Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

A worksheet is an optional working tool used by accountants to facilitate the preparation of financial statements. Consider the steps followed in preparing a worksheet. How does the use of a worksheet assist the accountant. Could financial statements be prepared without a worksheet? Evaluate how the process would differ. Consider factors such as timeliness, accuracy, and efficiency in your evaluation.

(Essay)

4.7/5  (32)

(32)

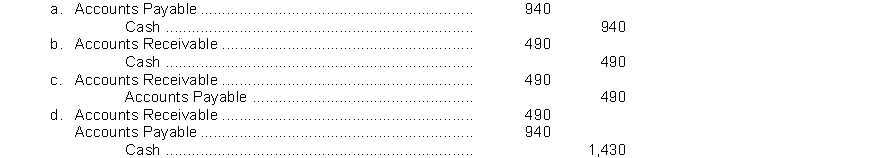

Jawbreaker Company paid $940 on account to a creditor. The transaction was erroneously recorded as a debit to Cash of $490 and a credit to Accounts Receivable, $490. The correcting entry is

(Short Answer)

4.9/5  (41)

(41)

The following items are taken from the financial statements of the Postal Service for the year ending December 31, 2018: Accounts payable 18,000 Accounts receivable 11,000 Accumulated depreciation - equipment 28,000 Advertising expense 21,000 Cash 15,000 Common stock 42,000 Dividends 14,000 Depreciation expense 12,000 Equipment 210,000 Insurance expense 3,000 Note payable, due 6/30/19 70,000 Prepaid insurance (12-month policy) 6,000 Rent expense 17,000 Retained earnings (1/1/18) 60,000 Salaries and wages expense 32,000 Service revenue 133,000 Supplies 4,000 Supplies expense 6,000 What is the book value of the equipment at December 31, 2018?

(Multiple Choice)

4.8/5  (42)

(42)

On a classified balance sheet, current assets are customarily listed

(Multiple Choice)

4.8/5  (46)

(46)

Which of the following depicts the proper sequence of steps in the accounting cycle?

(Multiple Choice)

4.8/5  (44)

(44)

Prepare the necessary correcting entry for each of the following.

a. A collection on account of $350 from a customer was credited to Accounts Receivable $530 and debited to Cash $530.

b. The purchase of supplies on account for $310 was recorded as a debit to Equipment $310 and a credit to Accounts Payable $310.

,

(Essay)

5.0/5  (38)

(38)

Sebastien Company earned net income of $44,000 during 2018. The company paid dividends totalling $20,000 during the period. Prepare the entries to close Income Summary and the Dividends account.

(Essay)

4.8/5  (39)

(39)

The income statement for the month of June, 2018 of Camera Obscura Enterprises contains the following information: Revenues \7 ,000 Expenses: Salaries and Wages Expense \ 3,000 Rent Expense 1,500 Advertising Expense 800 Supplies Expense 300 Insurance Expense 100 Total expenses 5,700 Net income \1 ,300 The entry to close the expense accounts includes a

(Multiple Choice)

4.8/5  (37)

(37)

Both correcting entries and adjusting entries always affect at least one balance sheet account and one income statement account.

(True/False)

4.9/5  (38)

(38)

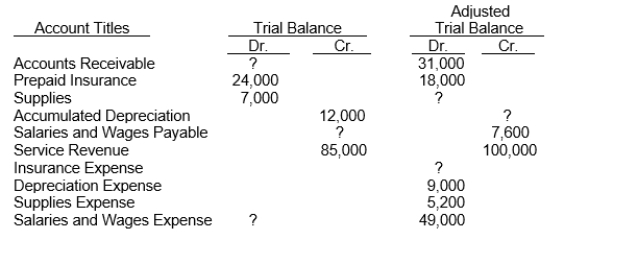

Selected worksheet data for Patinkin Company are presented below.  Instructions

(a) Fill in the missing amounts.

(b) Prepare the adjusting entries that were made.

Instructions

(a) Fill in the missing amounts.

(b) Prepare the adjusting entries that were made.

(Essay)

4.9/5  (43)

(43)

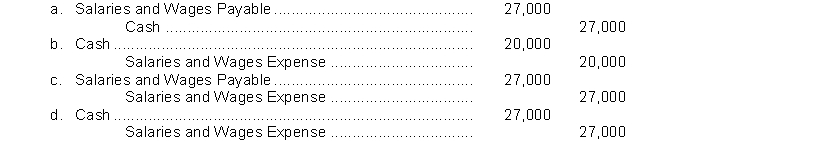

Zen Arcade paid the weekly payroll on January 2 by debiting Salaries and Wages Expense for $47,000. The accountant preparing the payroll entry overlooked the fact that Salaries and Wages Expense of $27,000 had been accrued at year end on December 31. The correcting entry is

(Short Answer)

4.9/5  (35)

(35)

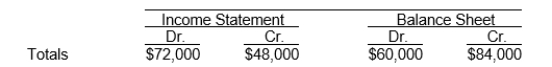

The income statement and balance sheet columns of Iron and Wine Company's worksheet reflect the following totals:  To enter the net income (or loss) for the period into the above worksheet requires an entry to the

To enter the net income (or loss) for the period into the above worksheet requires an entry to the

(Multiple Choice)

4.8/5  (44)

(44)

Remington Company discovered the following errors made in January 2015

1. A payment of salaries and wages of $1,000 was debited to Equipment and credited to Cash, both for $1,000. Remington recorded $200 of depreciation on this "equipment".

2. A collection of $3,000 from a client on account was debited to Cash $300 and credited to Service Revenue $300.

3. The purchase of supplies on account for $840 was debited to Supplies $480 and credited to Accounts Payable $480.

4. The purchase of short-term investments for $1,500 cash was debited to Prepaid Rent and credited to Cash. At year end, $500 of the "prepaid rent" was recorded as rent expense.

Instructions

(a) Correct the errors by reversing the incorrect entry and preparing the correct entry.

(b) Correct the errors without reversing the incorrect entry.

(Essay)

4.7/5  (36)

(36)

As Mel Smith was doing his year-end accounting, he noticed that the bookkeeper had made errors in recording several transactions. The erroneous transactions are as follows:

(a) A check for $700 was issued for goods previously purchased on account. The bookkeeper debited Accounts Receivable and credited Cash for $700.

(b) A check for $180 was received as payment on account. The bookkeeper debited Accounts Payable for $810 and credited Accounts Receivable for $810.

(c) When making the entry to record the year's depreciation expense, the bookkeeper debited Accumulated Depreciation-Equipment for $1,000 and credited Cash for $1,000.

(d) When accruing interest on a note payable, the bookkeeper debited Interest Receivable for $200 and credited Interest Payable for $200.

Instructions

Prepare the appropriate correcting entries. (Do not reverse the original entries.)

(Essay)

5.0/5  (43)

(43)

Two permanent accounts that are part of the stockholders' equity in a corporation are ______________ and ______________.

(Short Answer)

4.9/5  (41)

(41)

The income statement for the month of June, 2018 of Camera Obscura Enterprises contains the following information: Revenues \7 ,000 Expenses: Salaries and Wages Expense \ 3,000 Rent Expense 1,500 Advertising Expense 800 Supplies Expense 300 Insurance Expense 100 Total expenses 5,700 Net income \1 ,300 After the revenue and expense accounts have been closed, the balance in Income Summary will be

(Multiple Choice)

4.7/5  (31)

(31)

Showing 81 - 100 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)