Exam 16: Introduction to the Taxation of Individuals

Exam 1: Introduction to Taxation101 Questions

Exam 2: Working With the Tax Law72 Questions

Exam 3: Taxes on the Financial Statements85 Questions

Exam 4: Gross Income108 Questions

Exam 5: Business Deductions173 Questions

Exam 6: Losses and Loss Limitations121 Questions

Exam 7: Property Transactions: Basis, gain and Loss, and Nontaxable Exchange229 Questions

Exam 8: Property Transactions: Capital Gains and Losses, section 1231, and Recapture Provisions125 Questions

Exam 9: Corporations: Organization, capital Structure, and Operating Rules150 Questions

Exam 10: Corporations: Earnings Profits and Distributions106 Questions

Exam 11: Partnerships and Limited Liability Entities84 Questions

Exam 12: S Corporations146 Questions

Exam 13: Multijurisdictional Taxation129 Questions

Exam 14: Business Tax Credits and Corporate Alternative Minimum Tax106 Questions

Exam 15: Comparative Forms of Doing Business139 Questions

Exam 16: Introduction to the Taxation of Individuals180 Questions

Exam 17: Individuals As Employees and Proprietors168 Questions

Select questions type

Under the Federal income tax formula for individuals,the determination of adjusted gross income (AGI)precedes that of taxable income (TI).

(True/False)

4.8/5  (35)

(35)

Which of the following statements is true regarding the education tax credits?

(Multiple Choice)

5.0/5  (30)

(30)

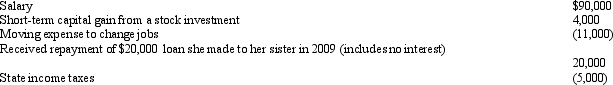

In 2013,Cindy had the following transactions:  Cindy's AGI is:

Cindy's AGI is:

(Multiple Choice)

4.9/5  (33)

(33)

A scholarship recipient at State University may exclude from gross income the scholarship proceeds used to pay for:

(Multiple Choice)

4.7/5  (32)

(32)

Kim,a resident of Oregon,supports his parents who are residents of Canada but citizens of Korea.Kim can claim his parents as dependents.

(True/False)

5.0/5  (45)

(45)

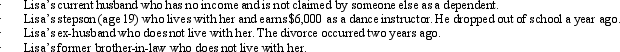

During 2013,Lisa (age 66)furnished more than 50% of the support of the following persons:  Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Lisa claim?

Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Lisa claim?

(Multiple Choice)

4.8/5  (46)

(46)

In 2012,Juan and Juanita incur $9,800 in legal and adoption fees directly related to the adoption of an infant son born in a nearby state.Over the next year,they incur another $4,500 of adoption expenses.The adoption becomes final in 2013.Which of the following choices properly reflects the amounts and years in which the adoption expenses credit is available. 2012 2013

(Multiple Choice)

4.8/5  (41)

(41)

If a lottery prize winner transfers the prize to a qualified government unit or nonprofit organization,then the prize is excluded from the winner's gross income if the amount of the prize does not exceed 30% of the winner's AGI.

(True/False)

4.8/5  (40)

(40)

Which,if any,of the following statements relating to the standard deduction is correct?

(Multiple Choice)

4.8/5  (48)

(48)

The kiddie tax does not apply to a child whose earned income is more than one-half of his or her support.

(True/False)

4.7/5  (38)

(38)

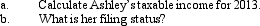

Ashley earns a salary of $55,000,has capital gains of $3,000,and interest income of $5,000 in 2013.Her husband died in 2012.Ashley has a dependent son,Tyrone,who is age 8.Her itemized deductions are $9,000.

(Essay)

4.8/5  (32)

(32)

Tim and Janet were divorced.Their only marital property was a personal residence with a value of $120,000 and cost of $50,000.Under the terms of the divorce agreement,Janet would receive the house and Janet would pay Tim $15,000 each year for 5 years,or until Tim's death,whichever should occur first.Tim and Janet lived apart when the payments were made to Tim.The divorce agreement did not contain the word "alimony."

(Multiple Choice)

4.8/5  (31)

(31)

For dependents who have income,special filing requirements apply.

(True/False)

4.8/5  (35)

(35)

Excess charitable contributions that come under the 30%-of-AGI ceiling are always subject to the 30%-of-AGI ceiling in the carryover year.

(True/False)

4.9/5  (25)

(25)

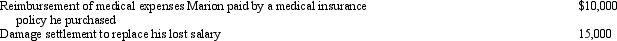

Early in the year,Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained,he received the following payments during the year:  What is the amount that Marion must include in gross income for the current year?

What is the amount that Marion must include in gross income for the current year?

(Multiple Choice)

4.8/5  (32)

(32)

Under the Federal income tax formula for individuals,a choice must be made between claiming deductions for AGI and itemized deductions.

(True/False)

4.9/5  (34)

(34)

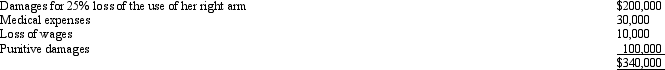

Barbara was injured in an automobile accident.She has threatened to file a suit against the other party involved in the accident and has proposed the following settlement:

The defendant's insurance company is reluctant to pay punitive damages.Also,the company disputes the amount of her loss of wages amount.Instead,the company offers to pay her $300,000 for damages to her arm and $30,000 medical expenses.Assuming Barbara is in the 35% marginal tax bracket,will her after-tax proceeds from accepting the offer be equal to what she considers to be her actual damages (listed above)?

The defendant's insurance company is reluctant to pay punitive damages.Also,the company disputes the amount of her loss of wages amount.Instead,the company offers to pay her $300,000 for damages to her arm and $30,000 medical expenses.Assuming Barbara is in the 35% marginal tax bracket,will her after-tax proceeds from accepting the offer be equal to what she considers to be her actual damages (listed above)?

(Essay)

4.8/5  (34)

(34)

Rick and Carol Ryan,married taxpayers,took out a mortgage of $160,000 when purchasing their home ten years ago.In October of the current year,when the home had a fair market value of $200,000 and they owed $125,000 on the mortgage,the Ryans took out a home equity loan for $110,000.They used the funds to purchase a sailboat to be used for recreational purposes.The sailboat does not qualify as a residence.What is the maximum amount of debt on which the Ryans can deduct home equity interest?

(Multiple Choice)

4.7/5  (39)

(39)

Showing 121 - 140 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)