Exam 7: Fraud, Internal Control, and Cash

Exam 1: Accounting in Action282 Questions

Exam 2: The Recording Process224 Questions

Exam 3: Adjusting the Accounts309 Questions

Exam 4: Completing the Accounting Cycle264 Questions

Exam 5: Accounting for Merchandising Operations245 Questions

Exam 6: Inventories258 Questions

Exam 7: Fraud, Internal Control, and Cash247 Questions

Exam 8: Accounting for Receivables270 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets342 Questions

Exam 10: Liabilities318 Questions

Exam 12: Investments228 Questions

Exam 13: Statement of Cash Flows217 Questions

Exam 14: Financial Statement Analysis235 Questions

Exam 15: Accounting Principles and Contingent Liabilities in Business Operations251 Questions

Select questions type

In the month of May, Grimm Company .wrote checks in the amount of $92,500. In June, checks in the amount of $126,580 were written. In May, $84,680 of these checks were presented to the bank for payment, and $108,830 in June. What is the amount of outstanding checks at the end of June?

(Multiple Choice)

4.8/5  (33)

(33)

Moyer Instruments is a rapidly growing manufacturer of medical devices. As a result of its growth, the company's management recently modified several of its procedures and practices to improve internal control. Some employees are upset with the changes. They have complained that all these changes just show that the company no longer trusts them.

Required:

"Internal controls exist because most people can't be trusted." Is this true? Explain.

(Essay)

4.8/5  (40)

(40)

A company maintains the asset account, Cash in Bank, on its books, while the bank maintains an account which is

(Multiple Choice)

4.7/5  (37)

(37)

An exception to disbursements being made by check is acceptable when cash is paid

(Multiple Choice)

4.8/5  (30)

(30)

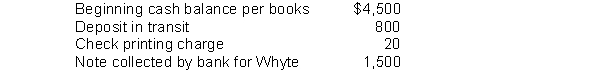

Compute Whyte Company's adjusted cash balance per books based on the following information:

(Essay)

4.8/5  (29)

(29)

Rainey Company wrote checks totaling $17,080 during October and $18,650 during November. $16,240 of these checks cleared the bank in October, and $18,220 cleared the bank in November. What was the amount of outstanding checks on November 30?

(Multiple Choice)

4.8/5  (36)

(36)

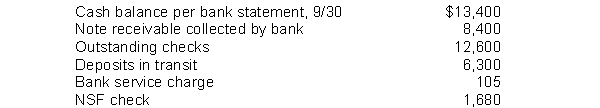

Jeter Company developed the following reconciling information in preparing its September bank reconciliation:  Using the above information, determine the cash balance per books (before adjustments) for the Jeter Company.

Using the above information, determine the cash balance per books (before adjustments) for the Jeter Company.

(Multiple Choice)

4.9/5  (39)

(39)

Because cash is the most liquid current asset it is listed first in the current assets section of the statement of financial position.

(True/False)

4.9/5  (48)

(48)

A voucher is recorded in the ________________ and filed according to the date on which it is to be paid.

(Not Answered)

This question doesn't have any answer yet

The cash account shows a balance of $75,000 before reconciliation. The bank statement does not include a deposit of $4,600 made on the last day of the month. The bank statement shows a collection by the bank of $1,880 and a customer's check for $640 was returned because it was NSF. A customer's check for $790 was recorded on the books as $970, and a check written for $159 was recorded as $195. The correct balance in the cash account was

(Multiple Choice)

4.8/5  (35)

(35)

Control over cash disbursements is improved if major expenditures are paid by check.

(True/False)

4.7/5  (38)

(38)

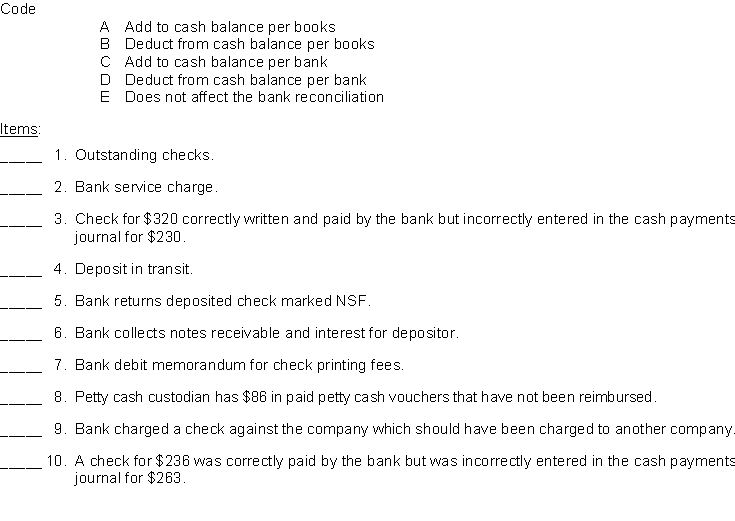

Using the code letters below, indicate how each of the items listed would be handled in preparing a bank reconciliation. Enter the appropriate code letter in the space to the left of each item.

(Essay)

4.7/5  (30)

(30)

Compensating balances are a restriction on the use of a company's cash and should be

(Multiple Choice)

4.8/5  (43)

(43)

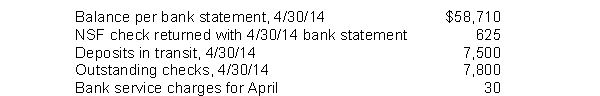

In preparing its bank reconciliation for the month of April 2014, Franklin, Inc. has available the following information.  What should be the adjusted cash balance at April 30, 2014?

What should be the adjusted cash balance at April 30, 2014?

(Multiple Choice)

4.9/5  (36)

(36)

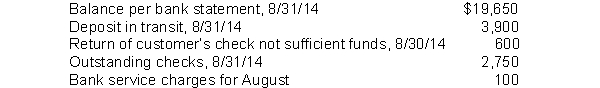

In preparing its August 31, 2014 bank reconciliation, Acme Corp. has the following information available.  At August 31, 2014, Acme's adjusted cash balance is

At August 31, 2014, Acme's adjusted cash balance is

(Multiple Choice)

4.8/5  (28)

(28)

Cash equivalents are highly liquid investments that can be converted into a specific amount of cash.

(True/False)

4.9/5  (32)

(32)

Showing 221 - 240 of 247

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)