Exam 18: Pricing Decisions

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

Magney, Inc., uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 84,000 units next year, the unit product cost of a particular product is $40.80. The company's selling and administrative expenses for this product are budgeted to be $1,705,200 in total for the year. The company has invested $300,000 in this product and expects a return on investment of 14%. The selling price for this product based on the absorption costing approach would be closest to:

(Multiple Choice)

4.9/5  (29)

(29)

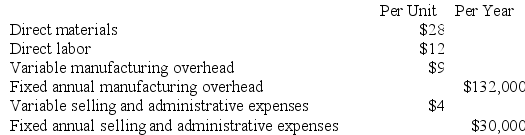

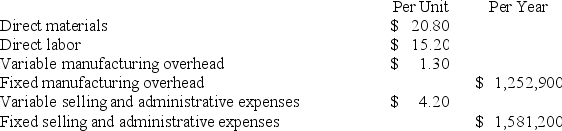

The management of Landstrom Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,036,200 and has a required return on investment of 10%.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the selling price for the new product using the absorption costing approach.

Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,036,200 and has a required return on investment of 10%.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the selling price for the new product using the absorption costing approach.

(Essay)

4.9/5  (42)

(42)

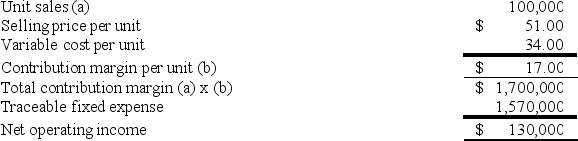

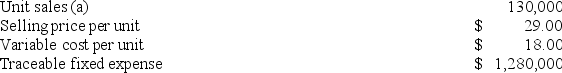

Pascal Corporation manufactures numerous products, one of which is called Gamma-66. The company has provided the following data about this product:  Assume that the total traceable fixed expense does not change. If Pascal decreases the price of Gamma-66 to $48.96, what percentage change in unit sales would provide the same net operating income as is currently being earned at a price of $51.00? (Your answer should be rounded to the nearest 0.1%.)

Assume that the total traceable fixed expense does not change. If Pascal decreases the price of Gamma-66 to $48.96, what percentage change in unit sales would provide the same net operating income as is currently being earned at a price of $51.00? (Your answer should be rounded to the nearest 0.1%.)

(Multiple Choice)

4.9/5  (36)

(36)

Kirgan, Inc., manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 57,000 units per year.

The company has invested $140,000 in this product and expects a return on investment of 13%.

The selling price based on the absorption costing approach would be closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 57,000 units per year.

The company has invested $140,000 in this product and expects a return on investment of 13%.

The selling price based on the absorption costing approach would be closest to:

(Multiple Choice)

5.0/5  (35)

(35)

In the absorption approach to cost-plus pricing, the anticipated markup in dollars is equal to the anticipated profit.

(True/False)

4.8/5  (32)

(32)

A new product, an automated crepe maker, is being introduced at Knutt Corporation. At a selling price of $59 per unit, management projects sales of 70,000 units. Launching the crepe maker as a new product would require an investment of $500,000. The desired return on investment is 12%. The target cost per crepe maker is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

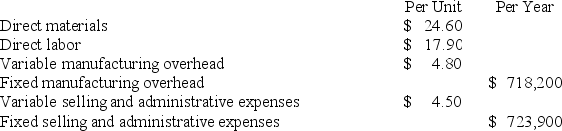

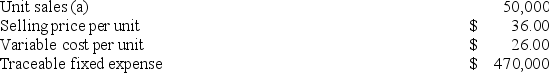

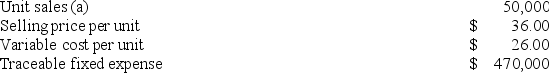

Kinsley Corporation manufactures numerous products, one of which is called Kappa-03. The company has provided the following data about this product:  Management is considering increasing the price of Kappa-03 by 7%, from $36.00 to $38.52. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 50,000 units to 45,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Kappa-03 earn at a price of $38.52 if this sales forecast is correct?

Management is considering increasing the price of Kappa-03 by 7%, from $36.00 to $38.52. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 50,000 units to 45,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Kappa-03 earn at a price of $38.52 if this sales forecast is correct?

(Multiple Choice)

4.7/5  (33)

(33)

Morice Industries Inc. has developed a new injection mold, model IA-05, that is designed to offer superior performance to a comparable injection mold sold by Morice's main competitor. The competing injection mold sells for $54,000 and needs to be replaced after 1,000 hours of use. It also requires $7,000 of preventive maintenance during its useful life. Model IA-05's performance capabilities are similar to the competing product with two important exceptions-it needs to be replaced only after 2,000 hours of use and it requires $8,000 of preventive maintenance during its useful life. From a value-based pricing standpoint what is model IA-05's economic value to the customer over its 2,000 hour life?

(Multiple Choice)

4.8/5  (32)

(32)

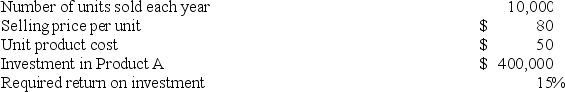

The following information is available on Bruder Inc.'s Product A:  The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are:

The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are:

(Multiple Choice)

4.8/5  (37)

(37)

Bohmker Corporation is introducing a new product whose direct materials cost is $25 per unit, direct labor cost is $13 per unit, variable manufacturing overhead is $9 per unit, and variable selling and administrative expense is $4 per unit. The annual fixed manufacturing overhead associated with the product is $18,000 and its annual fixed selling and administrative expense is $9,000. Management plans to produce and sell 1,000 units of the new product annually. The new product would require an investment of $110,500 and has a required return on investment of 10%. Management would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the selling price for the new product using the absorption costing approach.

(Essay)

4.9/5  (38)

(38)

Weitman Corporation manufactures numerous products, one of which is called Epsilon50. The company has provided the following data about this product:  What is the net operating income for product Epsilon50 at the current price?

What is the net operating income for product Epsilon50 at the current price?

(Multiple Choice)

4.7/5  (29)

(29)

Target costing is primarily used with well-established products.

(True/False)

4.9/5  (35)

(35)

Kinsley Corporation manufactures numerous products, one of which is called Kappa03. The company has provided the following data about this product:  What is the net operating income for product Kappa03 at the current price?

What is the net operating income for product Kappa03 at the current price?

(Multiple Choice)

4.7/5  (49)

(49)

Morr Logistic Solutions Corporation has developed a new forklift-model QY-49-that has been designed to outperform a competitor's best-selling forklift. The competitor's product has a useful life of 10,000 hours of service, has operating costs that average $3.70 per hour, and sells for $109,000. In contrast, model QY-49 has a useful life of 40,000 hours of service and its operating cost is $2.10 per hour. Morr has not yet established a selling price for model QY-49. From a value-based pricing standpoint what range of possible prices should Morr consider when setting a price for QY-49?

(Multiple Choice)

4.9/5  (26)

(26)

The sensitivity of unit sales to changes in price is called the price elasticity of demand.

(True/False)

4.9/5  (32)

(32)

Diedrich Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 67,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 12%.

Direct labor is a variable cost in this company.

The selling price based on the absorption costing approach is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 67,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 12%.

Direct labor is a variable cost in this company.

The selling price based on the absorption costing approach is closest to:

(Multiple Choice)

4.9/5  (41)

(41)

Tavis Robotics Corporation has developed a new robot-model FI-73-that has been designed to outperform a competitor's best-selling robot. The competitor's product has a useful life of 10,000 hours of service, has operating costs that average $4.60 per hour, and sells for $109,000. In contrast, model FI-73 has a useful life of 30,000 hours of service and its operating cost is $2.60 per hour. Tavis has not yet established a selling price for model FI-73. From a value-based pricing standpoint what is the differentiation value offered by FI-73 relative to the competitor's offering for each 30,000 hours of service?

(Multiple Choice)

4.8/5  (34)

(34)

Demand for a product is said to be elastic if a change in price has:

(Multiple Choice)

4.9/5  (43)

(43)

Mounger Industrial Products Inc. has developed a new industrial forklift, model CZ-03, that is designed to offer superior performance to a comparable forklift sold by Mounger's main competitor. The competing forklift sells for $27,000 and needs to be replaced after 1,000 hours of use. It also requires $3,000 of preventive maintenance during its useful life. Model CZ-03's performance capabilities are similar to the competing forklift with two important exceptions-it needs to be replaced only after 4,000 hours of use and it requires $6,000 of preventive maintenance during its useful life.

Required:

From a value-based pricing standpoint what is the differentiation value offered by model CZ-03 relative to the competitor's forklift for each 4,000 hours of usage?

(Essay)

4.9/5  (35)

(35)

Bochenski Mechanical Corporation has developed a new industrial grinder-model UF-48-that has been designed to outperform a competitor's best-selling industrial grinder. Model UF-48 has a useful life of 80,000 hours of service and its operating cost is $1.00 per hour. In contrast, the competitor's product has a useful life of 20,000 hours of service and has operating costs that average $1.80 per hour. The competitor's industrial grinder sells for $129,000. Bochenski has not yet established a selling price for model UF-48.

Required:

From a value-based pricing standpoint what is the differentiation value offered by model UF-48 relative to the competitor's offering for each 80,000 hours of service?

(Essay)

4.8/5  (43)

(43)

Showing 81 - 100 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)