Exam 4: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

J Corporation has two divisions. Division A has a contribution margin of $79,300 and Division B has a contribution margin of $126,200. If total traceable fixed expenses are $72,400 and total common fixed expenses are $34,900, what is J Corporation's net operating income?

(Multiple Choice)

4.9/5  (42)

(42)

Truo Corporation produces a single product. Last year, the company had net operating income of $100,000 using variable costing. Beginning and ending inventories were 13,000 units and 18,000 units, respectively. If the fixed manufacturing overhead cost was $4 per unit both last year and this year, what would have been the net operating income using absorption costing?

(Multiple Choice)

4.9/5  (35)

(35)

Under variable costing, all variable production costs are treated as product costs.

(True/False)

5.0/5  (35)

(35)

Pungent Corporation manufactures and sells a spice rack. Shown below are the actual operating results for the first two years of operations:  Pungent's selling price and unit variable cost and total fixed cost were the same for both years. What is Pungent's variable costing net operating income for Year 2?

Pungent's selling price and unit variable cost and total fixed cost were the same for both years. What is Pungent's variable costing net operating income for Year 2?

(Multiple Choice)

4.8/5  (39)

(39)

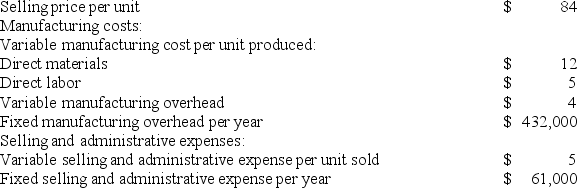

Mullee Corporation produces a single product and has the following cost structure:  The absorption costing unit product cost is:

The absorption costing unit product cost is:

(Multiple Choice)

4.8/5  (43)

(43)

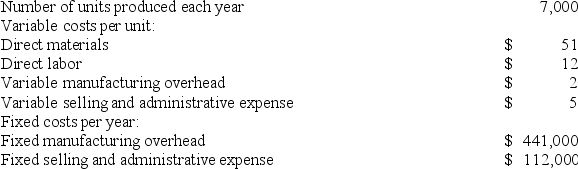

The Southern Corporation manufactures a single product and has the following cost structure:  Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

Under absorption costing, the cost of goods sold for the year would be:

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

Under absorption costing, the cost of goods sold for the year would be:

(Multiple Choice)

4.7/5  (40)

(40)

Miller Corporation produces a single product. The company had the following results for its first two years of operation:

In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units. The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year. Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year). Variable selling and administrative expenses are $2 per unit sold.

Required:

a. Compute the unit product cost for each year under absorption costing and under variable costing.

b. Prepare a contribution format income statement for each year using variable costing.

c. Reconcile the variable costing and absorption costing income figures for each year.

d. Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1, although the same number of units were sold in each year.

In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units. The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year. Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year). Variable selling and administrative expenses are $2 per unit sold.

Required:

a. Compute the unit product cost for each year under absorption costing and under variable costing.

b. Prepare a contribution format income statement for each year using variable costing.

c. Reconcile the variable costing and absorption costing income figures for each year.

d. Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1, although the same number of units were sold in each year.

(Essay)

4.7/5  (42)

(42)

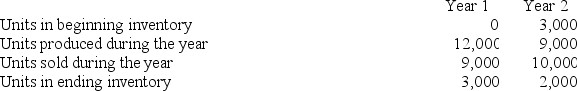

Neef Corporation has provided the following data for its two most recent years of operation:

Which of the following statements is true for Year 1?

Which of the following statements is true for Year 1?

(Multiple Choice)

4.9/5  (33)

(33)

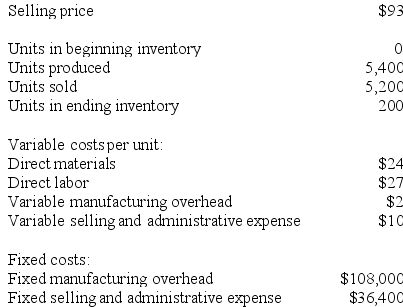

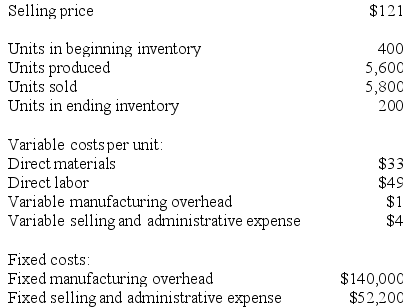

Qadir Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

Required:

a. What is the unit product cost for the month under variable costing?

b. Prepare a contribution format income statement for the month using variable costing.

c. Without preparing an income statement, determine the absorption costing net operating income for the month. (Hint: Use the reconciliation method.)

Required:

a. What is the unit product cost for the month under variable costing?

b. Prepare a contribution format income statement for the month using variable costing.

c. Without preparing an income statement, determine the absorption costing net operating income for the month. (Hint: Use the reconciliation method.)

(Essay)

5.0/5  (39)

(39)

Nelter Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a. Prepare a contribution format income statement for the month using variable costing.

b. Prepare an income statement for the month using absorption costing.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a. Prepare a contribution format income statement for the month using variable costing.

b. Prepare an income statement for the month using absorption costing.

(Essay)

4.8/5  (39)

(39)

Bryans Corporation has provided the following data for its two most recent years of operation:

The unit product cost under absorption costing in Year 1 is closest to:

The unit product cost under absorption costing in Year 1 is closest to:

(Multiple Choice)

4.9/5  (33)

(33)

Showing 281 - 291 of 291

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)