Exam 15: Part B: Interest Rates and Monetary Policy

Exam 1: Part A: Limits, Alternatives, and Choices60 Questions

Exam 1: Part B: Limits, Alternatives, and Choices265 Questions

Exam 2: Part A: The Market System and the Circular Flow42 Questions

Exam 2: Part B: The Market System and the Circular Flow119 Questions

Exam 3: Part A: Demand, Supply, and Market Equilibrium51 Questions

Exam 3: Part B: Demand, Supply, and Market Equilibrium291 Questions

Exam 4: Part A: Market Failures: Public Goods and Externalities36 Questions

Exam 4: Part B: Market Failures: Public Goods and Externalities133 Questions

Exam 5: Part A: Governments Role and Government Failure1 Questions

Exam 5: Part B: Governments Role and Government Failure121 Questions

Exam 6: Part A: An Introduction to Macroeconomics31 Questions

Exam 6: Part B: An Introduction to Macroeconomics65 Questions

Exam 7: Part A: Measuring the Economys Output30 Questions

Exam 7: Part B: Measuring the Economys Output191 Questions

Exam 8: Part A: Economic Growth35 Questions

Exam 8: Part B: Economic Growth122 Questions

Exam 9: Part A: Business Cycles, Unemployment, and Inflation40 Questions

Exam 9: Part B: Business Cycles, Unemployment, and Inflation193 Questions

Exam 10: Part A: Basic Macroeconomic Relationships26 Questions

Exam 10: Part B: Basic Macroeconomic Relationships200 Questions

Exam 11: Part A: The Aggregate Expenditures Model47 Questions

Exam 11: Part B: The Aggregate Expenditures Model238 Questions

Exam 12: Part A: Aggregate Demand and Aggregate Supply35 Questions

Exam 12: Part B: Aggregate Demand and Aggregate Supply203 Questions

Exam 13: Part A: Fiscal Policy, Deficits, Surpluses, and Debt53 Questions

Exam 13: Part B: Fiscal Policy, Deficits, Surpluses, and Debt234 Questions

Exam 14: Part A: Money, Banking, and Money Creation56 Questions

Exam 14: Part B: Money, Banking, and Money Creation206 Questions

Exam 15: Part A: Interest Rates and Monetary Policy47 Questions

Exam 15: Part B: Interest Rates and Monetary Policy239 Questions

Exam 16: Part A: Long-Run Macroeconomic Adjustments28 Questions

Exam 16: Part B: Long-Run Macroeconomic Adjustments122 Questions

Exam 17: Part A: International Trade40 Questions

Exam 17: Part B: International Trade188 Questions

Exam 17: Part C: Financial Economics323 Questions

Exam 18: Part A: The Balance of Payments and Exchange Rates133 Questions

Exam 18: Part B: The Balance of Payments and Exchange Rates30 Questions

Exam 19: The Economics of Developing Countries254 Questions

Select questions type

Other things being equal, monetary policy will be more effective the flatter the investment-demand curve.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

True

When a chartered bank borrows from the Bank of Canada:

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

C

The reason for the Bank of Canada to have a range for its inflation targeting is that some of the components of the CPI, fluctuate a lot.

Free

(True/False)

4.8/5  (31)

(31)

Correct Answer:

True

A restrictive monetary policy reduces investment spending and shifts the economy's aggregate demand curve to the right.

(True/False)

4.7/5  (42)

(42)

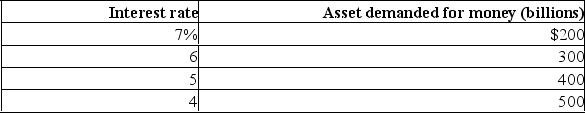

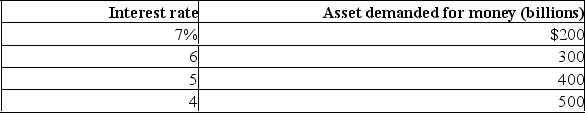

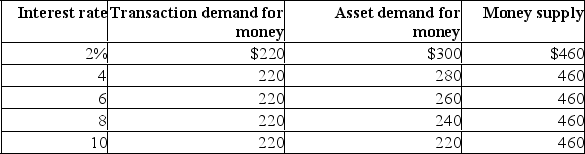

Refer to the above table.Suppose the transactions demand for money is $300 billion and the money supply is $700 billion.A decrease in the money supply to $600 billion would cause the interest rate to:

Refer to the above table.Suppose the transactions demand for money is $300 billion and the money supply is $700 billion.A decrease in the money supply to $600 billion would cause the interest rate to:

(Multiple Choice)

4.7/5  (33)

(33)

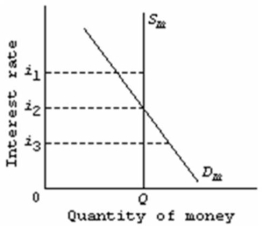

Refer to the diagram below for the market for money.Other things equal, the money demand curve in the diagram would shift leftward if:

(Multiple Choice)

4.9/5  (46)

(46)

All else equal, when the Bank of Canada engages in a restrictive monetary policy, the price of government securities tends to:

(Multiple Choice)

4.8/5  (37)

(37)

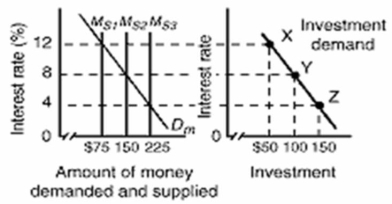

Refer to the graphs below.The first graph shows the money market of an economy, and the second graph shows the market for goods and services in the economy.

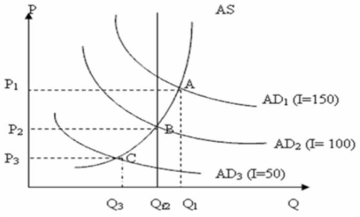

In the above diagrams, the numbers in the parentheses after the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each AD curve.All figures are in billions.Qf is the full-employment level of real output.Suppose the economy is in equilibrium at point C on the aggregate demand curve.Which of the following should the monetary authorities pursue to achieve a non-inflationary full-employment level of real GDP?

In the above diagrams, the numbers in the parentheses after the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each AD curve.All figures are in billions.Qf is the full-employment level of real output.Suppose the economy is in equilibrium at point C on the aggregate demand curve.Which of the following should the monetary authorities pursue to achieve a non-inflationary full-employment level of real GDP?

(Multiple Choice)

4.9/5  (41)

(41)

By early 2008 it became evident that the Canadian economy was slowing along with the U.S., where housing bubble had created a financial crisis worldwide.The Bank of Canada's response to this crisis was:

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following best describes the cause-effect chain of a restrictive monetary policy?

(Multiple Choice)

4.9/5  (34)

(34)

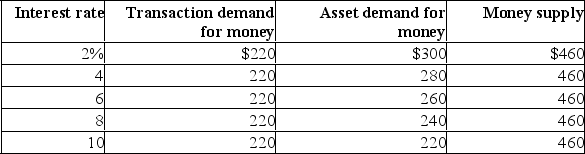

Refer to the above information.At equilibrium in the market for money, the total amount of money demanded is:

Refer to the above information.At equilibrium in the market for money, the total amount of money demanded is:

(Multiple Choice)

4.8/5  (34)

(34)

The asset demand for money varies directly with the interest rate.

(True/False)

4.8/5  (36)

(36)

The following information for a bond having no expiration date: bond price = $1,000; bond fixed annual interest payment = $100; bond annual interest rate = 10 percent.Refer to the above information.If the price of this bond falls by $200, the interest rate in effect will:

(Multiple Choice)

4.9/5  (39)

(39)

Refer to the above table.Suppose the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table.If the nominal GDP is $2000 billion, the equilibrium interest rate is:

Refer to the above table.Suppose the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table.If the nominal GDP is $2000 billion, the equilibrium interest rate is:

(Multiple Choice)

4.8/5  (33)

(33)

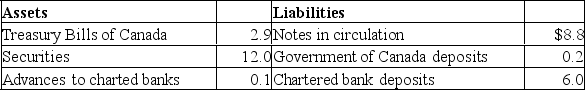

In the consolidated balance sheet of the Bank of Canada, loans to chartered banks are:

(Multiple Choice)

4.8/5  (41)

(41)

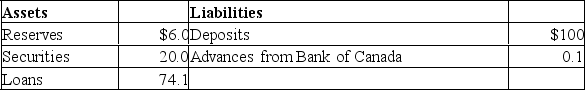

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA

Refer to the above information.The chartered banks have excess reserves of:

Refer to the above information.The chartered banks have excess reserves of:

(Multiple Choice)

4.9/5  (31)

(31)

The price of a bond having no expiration date is originally $8000 and has a fixed annual interest payment of $800.A fall in the price of the bond by $3,000 will provide a new buyer of the bond an interest rate of:

(Multiple Choice)

4.8/5  (37)

(37)

Refer to the above information.An increase in the money supply of $20 billion will cause the equilibrium interest rate to:

Refer to the above information.An increase in the money supply of $20 billion will cause the equilibrium interest rate to:

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 239

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)