Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes

Exam 19: Accounting for Estates and Trusts85 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations74 Questions

Exam 17: Accounting for State and Local Governments, Part II51 Questions

Exam 16: Accounting for State and Local Governments, Part I87 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 14: Partnerships: Formation and Operation91 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations88 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission79 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards65 Questions

Exam 10: Translation of Foreign Currency Financial Statements101 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk108 Questions

Exam 8: Segment and Interim Reporting120 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues119 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions126 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership128 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition123 Questions

Exam 2: Consolidation of Financial Information124 Questions

Exam 1: The Equity Method of Accounting for Investments123 Questions

Select questions type

Alpha Corporation owns 100% of Beta Company, and Beta owns 80% of Gamma, Inc., all of which are domestic corporations. There were no excess allocation values at the date of acquisition of the subsidiaries. Information for the three companies for the year ending December 31, 2021 follows:  What is Gamma's accrual-based net income for 2021?

What is Gamma's accrual-based net income for 2021?

(Multiple Choice)

4.7/5  (46)

(46)

For each of the following situations, select the best answer concerning accounting for income taxes in combinations:(A) May file a consolidated income tax return.(B) May not a file consolidated income tax return.(C) Must file a consolidated income tax return.Parent company owns 85% of the voting stock of the subsidiary, and there are significant intra-entity transfers.Subsidiary is a foreign corporation.Parent company owns 90% of the voting stock of the subsidiary, but there are no intra-entity transfers of inventory.Parent company owns 75% of the voting stock of the subsidiary but there are no intra-entity transfers of inventory.Parent company owns 90% of the voting stock of the subsidiary, and there are intra-entity transfers of inventory.Parent company owns 75% of the voting stock of the subsidiary and there are intra-entity transfers of inventory.

(Short Answer)

4.8/5  (49)

(49)

Florrick Co. owns 85% of Bishop Inc. The two companies file a consolidated income tax return and Florrick uses the initial value method to account for the investment. The following information is available from the two companies' financial statements:  The income tax rate was 40%.What is the amount of taxable income reported on the consolidated income tax return?

The income tax rate was 40%.What is the amount of taxable income reported on the consolidated income tax return?

(Multiple Choice)

4.9/5  (40)

(40)

Chase Company owns 80% of Lawrence Company and 40% of Ross Company. Lawrence Company also owns 30% of Ross Company. Separate company net incomes for 2021 of Chase, Lawrence, and Ross are $450,000, $300,000, and $250,000, respectively. Each company also defers a $20,000 intra-entity gain in its current income figures. Excess annual amortization expense of $15,000 is assigned to Chase's investment in Lawrence and another $15,000 is assigned to Lawrence's investment in Ross.Compute Chase's accrual-based net income for 2021.

(Multiple Choice)

4.8/5  (38)

(38)

Gardner Corp. owns 80% of the voting common stock of Lockhart Co. Lockhart owns 70% of Canning Co. Gardner and Lockhart both use the initial value method to account for their investments. The following information is available from the financial statements and records of the three companies:  Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.What amount of dividends should Gardner Corp. recognize in its consolidated net income with respect to dividends received from Canning Co.?

Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.What amount of dividends should Gardner Corp. recognize in its consolidated net income with respect to dividends received from Canning Co.?

(Multiple Choice)

4.9/5  (37)

(37)

What ownership pattern is referred to as mutual ownership? Describe briefly or illustrate with a diagram.

(Essay)

4.9/5  (40)

(40)

Alpha Corporation owns 100% of Beta Company, and Beta owns 80% of Gamma, Inc., all of which are domestic corporations. There were no excess allocation values at the date of acquisition of the subsidiaries. Information for the three companies for the year ending December 31, 2021 follows:  What is the total net income attributable to the noncontrolling interests for 2021?

What is the total net income attributable to the noncontrolling interests for 2021?

(Multiple Choice)

4.8/5  (36)

(36)

On January 1, 2020, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2021, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies. The following information is available regarding Jones and Whitton:

Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies. The following information is available regarding Jones and Whitton:  Compute the amount allocated to trademarks recognized in the January 1, 2021 consolidated balance sheet.

Compute the amount allocated to trademarks recognized in the January 1, 2021 consolidated balance sheet.

(Multiple Choice)

4.9/5  (38)

(38)

Alpha Corporation owns 100% of Beta Company, and Beta owns 80% of Gamma, Inc., all of which are domestic corporations. There were no excess allocation values at the date of acquisition of the subsidiaries. Information for the three companies for the year ending December 31, 2021 follows:  Which of the following statements is true?

Which of the following statements is true?

(Multiple Choice)

4.9/5  (39)

(39)

For each of the following situations, select the best answer concerning accounting for income taxes in combinations:(A) May file a consolidated income tax return.(B) May not a file consolidated income tax return.(C) Must file a consolidated income tax return.Parent company owns 85% of the voting stock of the subsidiary, and there are significant intra-entity transfers.Subsidiary is a foreign corporation.Parent company owns 90% of the voting stock of the subsidiary, but there are no intra-entity transfers of inventory.Parent company owns 75% of the voting stock of the subsidiary but there are no intra-entity transfers of inventory.Parent company owns 90% of the voting stock of the subsidiary, and there are intra-entity transfers of inventory.Parent company owns 75% of the voting stock of the subsidiary and there are intra-entity transfers of inventory.

(Short Answer)

4.8/5  (35)

(35)

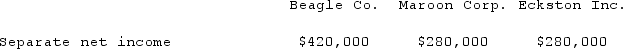

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Separate company net incomes for 2021 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 gross profit on intra-entity transfers to Maroon.  The accrual-based net income of Maroon Corp. is calculated to be

The accrual-based net income of Maroon Corp. is calculated to be

(Multiple Choice)

4.8/5  (44)

(44)

How is the amortization of goodwill treated for income tax purposes? How does the amortization of goodwill affect deferred income taxes?

(Essay)

4.7/5  (31)

(31)

Kurton Inc. owned 90% of Luvyn Corp.'s voting common stock. The consideration paid exceeded book value by $110,000. Of this amount, one half is attributable to a patent and is to be amortized over 5 years. Luvyn held 20% of Kurton's voting common stock, which cost $28,000 more than fair value. During the current year, Kurton reported separate net income of $224,000 as well as dividend income from Luvyn of $37,800. At the same time, Luvyn reported its separate net income of $70,000 as well as dividend income from Kurton of $19,600.Required:Prepare a schedule to show consolidated net income.

(Essay)

4.8/5  (35)

(35)

On January 1, 2021, Youder Inc. bought 120,000 shares of Nopple Co. for $384,000, giving Youder 30% ownership and the ability to apply significant influence to the operating and financing decisions of Nopple. Youder anticipated holding this investment for an indefinite time. In making this acquisition, Youder paid an amount equal to the book value for these shares. The fair value of each asset and liability was the same as its book value. Dividends and income for Nopple for 2021 were as follows:Dividends declared and paid: $ 0.40 per shareIncome before income tax provision: $400,000Required:Assume a 40% income tax rate. Prepare all necessary journal entries for Youder for 2021 beginning at acquisition and ending at tax accrual.

(Essay)

4.8/5  (31)

(31)

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Separate company net incomes for 2021 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 gross profit on intra-entity transfers to Maroon.  The accrual-based net income of Eckston Inc. is calculated to be

The accrual-based net income of Eckston Inc. is calculated to be

(Multiple Choice)

4.8/5  (33)

(33)

In a father-son-grandson combination, which of the following statements is true?

(Multiple Choice)

4.9/5  (37)

(37)

What are the essential criteria for including a subsidiary within an affiliated group?

(Essay)

4.8/5  (32)

(32)

What ownership structure is referred to as a connecting affiliation? Describe briefly or illustrate with a diagram.

(Essay)

4.7/5  (42)

(42)

For each of the following situations, select the best answer concerning accounting for income taxes in combinations:(A) May file a consolidated income tax return.(B) May not a file consolidated income tax return.(C) Must file a consolidated income tax return.Parent company owns 85% of the voting stock of the subsidiary, and there are significant intra-entity transfers.Subsidiary is a foreign corporation.Parent company owns 90% of the voting stock of the subsidiary, but there are no intra-entity transfers of inventory.Parent company owns 75% of the voting stock of the subsidiary but there are no intra-entity transfers of inventory.Parent company owns 90% of the voting stock of the subsidiary, and there are intra-entity transfers of inventory.Parent company owns 75% of the voting stock of the subsidiary and there are intra-entity transfers of inventory.

(Short Answer)

4.8/5  (31)

(31)

Showing 21 - 40 of 127

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)