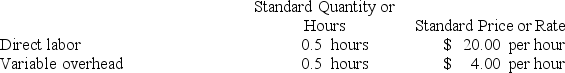

Juhasz Corporation makes a product with the following standards for direct labor and variable overhead:  In August the company produced 7,900 units using 4,080 direct labor-hours. The actual variable overhead cost was $15,096. The company applies variable overhead on the basis of direct labor-hours.

The variable overhead efficiency variance for August is:

In August the company produced 7,900 units using 4,080 direct labor-hours. The actual variable overhead cost was $15,096. The company applies variable overhead on the basis of direct labor-hours.

The variable overhead efficiency variance for August is:

(Multiple Choice)

4.8/5  (39)

(39)

A total of 6,850 kilograms of a raw material was purchased at a total cost of $21,920. The materials price variance was $1,370 favorable. The standard price per kilogram for the raw material must be:

(Multiple Choice)

4.9/5  (31)

(31)

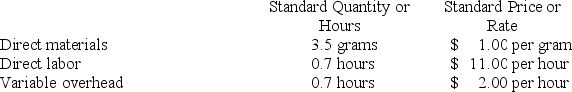

Majer Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in February.

The company reported the following results concerning this product in February.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for February is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for February is:

(Multiple Choice)

4.9/5  (44)

(44)

Showing 121 - 140 of 247

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)