Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

The adjusted trial balance columns of a worksheet are obtained by subtracting the adjustment columns from the trial balance columns.

(True/False)

4.8/5  (33)

(33)

The final closing entry to be journalized is typically the entry that closes the

(Multiple Choice)

5.0/5  (35)

(35)

Most companies that follow IFRS present balance sheet (statement of financial position) information in this order:

(Multiple Choice)

4.7/5  (42)

(42)

The income statement for the month of June, 2018 of Camera Obscura Enterprises contains the following information: Revenues \7 ,000 Expenses: Salaries and Wages Expense \ 3,000 Rent Expense 1,500 Advertising Expense 800 Supplies Expense 300 Insurance Expense 100 Total expenses 5,700 Net income \1 ,300 At June 1, 2018, Camera Obscura reported retained earnings of $35,000. The company had no dividends during June. At June 30, 2018, the company will report retained earnings of

(Multiple Choice)

4.9/5  (37)

(37)

A liability is classified as a current liability if the company is to pay it within the forthcoming year.

(True/False)

4.9/5  (41)

(41)

The four major classifications of assets in a classified balance sheet are: ________________, ________________, ________________ and ________________.

(Short Answer)

4.9/5  (43)

(43)

The account balances appearing in the adjusted trial balance columns are extended to the ______________ columns and the ______________ columns.

(Short Answer)

4.9/5  (35)

(35)

The dividends account is closed to the Income Summary account in order to properly determine net income (or loss) for the period.

(True/False)

4.9/5  (40)

(40)

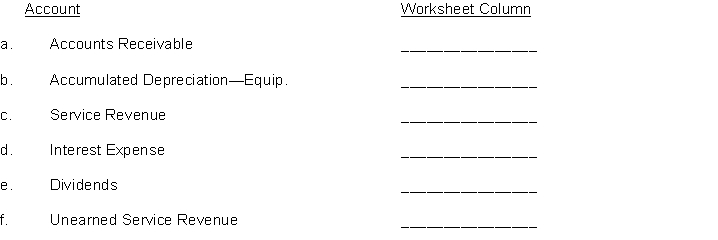

Indicate the worksheet column (income statement Dr., balance sheet Cr., etc.) to which each of the following accounts would be extended.

(Essay)

4.8/5  (35)

(35)

Current liabilities are obligations that the company is to pay within the coming year.

(True/False)

4.8/5  (41)

(41)

If the total debits exceed total credits in the balance sheet columns of the worksheet, stockholders' equity

(Multiple Choice)

4.8/5  (32)

(32)

The following items are taken from the financial statements of the Postal Service for the year ending December 31, 2018: Accounts payable 18,000 Accounts receivable 11,000 Accumulated depreciation - equipment 28,000 Advertising expense 21,000 Cash 15,000 Common stock 42,000 Dividends 14,000 Depreciation expense 12,000 Insurance expense 3,000 Note payable, due 6/30/19 70,000 Prepaid insurance (12-month policy) 6,000 Rent expense 17,000 Retained earnings (1/1/18) 60,000 Salaries and wages expense 32,000 Service revenue 133,000 Supplies 4,000 Supplies expense 6,000 Equipment 210,000 What are total current assets at December 31, 2018?

(Multiple Choice)

4.9/5  (41)

(41)

These financial statement items are for Rugen Company at year-end, July 31, 2018. Salaries and wages payable \ 2,980 Notes payable (long-term) \ 3,000 Salaries and wages expense 45,700 Cash 5,200 Utilities expense 21,100 Accounts receivable 9,780 Equipment 38,000 Accumulated depreciation 6,000 Accounts payable 4,100 Dividends 4,000 Service revenue 57,200 Depreciation expense 4,000 Rent revenue 6,500 Retained earnings 28,000 Common stock 20,000 (Auq. 1, 2017) Instructions

(a) Prepare an income statement and a retained earnings statement for the year. Stockholders not make any new investments during the year.

(b) Prepare a classified balance sheet at July 31.

(Essay)

4.7/5  (30)

(30)

The Income Summary account is an important account that is used

(Multiple Choice)

4.9/5  (39)

(39)

The following items are taken from the financial statements of the Postal Service for the year ending December 31, 2018: In Accounts payable 18,000 Accounts receivable 11,000 Accumulated depreciation - equipment 28,000 Advertising expense 21,000 Cash 15,000 Common stock 42,000 Dividends 14,000 Depreciation expense 12,000 Surance expense 3,000 Note payable, due 6/30/19 70,000 Prepaid insurance (12-month policy) 6,000 Rent expense 17,000 Retained earnings (1/1/18) 60,000 Salaries and wages expense 32,000 Service revenue 133,000 Supplies 4,000 Supplies expense 6,000 Equipment 210,000 What are total long-term liabilities at December 31, 2018?

(Multiple Choice)

4.8/5  (28)

(28)

Closing entries are unnecessary if the business plans to continue operating in the future and issue financial statements each year.

(True/False)

4.7/5  (44)

(44)

Showing 61 - 80 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)