Exam 16: Introduction to the Taxation of Individuals

Exam 1: Introduction to Taxation101 Questions

Exam 2: Working With the Tax Law72 Questions

Exam 3: Taxes on the Financial Statements85 Questions

Exam 4: Gross Income108 Questions

Exam 5: Business Deductions173 Questions

Exam 6: Losses and Loss Limitations121 Questions

Exam 7: Property Transactions: Basis, gain and Loss, and Nontaxable Exchange229 Questions

Exam 8: Property Transactions: Capital Gains and Losses, section 1231, and Recapture Provisions125 Questions

Exam 9: Corporations: Organization, capital Structure, and Operating Rules150 Questions

Exam 10: Corporations: Earnings Profits and Distributions106 Questions

Exam 11: Partnerships and Limited Liability Entities84 Questions

Exam 12: S Corporations146 Questions

Exam 13: Multijurisdictional Taxation129 Questions

Exam 14: Business Tax Credits and Corporate Alternative Minimum Tax106 Questions

Exam 15: Comparative Forms of Doing Business139 Questions

Exam 16: Introduction to the Taxation of Individuals180 Questions

Exam 17: Individuals As Employees and Proprietors168 Questions

Select questions type

Katrina,age 16,is claimed as a dependent by her parents.During 2013,she earned $5,600 as a checker at a grocery store.Her standard deduction is $5,950 ($5,600 earned income + $350).

(True/False)

4.8/5  (34)

(34)

For all of the current year,Randy (a calendar year taxpayer)allowed the Salvation Army to use a building he owns rent-free.The building normally rents for $24,000 a year.Randy will be allowed a charitable contribution deduction this year of $24,000.

(True/False)

4.8/5  (40)

(40)

Which of the following characteristics correctly describes the procedure for the phaseout of exemptions?

(Multiple Choice)

5.0/5  (37)

(37)

Ted earned $150,000 during the current year.He paid Alice,his former wife,$75,000 in alimony.Under these facts,the tax is paid by the person who benefits from the income rather than the person who earned the income.

(True/False)

4.9/5  (37)

(37)

When the kiddie tax applies,the child need not file an income tax return because the child's income will be reported on the parents' return.

(True/False)

4.7/5  (40)

(40)

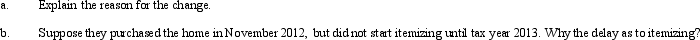

When filing their Federal income tax returns,the Youngs always claimed the standard deduction.After they purchased a home,however,they started to itemize their deductions from AGI.

(Essay)

4.8/5  (41)

(41)

Edna had an accident while competing in a rodeo.She sustained facial injuries that required cosmetic surgery.While having the surgery done to restore her appearance,she had additional surgery done to reshape her chin,which was not injured in the accident.The surgery to restore her appearance cost $9,000 and the surgery to reshape her chin cost $6,000.How much of Edna's surgical fees will qualify as a deductible medical expense (before application of the AGI limitation)?

(Multiple Choice)

4.8/5  (27)

(27)

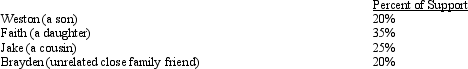

Millie,age 80,is supported during the current year as follows:  During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

(Multiple Choice)

5.0/5  (35)

(35)

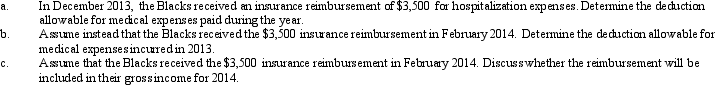

Paul and Patty Black (both are age 66)are married and together have AGI of $140,000 in 2013.They have two dependents and file a joint return.During the year,they paid $8,000 for medical insurance,$15,000 in doctor bills and hospital expenses,and $1,000 for prescribed medicine and drugs.

(Essay)

5.0/5  (37)

(37)

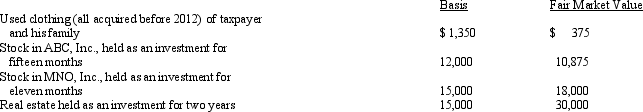

Zeke made the following donations to qualified charitable organizations during 2013:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2013 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2013 is:

(Multiple Choice)

4.8/5  (31)

(31)

In 2013,Theresa was in an automobile accident and suffered physical injuries.The accident was caused by Ramon's negligence.In 2014,Theresa collected from his insurance company.She received $15,000 for loss of income,$10,000 for pain and suffering,$50,000 for punitive damages,and $6,000 for medical expenses which she had deducted on her 2013 tax return (the amount in excess of 10% of adjusted gross income).As a result of the above,Theresa's 2014 gross income is increased by $56,000.

(True/False)

4.8/5  (32)

(32)

Child and dependent care expenses include amounts paid for general household services.

(True/False)

4.8/5  (32)

(32)

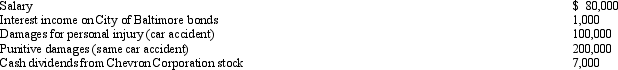

During 2013,Sarah had the following transactions:  Sarah's AGI is:

Sarah's AGI is:

(Multiple Choice)

4.9/5  (34)

(34)

The child tax credit is based on the number of the taxpayer's qualifying children under age 17.

(True/False)

4.8/5  (38)

(38)

Benjamin,age 16,is claimed as a dependent by his parents.During 2013,he earned $700 at a car wash.Benjamin's standard deduction is $1,350 ($1,000 + $350).

(True/False)

4.8/5  (34)

(34)

Sadie mailed a check for $2,200 to a qualified charitable organization on December 31,2013.The $2,200 contribution is deductible on Sadie's 2013 tax return.

(True/False)

4.8/5  (36)

(36)

Butch and Minerva are divorced in December of 2013.Since they were married for more than one-half of the year,they are considered asmarried for 2013.

(True/False)

4.8/5  (40)

(40)

The reduced deduction election enables a taxpayer to move from the 30%-of-AGI limitation to the 50%-of-AGI limitation.

(True/False)

4.7/5  (36)

(36)

Showing 101 - 120 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)