Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

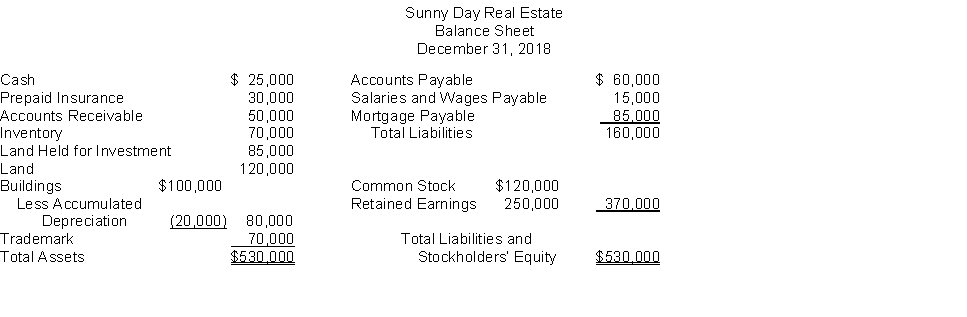

The following information is for Sunny Day Real Estate:  The total dollar amount of liabilities to be classified as current liabilities is

The total dollar amount of liabilities to be classified as current liabilities is

(Multiple Choice)

4.8/5  (35)

(35)

Identify which of the following accounts would have balances on a post-closing trial balance.

(1) Service Revenue

(2) Income Summary

(3) Notes Payable

(4) Interest Expense

(5) Cash

(Short Answer)

4.7/5  (39)

(39)

Which of the following is a true statement about closing the books of a corporation?

(Multiple Choice)

4.8/5  (38)

(38)

The following items are taken from the financial statements of the Postal Service for the year ending December 31, 2018: Accounts payable 18,000 Accounts receivable 11,000 Accumulated depreciation - equipment 28,000 Advertising expense 21,000 Cash 15,000 Common stock 42,000 Dividends 14,000 Depreciation expense 12,000 Insurance expense 3,000 Note payable, due 6/30/19 70,000 Prepaid insurance (12-month policy) 6,000 Rent expense 17,000 Retained earnings (1/1/18) 60,000 Salaries and wages expense 32,000 Service revenue 13,000 Supplies 4,000 Supplies expense 6,000 Equipment 210,000 The current assets should be listed on Postal Service's balance sheet in the following order:

(Multiple Choice)

4.8/5  (38)

(38)

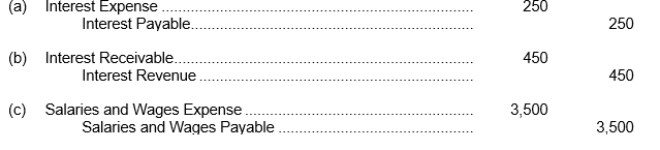

Inigo Company prepared the following adjusting entries at year end on December 31, 2018:  In an effort to minimize errors in recording transactions, Inigo Company utilizes reversing entries. Prepare reversing entries on January 1, 2019.

In an effort to minimize errors in recording transactions, Inigo Company utilizes reversing entries. Prepare reversing entries on January 1, 2019.

(Essay)

4.8/5  (36)

(36)

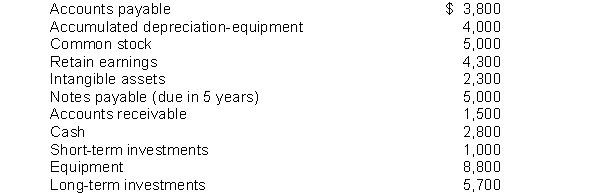

The following information is available for Elwes Company for the year ended December 31, 2018:  Instructions

Use the above information to prepare a classified balance sheet for the year ended December 31, 2018.

Instructions

Use the above information to prepare a classified balance sheet for the year ended December 31, 2018.

(Essay)

4.9/5  (34)

(34)

The ______________ of a company is the average time that it takes to purchase inventory, sell it on account, and then collect cash from customers.

(Short Answer)

4.9/5  (46)

(46)

The information for preparing a trial balance on a worksheet is obtained from

(Multiple Choice)

4.7/5  (34)

(34)

All of the following are property, plant, and equipment except

(Multiple Choice)

4.8/5  (33)

(33)

The amounts appearing on an income statement should agree with the amounts appearing on the post-closing trial balance.

(True/False)

4.7/5  (41)

(41)

What is the order in which assets are generally listed on a classified balance sheet?

(Multiple Choice)

4.7/5  (36)

(36)

The income statement for the month of June, 2018 of Camera Obscura Enterprises contains the following information: Revenues \7 ,000 Expenses: Salaries and Wages Expense \ 3,000 Rent Expense 1,500 Advertising Expense 800 Supplies Expense 300 Insurance Expense 100 Total expenses 5,700 Net income \1 ,300 The entry to close the revenue account includes a

(Multiple Choice)

4.8/5  (46)

(46)

At April 1, 2018, Spiderland Company reported a balance of $20,000 in the Retained Earnings account. Spiderland Company earned revenues of $50,000 and incurred expenses of $32,000 during April 2018. The company paid dividends of $10,000 during the month.

(a) Prepare the entries to close Income Summary and the Dividends acccount at April 30, 2018.

(b) What is the balance in Retained Earnings on the April 30, 2018 post-closing trial balance?

(Essay)

5.0/5  (36)

(36)

The following items are taken from the financial statements of the Postal Service for the year ending December 31, 2018: Accounts payable 18,000 Accounts receivable 11,000 Accumulated depreciation - equipment 28,000 Advertising expense 21,000 Cash 15,000 Common stock 42,000 Dividends 14,000 Depreciation expense 12,000 Insurance expense 3,000 Note pavable, due 6/30/19 70,000 Prepaid insurance (12-month policy) 6,000 Rent expense 17,000 Retained earnings (1/1/18) 60,000 Salaries and wages expense 32,000 Service revenue 133,000 Supplies 4,000 Supplies expense 6,000 Equipment 210,000 What is the company's net income for the year ending December 31, 2018?

(Multiple Choice)

4.9/5  (41)

(41)

Showing 21 - 40 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)