Exam 4: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

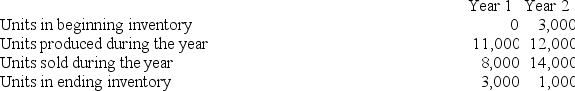

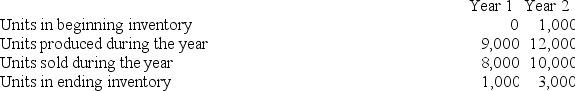

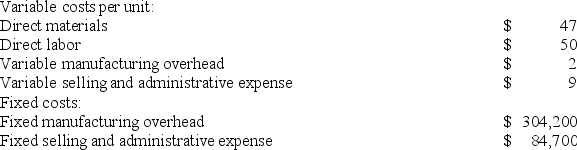

Plummer Corporation has provided the following data for its two most recent years of operation:

The unit product cost under absorption costing in Year 2 is closest to:

The unit product cost under absorption costing in Year 2 is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

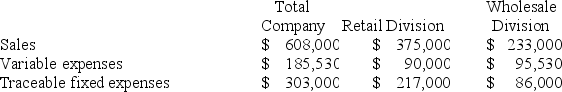

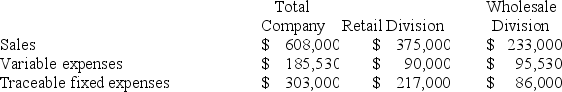

Bertie Corporation has two divisions: Retail Division and Wholesale Division. The following data are for the most recent operating period:  The common fixed expenses of the company are $103,360.

The company's overall break-even sales is closest to:

The common fixed expenses of the company are $103,360.

The company's overall break-even sales is closest to:

(Multiple Choice)

4.7/5  (30)

(30)

Sipho Corporation manufactures a single product. Last year, the company's variable costing net operating income was $90,900. Fixed manufacturing overhead costs released from inventory under absorption costing amounted to $21,900. What was the absorption costing net operating income last year?

(Multiple Choice)

4.8/5  (35)

(35)

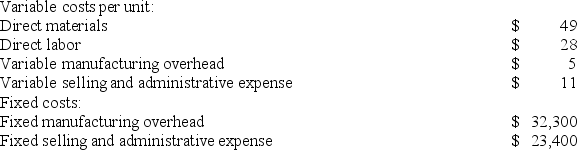

Tustin Corporation has provided the following data for its two most recent years of operation:

The unit product cost under absorption costing in Year 2 is closest to:

The unit product cost under absorption costing in Year 2 is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

Beach Corporation, which produces a single product, budgeted the following costs for its first year of operations. These costs are based on a budgeted volume of 30,000 towels produced and sold:  During the first year of operations, Beach Corporation actually produced 30,000 towels but only sold 24,000 towels. Actual costs did not fluctuate from the cost behavior patterns described above. The 24,000 towels were sold for $16 per towel. Assume that direct labor is a variable cost.

What is the total cost that would be assigned to Beach Corporation's finished goods inventory at the end of the first year of operations under variable costing?

During the first year of operations, Beach Corporation actually produced 30,000 towels but only sold 24,000 towels. Actual costs did not fluctuate from the cost behavior patterns described above. The 24,000 towels were sold for $16 per towel. Assume that direct labor is a variable cost.

What is the total cost that would be assigned to Beach Corporation's finished goods inventory at the end of the first year of operations under variable costing?

(Multiple Choice)

4.9/5  (44)

(44)

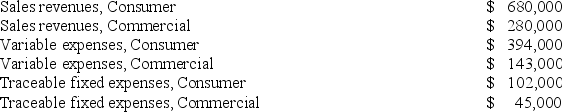

Ferrar Corporation has two major business segments: Consumer and Commercial. Data for the segments and for the company for March appear below:  In addition, common fixed expenses totaled $210,000 and were allocated as follows: $122,000 to the Consumer business segment and $88,000 to the Commercial business segment.

A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

In addition, common fixed expenses totaled $210,000 and were allocated as follows: $122,000 to the Consumer business segment and $88,000 to the Commercial business segment.

A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

(Multiple Choice)

4.8/5  (33)

(33)

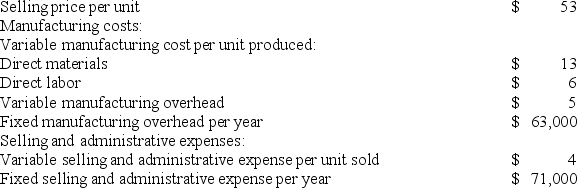

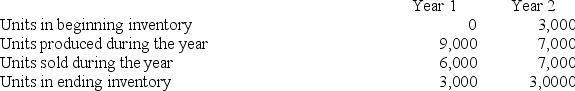

Homeyer Corporation has provided the following data for its two most recent years of operation:

The net operating income (loss) under absorption costing in Year 1 is closest to:

The net operating income (loss) under absorption costing in Year 1 is closest to:

(Multiple Choice)

4.7/5  (33)

(33)

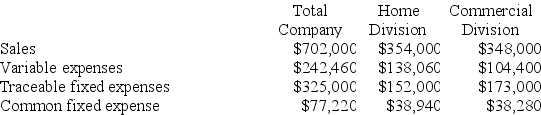

Petteway Corporation has two divisions: Home Division and Commercial Division. The following report is for the most recent operating period:

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a. What is the Home Division's break-even in sales dollars?

b. What is the Commercial Division's break-even in sales dollars?

c. What is the company's overall break-even in sales dollars?

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a. What is the Home Division's break-even in sales dollars?

b. What is the Commercial Division's break-even in sales dollars?

c. What is the company's overall break-even in sales dollars?

(Essay)

4.9/5  (31)

(31)

Data for January for Bondi Corporation and its two major business segments, North and South, appear below:  In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

(Multiple Choice)

5.0/5  (37)

(37)

Cahalane Corporation has provided the following data for its two most recent years of operation:

Which of the following statements is true for Year 2?

Which of the following statements is true for Year 2?

(Multiple Choice)

4.7/5  (37)

(37)

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS. Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible. The following data relate to last month's operations:

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products. Use the contribution approach.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products. Use the contribution approach.

(Essay)

4.8/5  (33)

(33)

Last year, Denogean Corporation's variable costing net operating income was $64,200 and ending inventory increased by 1,900 units. Fixed manufacturing overhead cost per unit was $4 in both beginning and ending inventory.

Required:

Determine the absorption costing net operating income for last year. Show your work!

(Essay)

4.9/5  (38)

(38)

Bertie Corporation has two divisions: Retail Division and Wholesale Division. The following data are for the most recent operating period:  The common fixed expenses of the company are $103,360.

The Wholesale Division's break-even sales is closest to:

The common fixed expenses of the company are $103,360.

The Wholesale Division's break-even sales is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

Absorption costing treats all manufacturing costs as product costs.

(True/False)

4.7/5  (38)

(38)

Ing Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

What is the unit product cost for the month under variable costing?

What is the unit product cost for the month under variable costing?

(Multiple Choice)

4.9/5  (29)

(29)

Columbia Corporation produces a single product. The company's variable costing income statement for November appears below:  During November, 35,000 units were manufactured and 8,000 units were in beginning inventory. Variable production costs have remained constant on a per unit basis over the past several months.

The value of the company's inventory on November 30 under absorption costing would be:

During November, 35,000 units were manufactured and 8,000 units were in beginning inventory. Variable production costs have remained constant on a per unit basis over the past several months.

The value of the company's inventory on November 30 under absorption costing would be:

(Multiple Choice)

4.8/5  (40)

(40)

Hadley Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

What is the net operating income for the month under variable costing?

What is the net operating income for the month under variable costing?

(Multiple Choice)

4.7/5  (34)

(34)

Bryans Corporation has provided the following data for its two most recent years of operation:

The unit product cost under variable costing in Year 1 is closest to:

The unit product cost under variable costing in Year 1 is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Ieso Corporation has two stores: J and K. During November, Ieso Corporation reported a net operating income of $30,000 and sales of $450,000. The contribution margin in Store J was $100,000, or 40% of sales. The segment margin in Store K was $30,000, or 15% of sales. Traceable fixed expenses are $60,000 in Store J, and $40,000 in Store K. Variable expenses in Store K totaled:

(Multiple Choice)

4.7/5  (36)

(36)

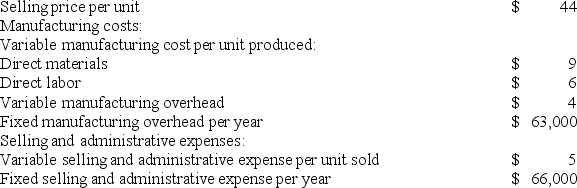

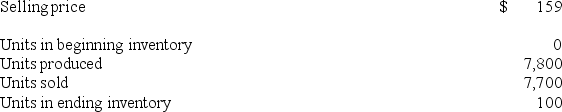

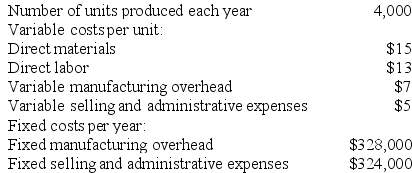

Olguin Corporation produces a single product and has the following cost structure:

Required:

a. Compute the unit product cost under absorption costing. Show your work!

b. Compute the unit product cost under variable costing. Show your work!

Required:

a. Compute the unit product cost under absorption costing. Show your work!

b. Compute the unit product cost under variable costing. Show your work!

(Essay)

4.8/5  (34)

(34)

Showing 81 - 100 of 291

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)