Exam 9: Long-Run Costs and Output Decisions

Exam 1: The Scope and Method of Economics241 Questions

Exam 2: The Economic Problem: Scarcity and Choice218 Questions

Exam 3: Demand, Supply, and Market Equilibrium309 Questions

Exam 4: Demand and Supply Applications173 Questions

Exam 5: Elasticity188 Questions

Exam 6: Household Behavior and Consumer Choice272 Questions

Exam 7: The Production Process: the Behavior of Profit-Maximizing Firms287 Questions

Exam 8: Short-Run Costs and Output Decisions386 Questions

Exam 9: Long-Run Costs and Output Decisions363 Questions

Exam 10: Input Demand: the Labor and Land Markets200 Questions

Exam 11: Input Demand: the Capital Market and the Investment Decision218 Questions

Exam 12: General Equilibrium and the Efficiency of Perfect Competition202 Questions

Exam 13: Monopoly and Antitrust Policy394 Questions

Exam 14: Oligopoly219 Questions

Exam 15: Monopolistic Competition235 Questions

Exam 16: Externalities, Public Goods, and Common Resources275 Questions

Exam 17: Uncertainty and Asymmetric Information134 Questions

Exam 18: Income Distribution and Poverty197 Questions

Exam 19: Public Finance: the Economics of Taxation281 Questions

Exam 20: International Trade, Comparative Advantage, and Protectionism287 Questions

Exam 21: Economic Growth in Developing Economies133 Questions

Exam 22: Critical Thinking About Research104 Questions

Select questions type

Industries in which firms ________ are likely to contract in the long-run.

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

B

Input prices rise as entry occurs in an constant-cost industry.

Free

(True/False)

4.9/5  (39)

(39)

Correct Answer:

False

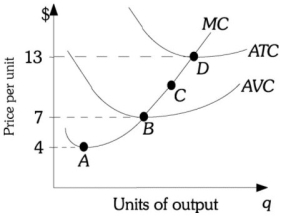

Refer to the information provided in Figure 9.3 below to answer the question(s) that follow.  Figure 9.3

-Refer to Figure 9.3. This firm's ________ point corresponds to point B.

Figure 9.3

-Refer to Figure 9.3. This firm's ________ point corresponds to point B.

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

B

The Reliable Auto Repair Shop is earning a total revenue of $7,000. Its total fixed costs are $700, and its total variable costs are $2,500. The Reliable Auto Repair Shopʹs profit is

(Multiple Choice)

4.9/5  (27)

(27)

Assume the tennis ball industry, a perfectly competitive, increasing‐cost industry, is in long-run equilibrium with a market price of $5. If the demand for tennis balls decreases, long-run equilibrium will be reestablished at a price

(Multiple Choice)

4.8/5  (39)

(39)

The shape of a firm's ________ -run average cost curve depends on how costs vary with ________.

(Multiple Choice)

4.9/5  (31)

(31)

Related to the Economics in Practice on page 197. Which of the following represents a situation in which a school is experiencing economies of scale?

(Multiple Choice)

4.9/5  (38)

(38)

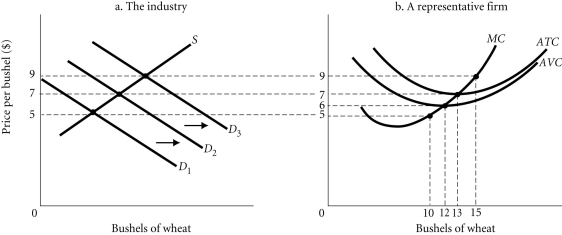

Refer to the information provided in Figure 9.2 below to answer the question(s) that follow.  Figure 9.2

-Refer to Figure 9.2. In which of the following price ranges will the firm continue to operate but at a loss?

Figure 9.2

-Refer to Figure 9.2. In which of the following price ranges will the firm continue to operate but at a loss?

(Multiple Choice)

4.8/5  (37)

(37)

Assume the market for orange juice is perfectly competitive. Orange juice producers currently earn a zero economic profit. Orange juice producers will likely begin to incur economic losses in the short run, and some producers will exit the industry until those remaining earn a zero economic profit, if consumers

(Multiple Choice)

4.7/5  (27)

(27)

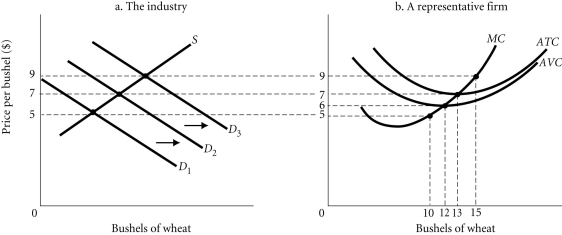

Refer to the information provided in Figure 9.2 below to answer the question(s) that follow.  Figure 9.2

-Refer to Figure 9.2. Suppose demand for wheat is initially D2. If consumer incomes decrease, then demand for wheat will shift to ________. This will ________ the equilibrium price of wheat and individual profit-maximizing firms will produce ________ bushels of wheat.

Figure 9.2

-Refer to Figure 9.2. Suppose demand for wheat is initially D2. If consumer incomes decrease, then demand for wheat will shift to ________. This will ________ the equilibrium price of wheat and individual profit-maximizing firms will produce ________ bushels of wheat.

(Multiple Choice)

4.8/5  (35)

(35)

Refer to Scenario 9.10 below to answer the question(s) that follow.

SCENARIO 9.10: Investors put up $1,040,000 to construct a building and purchase all equipment for a new cafe. The investors expect to earn a minimum return of 10 percent on their investment. The cafe is open 52 weeks per year and serves 900 meals per week. The fixed costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10% return to the investors and $2,000 in other fixed costs. Variable costs include $2,000 in weekly wages, and $600 per week in materials, electricity, etc. The cafe charges $6 on average per meal.

-Refer to Scenario 9.10. In the short run, if the cafe shuts down, its losses will equal its ________ costs of ________.

(Multiple Choice)

4.9/5  (32)

(32)

If revenues are greater than total variable costs of production but less than total costs, a firm

(Multiple Choice)

4.9/5  (38)

(38)

Refer to the data provided in Table 9.3 below to answer the following question(s).

Table 9.3

q TFC TVC TC MC AVC ATC 0 \ 100 \ 0 \ 100 -- -- -- 1 100 40 140 40 40 140 2 100 60 160 20 30 80 3 100 90 190 30 30 63.33 4 100 124 224 34 31 56 5 100 180 280 56 36 56 6 100 264 364 84 44 60.67 7 100 372 472 108 67.43

-Refer to Table 9.3. The shutdown point price for this firm is

(Multiple Choice)

4.8/5  (32)

(32)

Refer to Scenario 9.8 below to answer the question(s) that follow.

SCENARIO 9.8: Investors put up $1,040,000 to construct a building and purchase all equipment for a new gourmet cupcake bakery. The investors expect to earn a minimum return of 10 per cent on their investment. The bakery is open 52 weeks per year and sells 900 cupcakes per week. The fixed costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10% return to the investors and $2,000 in other fixed costs. Variable costs include $2,000 in weekly wages, and $600 per week in materials, electricity, etc. The bakery charges $8 on average per cupcake.

-Refer to Scenario 9.8. Total cost per week is

(Multiple Choice)

4.7/5  (34)

(34)

Assume the peanut industry, a perfectly competitive industry, is in long-run equilibrium with a market price of $5. If demand for peanuts increases and this industry is a decreasing-cost industry, long-run equilibrium will be reestablished at a price

(Multiple Choice)

4.8/5  (31)

(31)

A firm that is earning a positive profit in the short run and expects to continue doing so has an incentive to expand its scale of operation in the long run.

(True/False)

4.8/5  (37)

(37)

The Taste Freeze Ice Cream Company is a perfectly competitive firm producing where MR = MC. The current market price of an ice cream sandwich is $5.00. Taste Freeze sells 200 ice cream sandwiches. Its AVC is $8.00 and its AFC is $3.00. What should Taste Freeze do?

(Multiple Choice)

4.7/5  (33)

(33)

Showing 1 - 20 of 363

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)