Exam 7: Intercompany Transfers of Services and Noncurrent Assets

Exam 7: Intercompany Transfers of Services and Noncurrent Assets47 Questions

Exam 8: Intercompany Indebtedness39 Questions

Exam 8: Appendix a Intercompany Indebtedness40 Questions

Exam 9: Consolidation Ownership Issues51 Questions

Exam 10: Additional Consolidation Reporting Issues44 Questions

Exam 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments62 Questions

Exam 12: Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity Statements65 Questions

Exam 13: Segment and Interim Reporting61 Questions

Exam 14: Sec Reporting49 Questions

Exam 15: Partnerships: Formation, Operation, and Changes in Membership55 Questions

Exam 16: Partnerships: Liquidation59 Questions

Exam 17: Governmental Entities: Introduction and General Fund Accounting79 Questions

Exam 18: Governmental Entities: Special Funds and Governmentwide Financial Statements79 Questions

Exam 19: Not-For-Profit Entities121 Questions

Exam 20: Corporations in Financial Difficulty41 Questions

Select questions type

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On December 31, 20X8, Mortar received $390,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipments on a straight-line basis.

Based on the preceding information, in the preparation of the 20X9 consolidated financial statements, equipment will be:

(Multiple Choice)

4.7/5  (44)

(44)

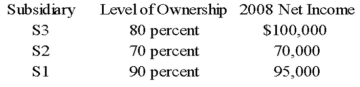

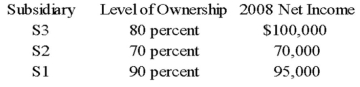

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26, 20X8. This purchase followed a series of transactions between P-controlled subsidiaries. On February 15, 20X8, S3 Corporation purchased the land from a nonaffiliate for $160,000. It sold the land to S2 Company for $145,000 on October 19, 20X8, and S2 sold the land to S1 for $197,000 on November 27, 20X8. Parent has control of the following companies:  Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information, at what amount should the land be reported in the consolidated balance sheet as of December 31, 20X8?

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information, at what amount should the land be reported in the consolidated balance sheet as of December 31, 20X8?

(Multiple Choice)

4.9/5  (36)

(36)

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26, 20X8. This purchase followed a series of transactions between P-controlled subsidiaries. On February 15, 20X8, S3 Corporation purchased the land from a nonaffiliate for $160,000. It sold the land to S2 Company for $145,000 on October 19, 20X8, and S2 sold the land to S1 for $197,000 on November 27, 20X8. Parent has control of the following companies:  Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information, what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8?

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information, what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8?

(Multiple Choice)

4.9/5  (35)

(35)

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On December 31, 20X8, Mortar received $390,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipments on a straight-line basis.

Based on the preceding information, in the preparation of the 20X8 consolidated financial statements, equipment will be:

(Multiple Choice)

4.9/5  (34)

(34)

Any intercompany gain or loss on a downstream sale of land should be recognized in consolidated net income:

I. in the year of the downstream sale.

II. over the period of time the subsidiary uses the land.

III. in the year the subsidiary sells the land to an unrelated party.

(Multiple Choice)

4.8/5  (35)

(35)

Blue Corporation holds 70 percent of Black Company's voting common stock. On January 1, 20X3, Black paid $500,000 to acquire a building with a 10-year expected economic life. Black uses straight-line depreciation for all depreciable assets. On December 31, 20X8, Blue purchased the building from Black for $180,000. Blue reported income, excluding investment income from Black, of $140,000 and $162,000 for 20X8 and 20X9, respectively. Black reported net income of $30,000 and $45,000 for 20X8 and 20X9, respectively.

Based on the preceding information, the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8 will be:

(Multiple Choice)

4.8/5  (42)

(42)

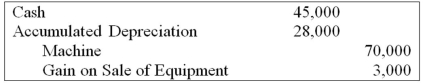

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:  Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information, consolidated net income for 20X9 will be:

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information, consolidated net income for 20X9 will be:

(Multiple Choice)

4.8/5  (39)

(39)

Showing 41 - 47 of 47

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)