Exam 18: Pricing Decisions

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

Management of Niemczyk Corporation is considering a new product, an outdoor speaker that would have a selling price of $31 per unit and projected sales of 10,000 units. Launching the new product would require an investment of $700,000. The desired return on investment is 16%.

Required:

Determine the target cost per unit for the outdoor speaker.

(Essay)

4.9/5  (37)

(37)

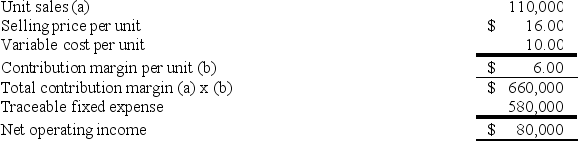

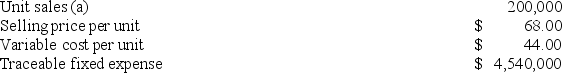

Spach Corporation manufactures numerous products, one of which is called Beta-68. The company has provided the following data about this product:  Assume that the total traceable fixed expense does not change. How many units of product Beta-68 would Spach need to sell at a price of $15.20 to earn the same net operating income that it currently earns at a price of $16.00? (Round your answer up to the nearest whole number.)

Assume that the total traceable fixed expense does not change. How many units of product Beta-68 would Spach need to sell at a price of $15.20 to earn the same net operating income that it currently earns at a price of $16.00? (Round your answer up to the nearest whole number.)

(Multiple Choice)

4.9/5  (33)

(33)

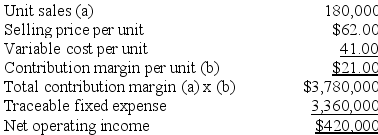

Ohanlon Corporation manufactures numerous products, one of which is called Delta27. The company has provided the following data about this product:

Required:

a. Management is considering increasing the price of Delta27 by 5%, from $62.00 to $65.10. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 180,000 units to 162,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Delta27 earn at a price of $65.10 if this sales forecast is correct?

b. Assuming that the total traceable fixed expense does not change, if Ohanlon increases the price of Delta27 to $65.10, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $62.00? (Round your answer to the nearest one-tenth of a percent.)

Required:

a. Management is considering increasing the price of Delta27 by 5%, from $62.00 to $65.10. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 180,000 units to 162,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Delta27 earn at a price of $65.10 if this sales forecast is correct?

b. Assuming that the total traceable fixed expense does not change, if Ohanlon increases the price of Delta27 to $65.10, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $62.00? (Round your answer to the nearest one-tenth of a percent.)

(Essay)

4.9/5  (34)

(34)

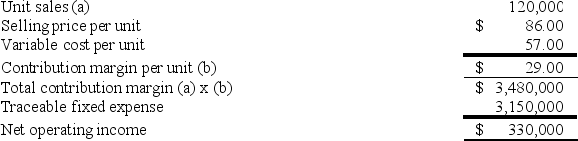

Boggess Corporation manufactures numerous products, one of which is called Alpha41. The company has provided the following data about this product:  Management is considering increasing the price of Alpha41 by 10%, from $86.00 to $94.60. The company's marketing managers estimate that this price hike would decrease unit sales by 20%, from 120,000 units to 96,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Alpha41 earn at a price of $94.60 if this sales forecast is correct?

Management is considering increasing the price of Alpha41 by 10%, from $86.00 to $94.60. The company's marketing managers estimate that this price hike would decrease unit sales by 20%, from 120,000 units to 96,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Alpha41 earn at a price of $94.60 if this sales forecast is correct?

(Multiple Choice)

4.8/5  (40)

(40)

Morice Industries Inc. has developed a new injection mold, model IA-05, that is designed to offer superior performance to a comparable injection mold sold by Morice's main competitor. The competing injection mold sells for $54,000 and needs to be replaced after 1,000 hours of use. It also requires $7,000 of preventive maintenance during its useful life. Model IA-05's performance capabilities are similar to the competing product with two important exceptions-it needs to be replaced only after 2,000 hours of use and it requires $8,000 of preventive maintenance during its useful life. From a value-based pricing standpoint what range of possible prices should Morice consider when setting a price for model IA-05?

(Multiple Choice)

4.7/5  (37)

(37)

Blauvelt Electronics Corporation has developed a new instrument-model GZ-29-that has been designed to outperform a competitor's best-selling instrument. Model GZ-29 has a useful life of 30,000 hours of service and its operating cost is $3.20 per hour.In contrast, the competitor's product has a useful life of 10,000 hours of service and has operating costs that average $5.60 per hour. The competitor's instrument sells for $149,000. Blauvelt has not yet established a selling price for model GZ-29. From a value-based pricing standpoint what is the differentiation value offered by GZ-29 relative to the competitor's offering for each 30,000 hours of service?

(Multiple Choice)

4.8/5  (45)

(45)

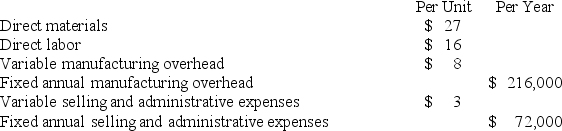

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

The unit target selling price using the absorption costing approach is closest to:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

The unit target selling price using the absorption costing approach is closest to:

(Multiple Choice)

4.9/5  (29)

(29)

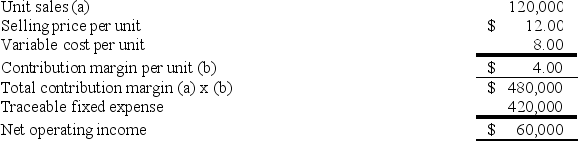

Starowicz Corporation manufactures numerous products, one of which is called Beta10. The company has provided the following data about this product:  Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

(Multiple Choice)

4.9/5  (34)

(34)

Conaghan Avionics Corporation has developed a new high pressure pump-model RA-79-that has been designed to outperform a competitor's best-selling high pressure pump. The competitor's product has a useful life of 30,000 hours of service, has operating costs that average $3.60 per hour, and sells for $159,000. In contrast, model RA-79 has a useful life of 60,000 hours of service and its operating cost is $2.00 per hour. Conaghan has not yet established a selling price for model RA-79. From a value-based pricing standpoint what is RA-79's economic value to the customer over its 60,000 hour useful life?

(Multiple Choice)

4.9/5  (39)

(39)

In value-based pricing, the value of what differentiates a product from the best available alternative is known as the differentiation value.

(True/False)

4.9/5  (35)

(35)

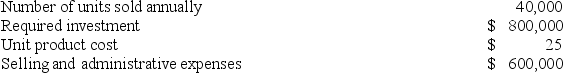

Minden Corporation estimates that the following costs and activity would be associated with the manufacture and sale of product A:  If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 15% rate of return on investment (ROI), the required markup on absorption cost for Product A would be closest to:

If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 15% rate of return on investment (ROI), the required markup on absorption cost for Product A would be closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Thoen Heavy Machinery Corporation has developed a new drill press-model OU-84-that has been designed to outperform a competitor's best-selling drill press. The competitor's product has a useful life of 30,000 hours of service, has operating costs that average $1.60 per hour, and sells for $189,000. In contrast, model OU-84 has a useful life of 120,000 hours of service and its operating cost is $1.00 per hour. Thoen has not yet established a selling price for model OU-84.

Required:

From a value-based pricing standpoint what range of possible prices should Thoen consider when setting a price for model OU-84?

(Essay)

4.8/5  (39)

(39)

Willow Corporation manufactures and sells 20,000 units of Product Z each year. In order to produce and sell this many units, it has been necessary for the company to make an investment of $500,000 in Product Z. The company requires a 20% rate of return on all investments in products. Selling and administrative expenses associated with Product Z total $200,000 per year. The unit product cost of Product Z is $20. The company uses the absorption costing approach to cost-plus pricing described in the text. The selling price for Product Z is:

(Multiple Choice)

4.9/5  (33)

(33)

Tavis Robotics Corporation has developed a new robot-model FI-73-that has been designed to outperform a competitor's best-selling robot. The competitor's product has a useful life of 10,000 hours of service, has operating costs that average $4.60 per hour, and sells for $109,000. In contrast, model FI-73 has a useful life of 30,000 hours of service and its operating cost is $2.60 per hour. Tavis has not yet established a selling price for model FI-73. From a value-based pricing standpoint what range of possible prices should Tavis consider when setting a price for FI-73?

(Multiple Choice)

4.8/5  (31)

(31)

Tavis Robotics Corporation has developed a new robot-model FI-73-that has been designed to out perform a competitor's best-selling robot. The competitor's product has a useful life of 10,000 hours of service, has operating costs that average $4.60 per hour, and sells for $109,000. In contrast, model FI-73 has a useful life of 30,000 hours of service and its operating cost is $2.60 per hour. Tavis has not yet established a selling price for model FI-73. From a value-based pricing standpoint what is FI-73's economic value to the customer over its 30,000 hour useful life?

(Multiple Choice)

4.9/5  (41)

(41)

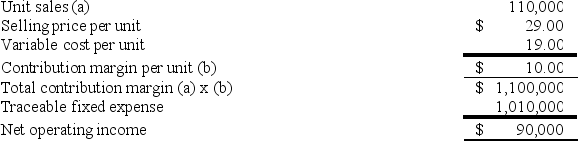

Herrell Corporation manufactures numerous products, one of which is called Delta11. The company has provided the following data about this product:  Management is considering increasing the price of Delta11 by 5%, from $29.00 to $30.45. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 110,000 units to 99,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Delta11 earn at a price of $30.45 if this sales forecast is correct?

Management is considering increasing the price of Delta11 by 5%, from $29.00 to $30.45. The company's marketing managers estimate that this price hike would decrease unit sales by 10%, from 110,000 units to 99,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Delta11 earn at a price of $30.45 if this sales forecast is correct?

(Multiple Choice)

4.7/5  (40)

(40)

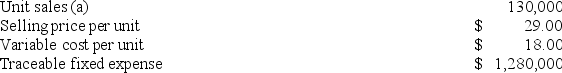

Weitman Corporation manufactures numerous products, one of which is called Epsilon-50. The company has provided the following data about this product:  Assume that the total traceable fixed expense does not change. How many units of product Epsilon-50 would Weitman need to sell at a price of $31.61 to earn the same net operating income that it currently earns at a price of $29.00? (Round your answer up to the nearest whole number.)

Assume that the total traceable fixed expense does not change. How many units of product Epsilon-50 would Weitman need to sell at a price of $31.61 to earn the same net operating income that it currently earns at a price of $29.00? (Round your answer up to the nearest whole number.)

(Multiple Choice)

4.7/5  (39)

(39)

Turnhilm, Inc. is considering adding a small electric mower to its product line. Management believes that in order to be competitive, the mower cannot be priced above $139. The company requires a minimum return of 25% on its investments. Launching the new product would require an investment of $8,000,000. Sales are expected to be 40,000 units of the mower per year.

Required:

Compute the target cost of a mower.

(Essay)

4.7/5  (41)

(41)

Napp Heavy Machinery Corporation has developed a new drill press-model GJ-37-that has been designed to outperform a competitor's best-selling drill press. The competitor's product has a useful life of 30,000 hours of service, has operating costs that average $1.70 per hour, and sells for $169,000. In contrast, model GJ-37 has a useful life of 120,000 hours of service and its operating cost is $1.10 per hour. Napp has not yet established a selling price for model GJ-37. From a value-based pricing standpoint what range of possible prices should Napp consider when setting a price for GJ-37?

(Multiple Choice)

4.7/5  (36)

(36)

Contento Corporation manufactures numerous products, one of which is called Kappa15. The company has provided the following data about this product:  What is the net operating income for product Kappa15 at the current price?

What is the net operating income for product Kappa15 at the current price?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 61 - 80 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)