Exam 4: Supply and Demand: Applications and Extensions

Exam 1: The Economic Approach164 Questions

Exam 2: Some Tools of the Economist200 Questions

Exam 3: Demand, Supply, and the Market Process336 Questions

Exam 4: Supply and Demand: Applications and Extensions254 Questions

Exam 5: Difficult Cases for the Market, and the Role of Government130 Questions

Exam 6: The Economics of Political Action154 Questions

Exam 7: Taking the Nations Economic Pulse214 Questions

Exam 8: Economic Fluctuations, Unemployment, and Inflation174 Questions

Exam 9: An Introduction to Basic Macroeconomic Markets219 Questions

Exam 10: Dynamic Change, Economic Fluctuations, and the Ad-As Model189 Questions

Exam 11: Fiscal Policy: the Keynesian View and the Historical Development of Macroeconomics109 Questions

Exam 12: Fiscal Policy, Incentives, and Secondary Effects146 Questions

Exam 13: Money and the Banking System209 Questions

Exam 14: Modern Macroeconomics and Monetary Policy192 Questions

Exam 15: Stabilization Policy, Output, and Employment148 Questions

Exam 16: Creating an Environment for Growth and Prosperity120 Questions

Exam 17: Institutions, Policies, and Cross-Country Differences in Income and Growth111 Questions

Exam 18: Gaining From International Trade170 Questions

Exam 19: International Finance and the Foreign Exchange Market148 Questions

Select questions type

Data from the effects of the substantial tax rate reductions in the 1980s

(Multiple Choice)

4.9/5  (32)

(32)

How would a decrease in lumber prices influence the home construction market?

(Multiple Choice)

4.7/5  (29)

(29)

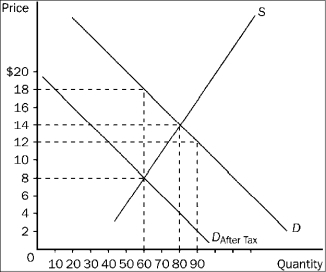

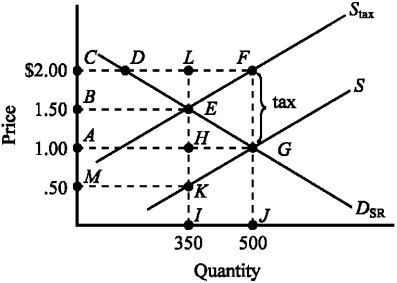

Figure 4-21  -Refer to Figure 4-21. The per-unit burden of the tax is

-Refer to Figure 4-21. The per-unit burden of the tax is

(Multiple Choice)

4.8/5  (39)

(39)

If an increase in the government-imposed minimum wage pushes the price (wage) of unskilled labor above market equilibrium, which of the following will most likely occur in the unskilled labor market?

(Multiple Choice)

4.7/5  (35)

(35)

Which tax rate measures the percent of your income paid in taxes?

(Multiple Choice)

4.9/5  (30)

(30)

When a government subsidy is granted to the buyers of a product, sellers can end up capturing some of the benefit because

(Multiple Choice)

4.8/5  (35)

(35)

Use the figure below to answer the following question(s).

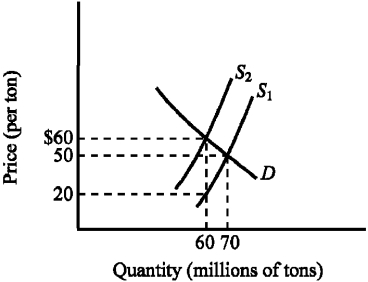

Figure 4-8  -Refer to Figure 4-8. How much revenue does the $40-per-ton tax generate for the government?

-Refer to Figure 4-8. How much revenue does the $40-per-ton tax generate for the government?

(Multiple Choice)

4.7/5  (36)

(36)

Suppose the U.S. Government banned the sale and production of cigarettes. What are likely effects of this action on the market for cigarettes?

(Essay)

4.7/5  (40)

(40)

In 2010 the federal government reduced the Social Security tax withholding rate from 12.4 percent (6.2 percent on both the employer and employee) to 8.4 percent (4.2 percent on both the employer and employee) on the wages of all workers. If the supply of labor is relatively inelastic when compared to the elasticity of the demand for labor, the burden of this tax will

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following statements regarding black markets is true?

(Multiple Choice)

4.9/5  (27)

(27)

The state of Florida is considering putting an excise tax on either good X or good Y. An economist discovers the supply of good X is more elastic than the supply of good Y, while the demand elasticities are identical. Which good should Florida tax in order to minimize the deadweight loss of the tax?

(Essay)

4.8/5  (33)

(33)

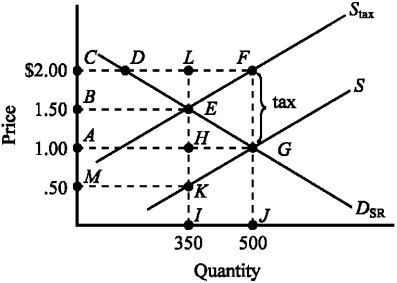

Figure 4-18  -Refer to Figure 4-18. The price of the good would continue to serve as the rationing mechanism if

-Refer to Figure 4-18. The price of the good would continue to serve as the rationing mechanism if

(Multiple Choice)

4.8/5  (32)

(32)

In a market economy, which of the following would most likely cause a prolonged grain surplus?

(Multiple Choice)

4.9/5  (25)

(25)

Use the figure below illustrating the impact of an excise tax to answer the following question(s).

Figure 4-6  -The deadweight loss of the tax illustrated in Figure 4-6 is given by the area

-The deadweight loss of the tax illustrated in Figure 4-6 is given by the area

(Multiple Choice)

4.8/5  (36)

(36)

If a household has $40,000 in taxable income and its tax liability is $4,000, the household's average tax rate is

(Multiple Choice)

4.8/5  (30)

(30)

Approximately 50,000 luxury boats (priced $100,000 or more) are currently produced each year. Using the economic way of thinking, how much revenue would the government actually generate with a $10,000 excise tax on luxury boats?

(Multiple Choice)

4.9/5  (25)

(25)

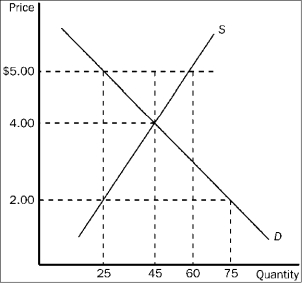

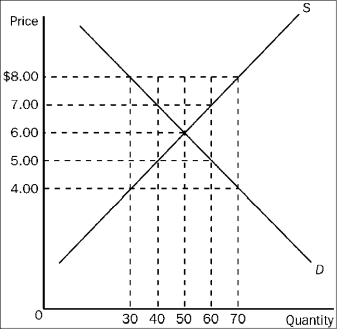

Figure 4-17  -Refer to Figure 4-17. If the government imposes a price ceiling in this market at a price of $5.00, the result would be a

-Refer to Figure 4-17. If the government imposes a price ceiling in this market at a price of $5.00, the result would be a

(Multiple Choice)

4.9/5  (30)

(30)

Use the figure below illustrating the impact of an excise tax to answer the following question(s).

Figure 4-6  -The revenue generated by the tax illustrated in Figure 4-6 is given by the area

-The revenue generated by the tax illustrated in Figure 4-6 is given by the area

(Multiple Choice)

4.9/5  (40)

(40)

Suppose the U.S. government banned the sale and production of cigarettes. Which of the following would be most likely to occur?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 21 - 40 of 254

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)