Exam 4: Completing the Accounting Cycle

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

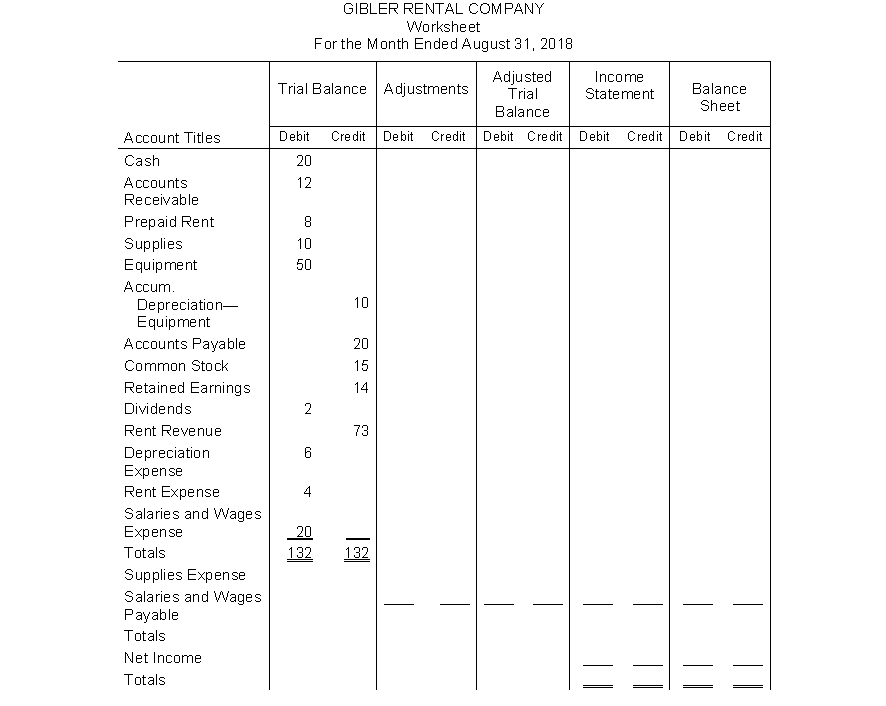

The worksheet for Gibler Rental Company appears below. Using the adjustment data below, complete the worksheet. Add any accounts that are necessary.

Adjustment data:

(a) Prepaid rent expired during August, $3.

(b) Depreciation expense on equipment for the month of August, $8.

(c) Supplies on hand on August 31 amounted to $6.

(d) Salaries and wages expense incurred at August 31 but not yet paid amounted to $10.

(Essay)

4.7/5  (31)

(31)

After the adjusting entries are journalized and posted to the accounts in the general ledger, the balance of each account should agree with the balance shown on the

(Multiple Choice)

4.8/5  (37)

(37)

The relationship between current assets and current liabilities is important in evaluating a company's

(Multiple Choice)

4.7/5  (40)

(40)

An examination of the accounts of Savage Company for the month of June revealed the following errors after the transactions were journalized and posted.

1. A check for $800 from R. Wright, a customer on account, was debited to Cash $800 and credited to Service Revenue, $800.

2. A payment for Advertising Expense costing $630 was debited to Utilities Expense, $360 and credited to Cash $360.

3. A bill for $850 for Supplies purchased on account was debited to Equipment, $580 and credited to Accounts Payable $580.

Instructions

Prepare correcting entries for each of the above assuming the erroneous entries are not reversed. Explain how the transaction as originally recorded affected net income for the month of June.

(Essay)

4.9/5  (39)

(39)

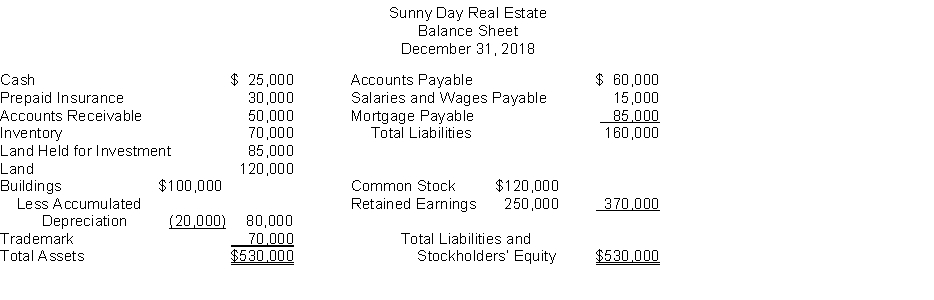

The following information is for Sunny Day Real Estate:  The total dollar amount of assets to be classified as investments is

The total dollar amount of assets to be classified as investments is

(Multiple Choice)

4.8/5  (39)

(39)

Closing entries may be prepared from all of the following except

(Multiple Choice)

4.8/5  (42)

(42)

Under Protection provides underground storage facilities for companies desiring off-site storage of sensitive documents, computer records, and other items. They have developed a sophisticated surveillance and security system which they initially used in their own facilities, and have recently started to market elsewhere as well.

The underground storage facilities are made from natural caves in some instances (reinforced and modified as appropriate) and from excavations of natural rock formations in others. The land was purchased over ten years ago for a total of $2.5 million. The modifications have cost approximately $15 million more. The company has never depreciated its storage facilities because the market value of the property has continued to rise. Presently, the market price is between $30 and $40 million.

Betsy Brantley, a new accounting manager, questioned this depreciation policy. Will Gray, the controller, has told her that she needn't worry about it. For one thing, he says, this is really a special form of Land account, which should not be depreciated at all. For another, this is a privately held company, and so they don't need to worry about misleading investors. All the owners know about and approve the depreciation policy.

Required:

What are the ethical issues in this situation?

(Essay)

4.9/5  (39)

(39)

Closing revenue and expense accounts to the Income Summary account is an optional bookkeeping procedure.

(True/False)

4.9/5  (36)

(36)

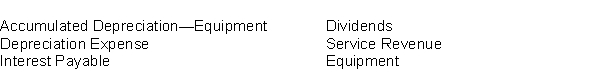

Identify which of the following accounts would appear in a post-closing trial balance.

(Essay)

4.8/5  (41)

(41)

To close net income to retained earnings, Income Summary is debited and Retained Earnings is credited.

(True/False)

4.9/5  (41)

(41)

The most efficient way to accomplish closing entries is to

(Multiple Choice)

4.8/5  (35)

(35)

Which one of the following is an optional step in the accounting cycle of a business?

(Multiple Choice)

4.8/5  (32)

(32)

All of the following are stockholders' equity accounts except

(Multiple Choice)

4.7/5  (42)

(42)

The post-closing trial balance will contain only retained earnings statement accounts and balance sheet accounts.

(True/False)

4.7/5  (45)

(45)

Distinguish between a reversing entry and an adjusting entry. Are reversing entries required?

(Essay)

4.8/5  (22)

(22)

The operating cycle of a company is determined by the number of years the company has been operating.

(True/False)

4.9/5  (35)

(35)

Showing 121 - 140 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)