Exam 20: Forming and Operating Partnerships

Exam 1: An Introduction to Tax113 Questions

Exam 2: Tax Compliance,the Irs,and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview,dependents,and Filing Status125 Questions

Exam 5: Gross Income and Exclusions130 Questions

Exam 6: Individual Deductions98 Questions

Exam 7: Investments74 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income,deductions,and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery103 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation99 Questions

Exam 13: Retirement Savings and Deferred Compensation111 Questions

Exam 14: Tax Consequences of Home Ownership108 Questions

Exam 15: Entities Overview80 Questions

Exam 16: Corporate Operations106 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation,reorganization,and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships106 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Ustaxation of Multinational Transactions89 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

The least aggregate deferral test uses the profit percentage of each partner to determine the minimum amount of tax deferral for the partner group as a whole in determining the permissible tax year-end of a partnership.

(True/False)

4.9/5  (36)

(36)

Under general circumstances,debt is allocated from the partnership to each partner in the following manner:

(Multiple Choice)

4.9/5  (37)

(37)

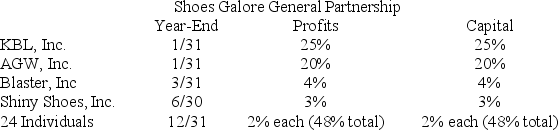

KBL,Inc.,AGW,Inc.,Blaster,Inc.,Shiny Shoes,Inc.,and a group of 24 individuals form Shoes Galore General Partnership on October 11,20X9.Now,Shoes Galore must adopt its required tax year-end.The partners' year-ends,profits interests,and capital interests are reflected in the table below.Given this information,what tax year-end must Shoes Galore use,and what rule requires this year-end?

(Essay)

4.8/5  (33)

(33)

What is the rationale for the specific rules partnerships must follow in determining a partnership's taxable year-end?

(Multiple Choice)

4.9/5  (39)

(39)

Gerald received a one-third capital and profit (loss)interest in XYZ Limited Partnership (LP).In exchange for this interest,Gerald contributed a building with an FMV of $30,000.His adjusted basis in the building was $15,000.In addition,the building was encumbered with a $9,000 nonrecourse mortgage that XYZ LP assumed at the time the property was contributed.What is Gerald's outside basis immediately after his contribution?

(Multiple Choice)

4.8/5  (33)

(33)

Partners must generally treat the value of profits interests they receive in exchange for services as ordinary income.

(True/False)

4.9/5  (44)

(44)

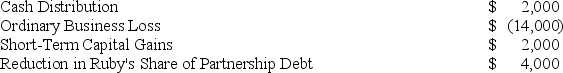

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000.The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

(Essay)

4.8/5  (38)

(38)

Jerry,a partner with 30 percent capital and profits interest,received his Schedule K-1 from Plush Pillows,LP.At the beginning of the year,Jerry's tax basis in his partnership interest was $50,000.His current-year Schedule K-1 reported an ordinary loss of $15,000,long-term capital gain of $3,000,qualified dividends of $2,000,$500 of non-deductible expenses,a $10,000 cash contribution,and a reduction of $4,000 in his share of partnership debt.What is Jerry's adjusted basis in his partnership interest at the end of the year?

(Multiple Choice)

4.7/5  (36)

(36)

In what order should the tests to determine a partnership's year-end be applied?

(Multiple Choice)

4.8/5  (30)

(30)

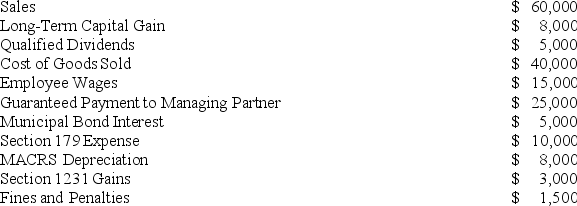

Illuminating Light Partnership had the following revenues,expenses,gains,losses,and distributions:

Given these items,what is Illuminating Light's ordinary business income (loss)for the year?

Given these items,what is Illuminating Light's ordinary business income (loss)for the year?

(Essay)

4.8/5  (38)

(38)

Income earned by flow-through entities is usually taxed only once at the entity level.

(True/False)

4.8/5  (32)

(32)

Which of the following entities is not considered a flow-through entity?

(Multiple Choice)

4.8/5  (39)

(39)

Peter,Matt,Priscilla,and Mary began the year in the PMPM General Partnership sharing profits,losses,and capital equally.They had a tax basis at the beginning of the year of $3,000,$10,000,$8,000,and $11,000,respectively.Early in the year,Mary provided general consulting services to the partnership and received an additional 15 percent profits,losses,and capital interest in the partnership.The liquidation value of her additional interest was $45,000.Later the same year,the partnership received cash contributions of $25,000 from Peter and Matt that it used to repay the partnership's $35,000 recourse debt.According to state law,the partners shared responsibility for this debt in accordance with their loss-sharing ratios.What is each partner's tax basis after adjustment for these transactions?

(Essay)

4.8/5  (34)

(34)

John,a limited partner of Candy Apple,LP,is allocated $30,000 of ordinary business loss from the partnership.Before the loss allocation,his tax basis is $20,000 and his at-risk amount is $10,000.John also has ordinary business income of $20,000 from Sweet Pea,LP,as a general partner and ordinary business income of $5,000 from Red Tomato as a limited partner.How much of the $30,000 loss from Candy Apple can John deduct currently?

(Multiple Choice)

4.8/5  (31)

(31)

An additional allocation of partnership debt or relief of partnership debt is considered to be a deemed cash contribution or cash distribution,respectively.

(True/False)

5.0/5  (39)

(39)

Erica and Brett decide to form their new motorcycle business as an LLC.Each will receive an equal profits (loss)interest by contributing cash,property,or both.In addition to the members' contributions,their LLC will obtain a $50,000 nonrecourse loan from First Bank at the time it is formed.Brett contributes cash of $5,000 and a building he bought as a storefront for the motorcycles.The building has an FMV of $45,000 and an adjusted basis of $30,000 and is secured by a $35,000 nonrecourse mortgage that the LLC will assume.What is Brett's outside tax basis in his LLC interest?

(Multiple Choice)

5.0/5  (26)

(26)

TQK,LLC,provides consulting services and was formed on 1/31/X5.Aaron and ABC,Inc.,each hold a 50 percent capital and profits interest in TQK.If TQK averaged $27,000,000 in annual gross receipts over the last three years,what accounting method can TQK use for X9?

(Multiple Choice)

4.7/5  (41)

(41)

XYZ,LLC,has several individual and corporate members.Abe and Joe,individuals with 4/30 year-ends,each have a 23 percent profits and capital interest.RST,Inc.,a corporation with a 6/30 year-end,owns a 4 percent profits and capital interest,while DEF,Inc.,a corporation with an 8/30 year-end,owns a 4.9 percent profits and capital interest.Finally,30 other calendar year-end individual partners (each with less than a 2 percent profits and capital interest)own the remaining 45 percent of the profits and capital interests in XYZ.What tax year-end should XYZ use,and which test or rule requires this year-end?

(Multiple Choice)

4.8/5  (40)

(40)

Which requirement must be satisfied in order to specially allocate partnership income or losses to partners?

(Multiple Choice)

4.8/5  (34)

(34)

A partnership with a C corporation partner must always use the accrual method as its accounting method.

(True/False)

4.8/5  (32)

(32)

Showing 41 - 60 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)